Over the past several quarters, Tesla (TSLA) has made a habit of beating its prior delivery records, but that trend is unlikely to continue when the EV leader reports the Q3 haul shortly (probably either on Sunday night/Monday).

On the Q2 earnings call, CEO Elon Musk already warned this time around could be different, and that is down to the fact production will take a hit in the quarter due to “summer shutdowns for a lot of factory upgrades.” When there’s a drop in production, it’s common for deliveries to also decrease.

Last quarter, Tesla produced 479,700 vehicles, when deliveries reached 466,140. Analysts have offered a wide range of forecasts for Q3, with the consensus estimate landing at ~461,000 deliveries. Canaccord analyst George Gianarikas expects quite a lot less, estimating ~443,000 deliveries in the quarter. While that might indicate Gianarikas has a bearish take, the opposite is true, with the analyst telling investors not to get “too hung up on the delivery number, it’s less relevant this quarter.”

That is because since the Q2 call, a refreshed Model 3 has been introduced, which Gianarikas thinks explains “much of the mystery” behind Musk’s comments. Deliveries of the new Model 3 are anticipated in China and Europe in 4Q23 and the Cybertruck should also become available shortly, most likely in Q4, too, says Gianarikas.

So, the analyst believes much of the sequential drop forecasted for Q3 is down to the introduction of new products. And these, he says, “appear to have strong underlying demand,” and will play a part in impacting Q4.

In fact, Gianarikas makes the case that “lots of good stuff is happening” at Tesla for investors to look forward to.

“With new products in 4Q23, not to mention a UAW strike with positive implications, a new giga-casting technology that could help margins, and an Optimus robot that appears to be coming alive,” says the analyst, “our message is: stay focused on the medium to long term and ignore potential downside volatility in the 3Q23 delivery number.”

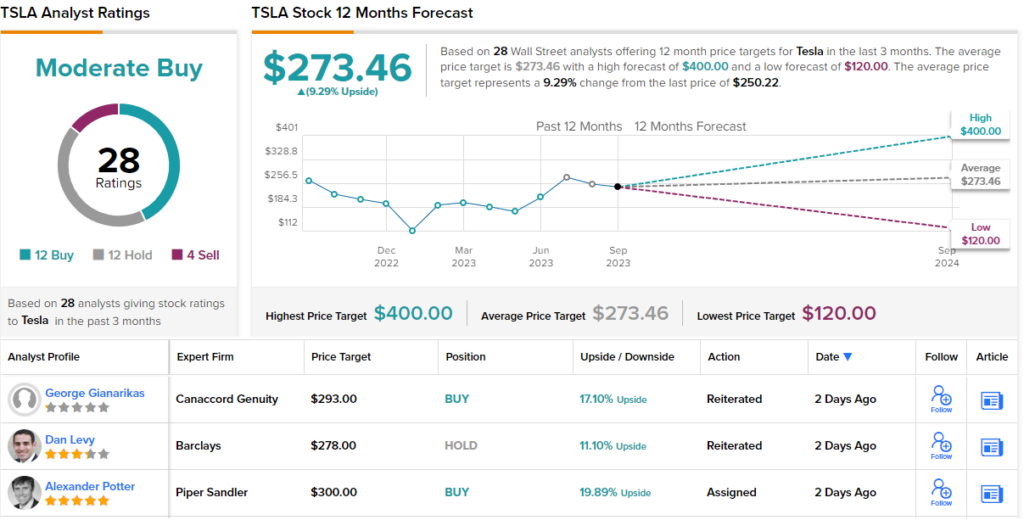

All told, Gianarikas reiterated a Buy rating on the stock to go alongside a $293 price target, suggesting shares will climb 17% higher in the year ahead. (To watch Gianarikas’ track record, click here)

Elsewhere on the Street, TSLA stock garners an additional 11 Buys, 12 Holds and 4 Sells, all coalescing to a Moderate Buy consensus rating. Going by the $273.46 average target, the shares will appreciate by 9% over the coming months. (See Tesla stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.