The electric vehicles industry was a very speculative one during the previous decade. Yet, having an electric vehicle these days has started to become mainstream. In fact, the EV market is estimated to achieve revenues of $384 billion this year. In comparison, global EV revenues were just $111.87 billion in 2018. In this article, we are looking at five EV names that appear well-positioned to continue thriving going into 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With automobile companies investing billions to participate in the race for EV dominance and consumers eager to get their hands on the most efficient vehicles, the industry has entered a more mature but still exciting phase. This has commenced a new era for EV investors as well, as many companies in the space have now gradually started to achieve sustainable profits.

Tesla (NASDAQ:TSLA)

You already knew Tesla was going to be included in this list, and how could it not? Boasting roughly 565,000 vehicles sold in the first half of 2022, Tesla managed to capture 19% of the underlying market share, leading the EV race by a wide margin. For context, Chinese EV maker BYD Company (OTC: BYDDY) was the second-best-selling EV manufacturing company unit-wise, selling roughly 326,000 vehicles during the same period.

Importantly, Tesla now has an established track record of strong free-cash-flow generation. Over the past four quarters, free cash flow has amounted to nearly $9 billion, which indicates that the company should continue to self-fund its expansion goals with relative ease, which should further facilitate its dominant market position.

With shares down 54% year-to-date, Tesla may still not be a cheap stock, but it’s certainly one of the safest bets long-term EV investors can make in the market.

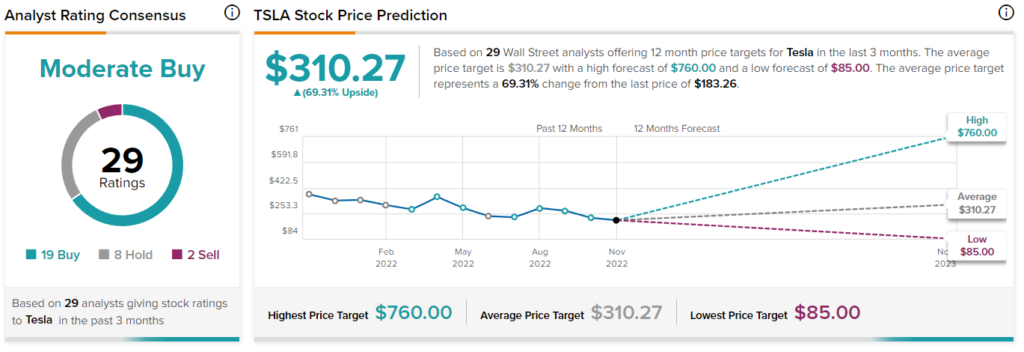

Is TSLA Stock a Buy, According to Analysts?

Turning to Wall Street, Tesla has a Moderate Buy consensus rating based on 19 Buys, eight Holds, and two Sells assigned in the past three months. At $310.27, the average Tesla stock price prediction implies 69.31% upside potential.

NIO (NYSE: NIO)

Shares of NIO have suffered quite dramatically over the past year, losing roughly 3/4 of their value during this time. Nevertheless, the company remains a leading player in the Chinese EV market, whose growth remains rather explosive.

In Q3, NIO achieved record-high deliveries of 31,607 vehicles, including 10,878 vehicles in September, representing a year-over-year increase of 29.3%. Combined with higher pricing, revenues rose 32.6% to $1.83 billion. While the company remains unprofitable, the stock trades at just 2.4x this year’s projected sales.

Thus, once NIO’s economies of scale start to kick in and the first profits flow, the stock’s current price levels could end up undervaluing the company rather substantially. Regardless, risks remain, including the typical governance issues that usually come attached to Chinese equities.

Is NIO Stock a Buy, According to Analysts?

Turning to Wall Street, NIO has a Strong Buy consensus rating based on nine Buys and three Holds assigned in the past three months. At $21.15, the average NIO stock price prediction implies 100% upside potential.

ON Semiconductor (NASDAQ: ON)

ON Semiconductor Corporation does not produce EVs, but it does produce a range of power control and image-sensing chips that are essential components for EVs. Thus, the semiconductor specialist could make a fine indirect play to invest in EVs without having to bet on which EV manufacturer will beat the market moving forward.

Driven by robust demand tailwinds, the company achieved record Q3 revenues of $2.19 billion, implying a year-over-year increase of 26%. ON Semiconductor is also highly profitable, with its adjusted operating margin and free cash flow margin landing at 35.4% and 21%, respectively, during the quarter. With shares trading at roughly 14x this year’s projected earnings per share, ON Semiconductor may be attractively priced given that growing EV sales should continue boosting its results higher.

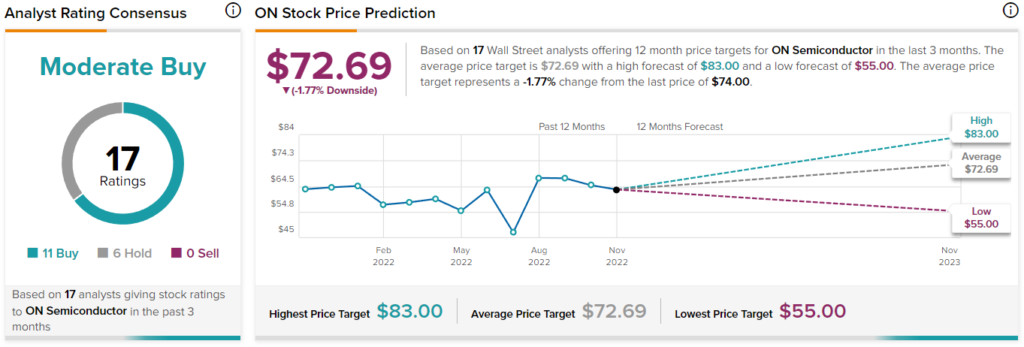

Is ON Stock a Buy, According to Analysts?

