Tesla, Inc. (TSLA), the leading EV maker in the United States, is scheduled to debut its highly anticipated robotaxi on October 10 at a special event named We, Robot at Warner Bros. (WBD) Studios in California. The launch of Cybercab, the robotaxi, will present Tesla with new opportunities and risks as the company gears up to navigate stiff competition from the likes of Waymo and increased regulatory scrutiny for its full self-driving technology. Despite short-term risks, I am bullish on Tesla as I believe the company’s technological investments will pave the way for robust long-term earnings growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

We, Robot Is More than Just Robotaxis

Tesla’s robotaxi, Cybercab, is likely to be a two-seater compact vehicle with a stainless steel finish. The company is expected to introduce a prototype for the Cybercab tomorrow. Tesla is also expected to announce the timing of production and the planned number of vehicles for the next couple of years, giving investors an idea about the investments required to mass produce Cybercabs to pursue a future as a robotaxi company.

According to Morgan Stanley analyst Adam Jonas, Tesla is likely to announce a dual approach to monetize autonomous ridesharing by unveiling a supervised autonomous ridesharing service alongside the highly anticipated fully autonomous ridesharing platform. In addition, according to Deepwater Asset Management, the event would not be all about robotaxis. The investment management company co-founded by Gene Munster believes Tesla will preview its low-cost EV during this event. Deepwater predicts this low-cost model to be named Model 2 and start at a price of $25,000.

This would be a major development for Tesla as the company has been under pressure in global markets due to its inability to compete with low-cost EVs launched by Chinese automakers. In fact, BYD Company Limited (BYDDF) surpassed Tesla last year to become the best-selling EV brand in the world. Deepwater also expects Tesla to introduce a Cybervan, a fully autonomous passenger van capable of transporting 8-10 people.

Tesla Will Benefit from Autonomous Ridesharing Growth

One of the key factors behind my bullish stance on Tesla is the company’s potential to emerge as a leader in the global autonomous ridesharing market, which is expected to grow exponentially in the next decade. According to Global Market Insights, this industry was valued at just $910 million in 2023 but is projected to grow at a stellar annual rate of 64% through 2032, lifting the market value to almost $66 billion.

The growing regulatory support around the world and technological advancements will play key roles in this expected growth. The rapid urbanization in populous regions calls for efficient transportation solutions, and autonomous ridesharing has been identified as one possible solution to address this demand.

One major advantage Tesla has over its peers is its access to real-world self-driving data. According to Ark Invest’s estimates, Tesla customers drive approximately 5 million miles per day in FSD mode compared to just 70,000 miles for Waymo. This access to real-world data should enable Tesla to scale faster by investing in technological upgrades, potentially helping the company capture a meaningful share of the autonomous ridesharing market.

Commercialization of Robotaxis Will Face Challenges

Although I am bullish on Tesla’s robotaxi prospects, the company is likely to face a few challenges as it attempts to commercialize the Cybercab. One major challenge is the stiff competition in the industry. Google-owned Waymo has already made its presence felt in a few U.S. cities, including San Francisco, Los Angeles, Phoenix, and Austin. Last month, Waymo co-CEO Tekedra Mawakana announced on LinkedIn that Waymo had surpassed 100,000 paid trips per week, which highlights the traction that the autonomous ridehailing platform has gained in the recent past.

Alphabet (GOOGL), Waymo’s parent, recently announced a $5 billion investment in the self-driving car business, which is an indication that big tech giants are gearing up to aggressively invest in autonomous driving, threatening Tesla’s path to commercialization. In addition to Waymo, Tesla faces competition from several other self-driving startups, such as Cruise, owned by General Motors (GM), and Zoox, acquired by Amazon.com, Inc. (AMZN). In global markets, the biggest competition stems from Chinese Internet giant Baidu (BIDU), which has made stellar progress with its self-driving unit, Apollo Go.

Another challenge that Tesla would face is continued pressure on operating margins as the company will be forced to invest aggressively to upgrade manufacturing plants to support mass production of robotaxis. Potential factory downtime required to upgrade facilities may exacerbate this challenge. Still, I believe Tesla’s vertically integrated business model, which allows the company to manage costs efficiently while investing in self-driving technology, will help the company offer autonomous rides at a more affordable cost than many of its competitors in the long run, paving the way for competitive advantages.

