Tesla’s (TSLA) series of price cuts on its models this year has had the desired effect – after a period of waning demand, it has seen volumes increase to such an extent that the EV leader reported record deliveries of 466,140 in the second quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, the price reductions have had a less welcome result; lowering them has seen margins take a hit. But in order to support higher volumes, Goldman Sachs analyst Mark Delaney thinks Tesla will probably keep on slashing prices in 2024. And while the company has also been focused on cost reductions, the lower prices will mitigate any EPS benefit.

That said, even with the price reductions, Delaney expects Tesla will sell less vehicles than he previously anticipated in Q3. While in key geographies, the July and August regional Tesla sales data was above those seen in the first two months of Q2, to better account for what Delaney believes is “lower S/X demand and the impact of the changeover for the Model 3 Highland,” he has lowered his Q3 volume forecast to 460,000. Although boosted by the Highland launch, and factoring in better S/X volumes in the wake of the big price cuts, he anticipates a rebound to 494,000 in Q4. This brings Delaney’s 2023 delivery outlook to 1.842 million.

Nevertheless, given expected lower ASPs (average selling prices) and the lower prices’ effect on the auto gross margin (ex credit), Delaney has reduced his 2023 and 2024 EPS estimates to $2.90/$4.15, respectively, from the prior $3.00/$4.25.

“We are Neutral rated on the stock,” the 5-star analyst summed up, “with our expectation for near to intermediate term margin headwinds offset by our positive view of Tesla’s leadership position in the industry and long-term growth potential (including with software, services and opportunity in related markets like Energy).”

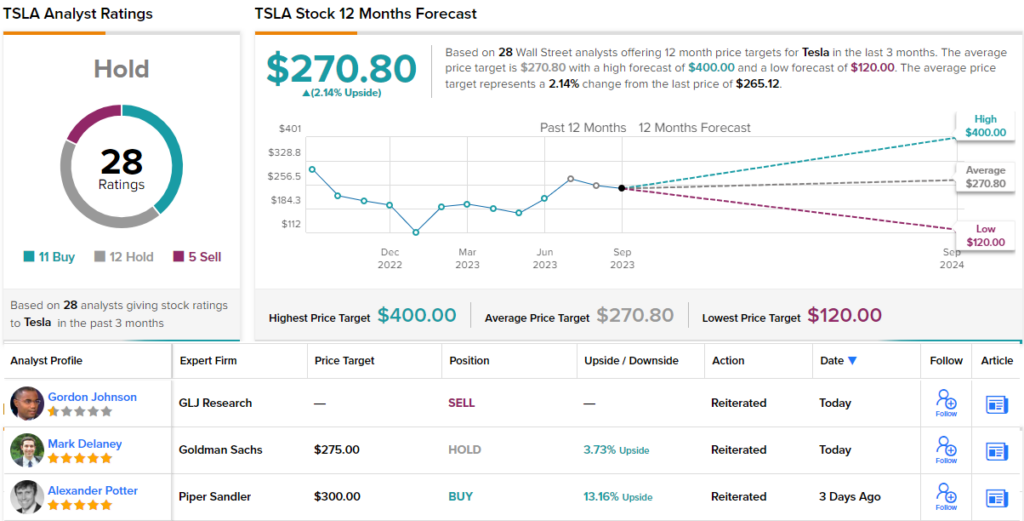

That on-the-fence rating is backed by a $275 price target (the same as before), indicating the shares will move a modest 4% higher over the coming months. (To watch Delaney’s track record, click here)

What do others on the Street think? The majority sides, just, with Delaney. Based on a mix of 12 Holds, 11 Buys and 5 Sells, the stock receives a Hold consensus rating. The $270.8 average target suggests the shares will remain rangebound for the foreseeable future. (See Tesla stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.