Turning to Wall Street, ON Semiconductor Corporation has a Moderate Buy consensus rating based on 11 Buys and six Holds assigned in the past three months. At $72.69, the average ON Semiconductor Corporation stock price prediction implies 1.77% downside potential, nonetheless.

ChargePoint Holdings (NYSE: CHPT)

You can argue the benefits of one EV over another, but what all of these vehicle models have in common is that they require constant charging. Sure, some vehicles have better battery spans than others, but you can’t really go on a long trip without charging your EV.

Since ChargePoint Holdings already operates about 200,000 charging points across North America and 16 EU countries, the company is leading the EV charging networks market. With the global EV market expected to grow at an accelerated CAGR of 18.2% through 2030, there will be a massive TAM for ChargePoint to gradually capture.

That said, the company is likely to remain unprofitable for years as it strives to expand its network, which could mean continuous capital raising that may take a toll on investors. Thus, make sure your due diligence goes the extra mile on this one before investing.

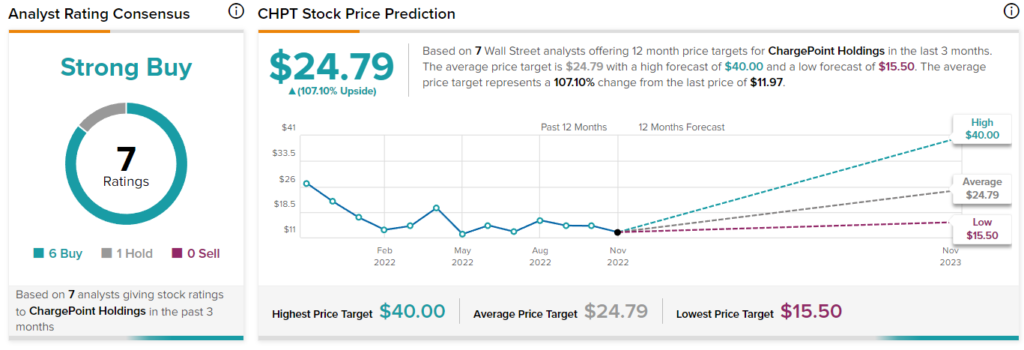

Is CHPT Stock a Buy, According to Analysts?

Turning to Wall Street, ChargePoint Holdings has a Strong Buy consensus rating based on six Buys and one Hold assigned in the past three months. At $24.79, the average ChargePoint Holdings stock price prediction implies 107.1% upside potential.

General Motors (NYSE: GM)

General Motors is not a pure-EV play, but the company is undergoing a massive transformation as it aims to penetrate deeper into the EV market. Specifically, the company plans to invest around $27 billion in EVs and autonomous vehicles by next year, while management expects it will be offering 30 EV models across the globe by 2025.

In the meantime, General Motors remains profitable through this transition, which should prevent shareholder value deterioration through this period. Additionally, General Motors features $30.3 billion in cash and equivalents that can further aid the company through its transformation.

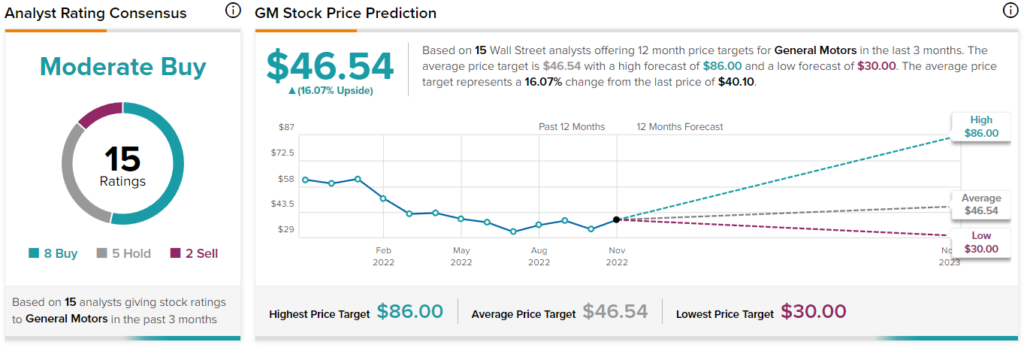

Is GM Stock a Buy, According to Analysts?

Turning to Wall Street, General Motors has a Moderate Buy consensus rating based on eight Buys, five Holds, and two Sells assigned in the past three months. At $46.54, the average General Motors stock price prediction implies 16% upside potential.

The Takeaway

The EV space is finally starting to take shape, with multiple companies in the space coming together to form an increasingly maturing market. The stocks listed here appear to be compelling picks as we are going into 2023.

Nevertheless, the industry is brutally competitive, which, combined with its transitory phase, means that EV stocks come with their fair share of speculation attached. Therefore, make sure you do your own research before allocating capital to any stock in the space.