1Q23 is about to come to an end but before we get a full picture on how it turned out for Tesla (NASDAQ:TSLA), the EV leader will announce its delivery numbers on the weekend.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ahead of the reveal, Deutsche Bank analyst Emmanuel Rosner has tweaked expectations – and not for the better.

“We expect Tesla to report 1Q23 deliveries of 416k units (+34% year-over-year, +3% quarter-over-quarter), down from the previous estimate of ~432k, reflecting still the uncertain macro environment after the price cuts, as well as competitive pricing responses in China,” the analyst explained.

On account of the lowered volume, Rosner has also reduced Q1 revenue expectations from $23.3 billion to $22.5 billion. At the same time, gross margin (ex-credit) expectations get a haircut, down from a sequential -420bps to a -600bp, landing at 18.3% for the quarter. While the figure factors in an “improvement in factory and battery ramp cost” and a beneficial contribution from IRA battery production credit, that is more than canceled out by recent price trims in China, the U.S. and Europe and “non-recurrence of retroactive FSD revenue recognition.” The result of which is an EPS outlook of $0.69 compared to $0.84 beforehand. The top-and bottom-line figures are both lower than the Street’s revenue estimate of $23.5 billion and EPS forecast of $0.87.

Although Q1 is expected to represent the “trough” for the year, and Tesla has stressed it still expects auto GM (ex-credit, including FSD) to stay in the 20%+ range during each of the year’s quarters, Rosner thinks that in a year as difficult to predict as this one, reaching that goal will depend on the “volume/pricing dynamics and macro conditions.”

Over the very near term, Rosner sees investors’ concerns around volume, price, and margin dynamics as “warranted.” That, in turn, could keep the stock range-bound. A shift could come later in the year when more details regarding the next-gen platform will be revealed, along with potentially a new product.

All told, despite the issues, Rosner takes a bullish view regarding Tesla’s positioning.

“We continue to view Tesla as an EV leader in the autos sector thanks to its superior cost structure and agility in the midst of challenging macro conditions which could manifest in remainder of the year,” the analyst summed up.

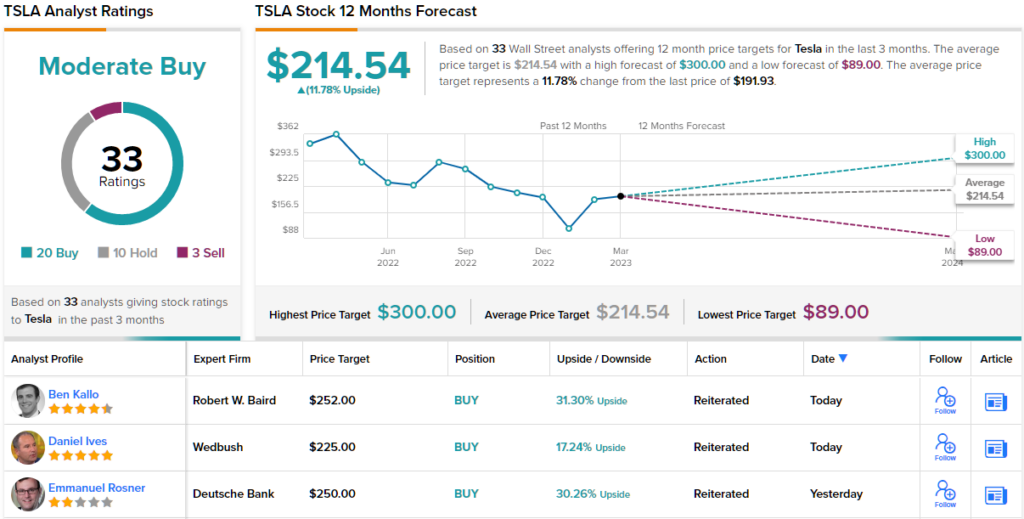

As such, Rosner reiterates a Buy rating on TSLA shares, along with a $250 price target, suggesting the shares will post growth of 30% in the year ahead. (To watch Rosner’s track record, click here)

Overall, 19 other analysts join Rosner in the bull camp and with the addition of 10 Holds and 3 Sells, the stock claims a Moderate Buy consensus view. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.