After a wild ride for stocks in 2023, what’s next in 2024? Picking the best stocks for the new year isn’t about making predictions, but it’s about choosing high-quality companies with growth prospects and good value for shareholders.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

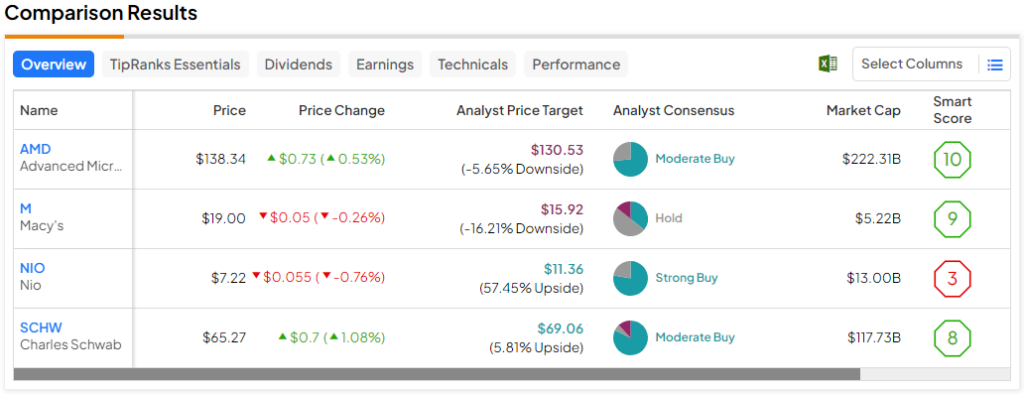

Furthermore, it’s important to pick stocks for 2024 from a variety of market sectors. That way, investors can diversify their portfolios and avoid overdependence on one type of stock. So, let’s take a closer look at four picks for potentially powerful returns over the next 12 months — Advanced Micro Devices (NASDAQ:AMD), Macy’s (NYSE:M), NIO (NYSE:NIO), and Charles Schwab (NYSE:SCHW).

Advanced Micro Devices (NASDAQ:AMD)

News flash — you’re not required to have a “Magnificent Seven” stock in your portfolio next year. Yet, it’s not a terrible idea to have at least one large-cap technology stock. I’m choosing Advanced Micro Devices, commonly abbreviated as AMD, because the company is aggressively pursuing the latest and greatest in artificial intelligence (AI) processor technology.

Not long ago, AMD showcased its AI-powered hardware solutions at Advancing AI, a tech-industry event. AMD CEO Lisa Su highlighted the company’s AI-compatible MI300 processors, saying, “We are seeing very strong demand for our new Instinct MI300 GPUs, which are the highest-performance accelerators in the world for generative AI.”

Furthermore, AMD’s management expects the company to generate over $2 billion in revenue next year just from the MI300 processor lineup. Therefore, investors should think about adding some AMD stock to capture potential gains from the AI hardware market.

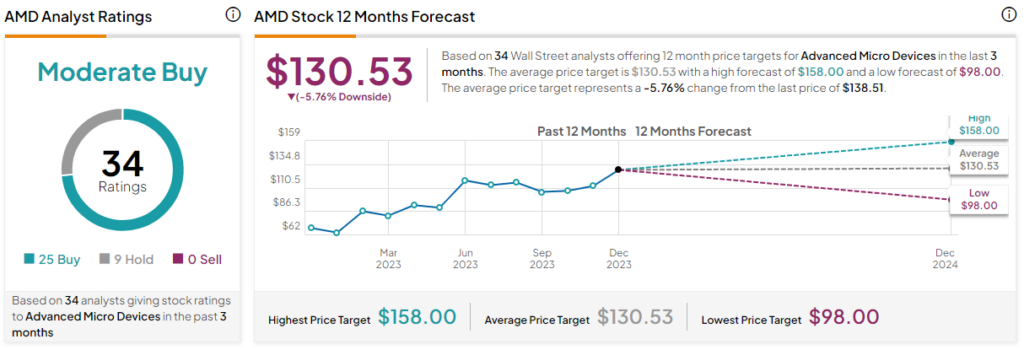

What is the Price Target for AMD Stock?

On TipRanks, AMD is a Moderate Buy based on 25 Buys and nine Hold ratings in the past three months. Nonetheless, the average Advanced Micro Devices stock price target is $130.53, implying 5.8% downside potential.

Macy’s (NYSE:M)

Strong Black Friday and Cyber Monday sales figures demonstrated that the U.S. consumer is surprisingly resilient despite persistent inflation. Amid this bullish backdrop, beaten-down Macy’s stock appears to be making a comeback.

The positive momentum for Macy’s could continue in 2024, as the retailer has an excellent track record of beating analysts’ quarterly earnings forecasts. Besides, even after yesterday’s nearly 20% rally in M stock, Macy’s still has a trailing P/E ratio of 7.7x, which is well below the sector median of 17.2x.

Best of all, Macy’s received a $5.8 billion buyout offer from a pair of financial firms. If Macy’s gets a lifeline in the form of a buyout, the retailer could go from an apparent zero to a hero in 2024.

What is the Price Target for Macy’s Stock?