Is Tesla a Buy, According to Wall Street Analysts?

Tesla seems well-positioned to benefit from the launch of robotaxis in the long term despite facing several challenges on the path toward commercialization. However, RBC Capital Markets analyst Tom Narayan believes it’s too early to be excited about the robotaxi launch, given that this is a very long-term play. However, he believes the robotaxi business unit will account for half of Tesla’s valuation in the long term, which reveals his positive long-term stance on this business unit.

CFRA Research analyst Garrett Nelson also believes the short-term optimism on robotaxis may be displaced since a true driverless taxi is many years away. In a note yesterday, the analyst claimed that Tesla still has a long way to go to achieve Level 4 autonomy.

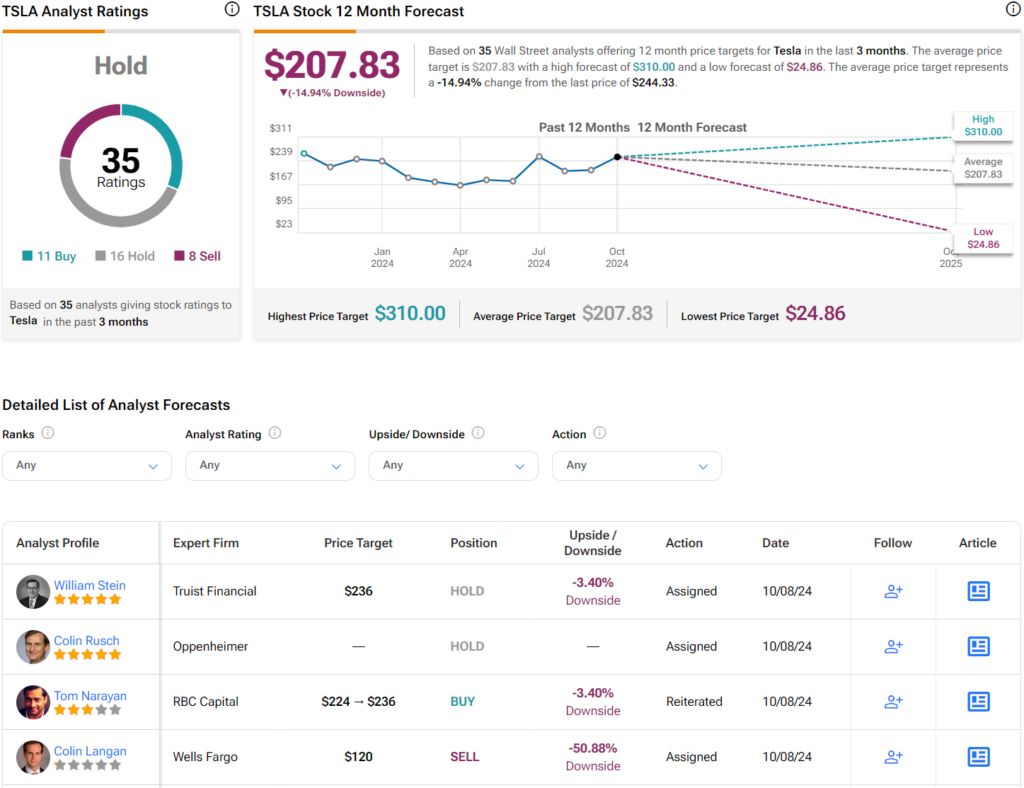

Overall, based on the ratings of 35 Wall Street analysts, the average Tesla price target is $207.83, which implies downside of 15% from the current market price.

While I acknowledge some of the short-term challenges limiting Tesla’s growth, I believe the company will continue to grow at a stellar pace in the next decade, aided by its strong market position in the North American EV sector, the expected success of its energy storage business, and the diversification into robotaxis.

Takeaway

Tesla is expected to introduce its robotaxi prototype on October 10, marking the most important product unveil since the Model 3 launch, according to CEO Elon Musk. The company may face several commercialization challenges for the robotaxi, but the long-term outlook is promising. Tesla seems well-positioned to enjoy durable competitive advantages in the EV space and the autonomous ridesharing market, which should pave the way for robust earnings growth.