It was hard to avoid the sense of anticlimax following Tesla’s (NASDAQ:TSLA) recent Investor Day.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The event offered a run down of the EV leader’s achievements and CEO Elon Musk outlined his long-term vision, but there was not much digging into the nitty-gritty.

“Walking away from Tesla’s investor day, we were admittedly disappointed with the overall lack of details on its next-gen platform, including launch timing, vehicle segments and price points, and financial implications,” Deutsche Bank analyst Emmanuel Rosner noted.

It was a feeling evidently shared by many investors as the shares trended south in the aftermath of the hyped-up event.

While the reveal of the ‘Master Plan 3’ ended up being underwhelming, Rosner believes there was still plenty to unpack as the company turned the spotlight on the “longer term investment and transformation initiatives” for the company and the industry so to address the planet’s energy needs in a sustainable way.

The event also highlighted cost-saving opportunities for its next-generation platform and other manufacturing/design innovations that are currently being developed. These are anticipated to result in cost savings of 50% compared to the current platform while supporting the production of different types of vehicles. Even though a precise launch date wasn’t given, Tesla did reveal it will construct a new Gigafactory in Mexico to manufacture next-generation vehicles. Production could start there in late 2024 or early 2025. Still, following the event, Rosner thinks that over the very near-term, there aren’t any “large potential positive catalysts” for the stock.

That’s not to say the Tesla story took a turn for the worse. In fact, looking ahead, Rosner thinks the company is well-positioned to keep on driving the EV revolution.

“As Tesla executes on its cost and efficiency initiatives, we still believe it will deepen its competitive moat and maintain its lead in the electrification space for years to come, prompting us to look past the lower visibility over the project roadmap in the near term,” the analyst summed up.

Accordingly, Rosner reiterated a Buy rating on Tesla shares to go alongside a $250 price target. The implication for investors? Upside of 28% from current levels. (To watch Rosner’s track record, click here)

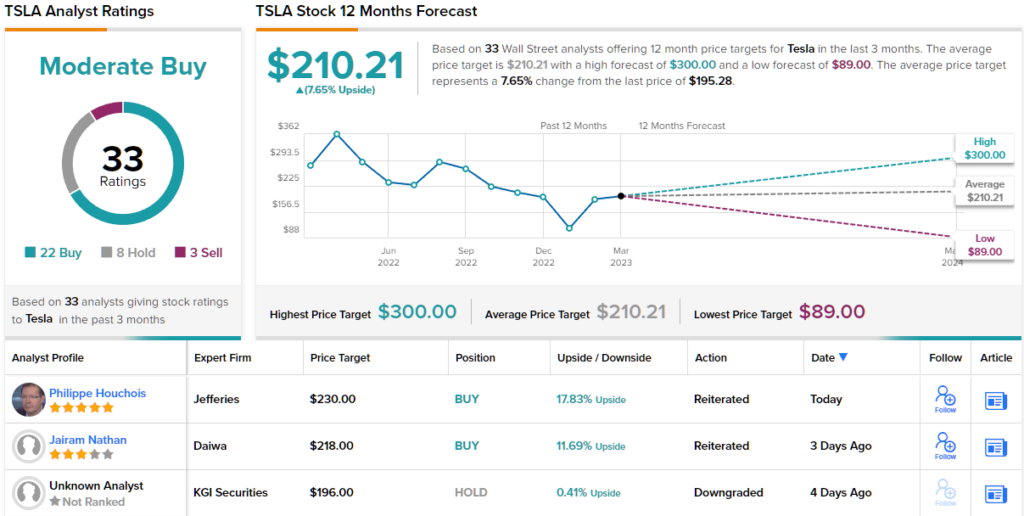

Elsewhere on the Street, the stock claims an additional 21 Buys, 8 Holds and 3 Sells, all culminating in a Moderate Buy consensus rating. Going by the $210.21 average target, the shares will climb ~8% in the year ahead. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.