M stock is a Moderate Buy, based on five Buys, seven Holds, and one Sell rating in the past three months. The average Macy’s stock price target is $15.27, implying 17.7% upside potential.

NIO (NYSE:NIO)

The last thing any forward-looking investor should want to do is skip out on the electric vehicle (EV) revolution in 2024. Consequently, you’ll probably want to pick at least one EV manufacturing stock, and my choice is NIO stock.

As we’ll see in a moment, analysts generally expect NIO stock to move higher over the next 12 months. Most likely, analysts are bullish because NIO’s vehicle sales are growing rapidly.

The company’s numbers will amaze you. Believe it or not, NIO’s vehicle deliveries rose 75.4% year-over-year and 135.7% quarter-over-quarter in Q3 2023. Moreover, the company’s EV deliveries increased 12.6% year-over-year in November — not jaw-dropping, but not too bad. Thus, investors should try to think globally, and not just locally, and consider putting NIO stock on their watch lists.

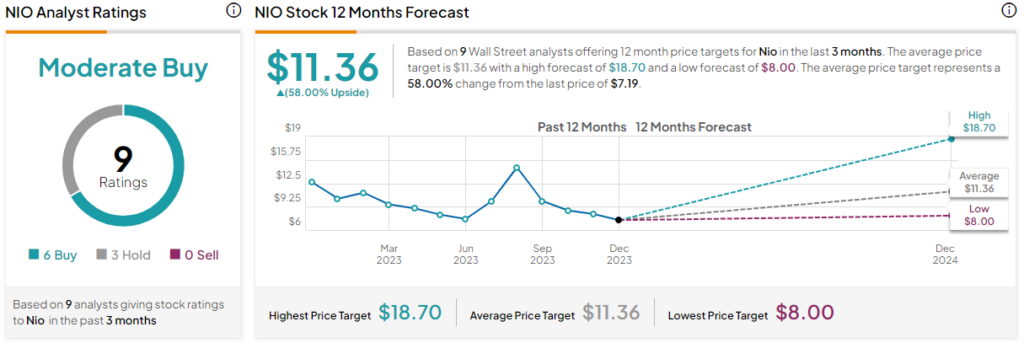

What is the Price Target for NIO Stock?

According to TipRanks’ analyst rating consensus, NIO is a Moderate Buy based on six Buys and three Hold ratings. The average NIO stock price target is $11.36, implying 58% upside potential.

Charles Schwab (NYSE:SCHW)

I haven’t forgotten about all the passive-income investors out there. Are you looking for a great dividend stock for 2024? Then check out Charles Schwab, commonly referred to as Schwab. The company has a dividend yield of 1.61%. Plus, it has grown its dividend payments at a compound annual growth rate of 16.8% over the past five years, so don’t be surprised if Schwab continues its dividend-growth pattern in the coming year.

Don’t just buy SCHW stock for the dividend, though. What matters the most is Schwab’s comeback story. Do you remember the banking scare from March and April? Schwab survived the “cash sorting” and bank run headlines, stayed profitable, and has posted nothing but quarterly earnings beats in 2023 so far.

Additionally, Barclays (NYSE:BCS) analyst Benjamin Budish recently reiterated his Buy rating on SCHW stock along with a price target of $66. Budish feels that fears about continuous cash outflows are subsiding — a point that I fully agree with. The market expects interest-rate cuts to happen next year, and this should encourage borrowing and lending activity. All of this, if it goes according to plan, could significantly support Schwab’s financials in 2024.

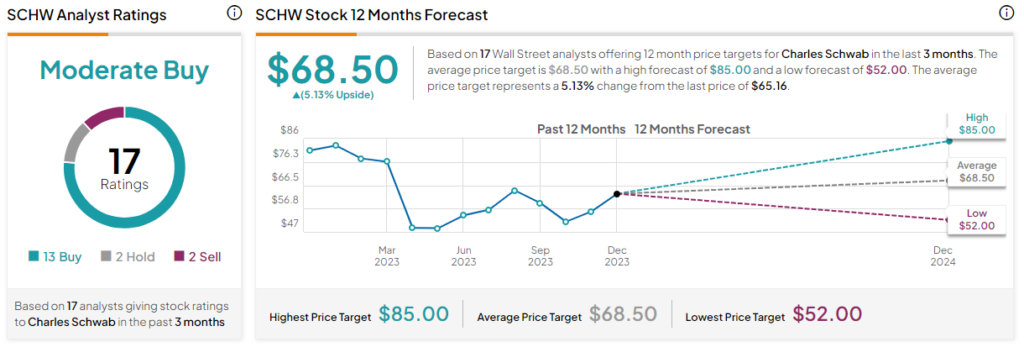

What is the Price Target for SCHW Stock?

On TipRanks, SCHW stock comes in as a Moderate Buy based on 13 Buys, two Holds, and two Sell ratings assigned in the past three months. The average Charles Schwab stock price target is $68.50, implying 5.13% upside potential.

The Takeaway

As an investor, you can hedge your bets while still targeting growth in 2024. The idea is to choose a diversified set of prime businesses, such as Advanced Micro Devices, Macy’s, NIO, and Charles Schwab. By considering share positions in these and other well-researched businesses, you can hopefully enjoy a solid year of gains in your portfolio.