A common thought amongst auto analysts is that the Inflation Reduction Act (IRA) is set to be equally beneficial to all those operating in the EV industry.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, that is a misconception, says Morgan Stanley analyst Adam Jonas, who believes that EV giant Tesla (NASDAQ:TSLA) stands to benefit far more than others.

“The US Inflation Reduction Act was written into law, providing abundant tax credits allocated by kilowatt-hour that cement Tesla’s leadership and widen the gap to the competition,” Jonas explained. “We believe that the IRA is so advantageous to Tesla in terms of absolute dollars and vs. legacy OEMs that it functions as an insurance policy that investors are currently overlooking.”

Compared to its peers, Jonas expects Tesla will ‘harvest’ a lot more benefits from the IRA, with the consumer ultimately benefiting, thereby “padding” Tesla’s market share.

What really makes the difference is the “sheer magnitude” of Tesla’s EV unit volumes. Jonas makes the case that the “relative scale and cost advantages” continue to stand out and may reflect operating margin differences in the thousands of basis points. According to his analysis, the IRA incentive structure for EVs is much more favorable to Tesla than to others, potentially compounding the “cost disadvantage” that legacy OEMs have in comparison to Tesla. In Jonas’ opinion, the notion that Tesla has a ‘margin to keep’ for shareholders, fails to take into account the auto industry framework and surplus EV capacity.

Talking numbers, for example, Jonas’ calculations show that the IRA could bring about a respective ~$190 million and ~$150 million uptick to his FY23 estimates for GM and Ford. Yet, factoring in a host of different outcomes, Jonas thinks Tesla could be eligible for a range of $500 million to $900 million in IRA tax credits in FY23. And that could impact other companies’ actions. “We think the relative advantage to Tesla could catalyze legacy OEMs to re-think their next $50bn of capex into loss-making EVs and inspire an era of capital discipline,” Jonas opined.

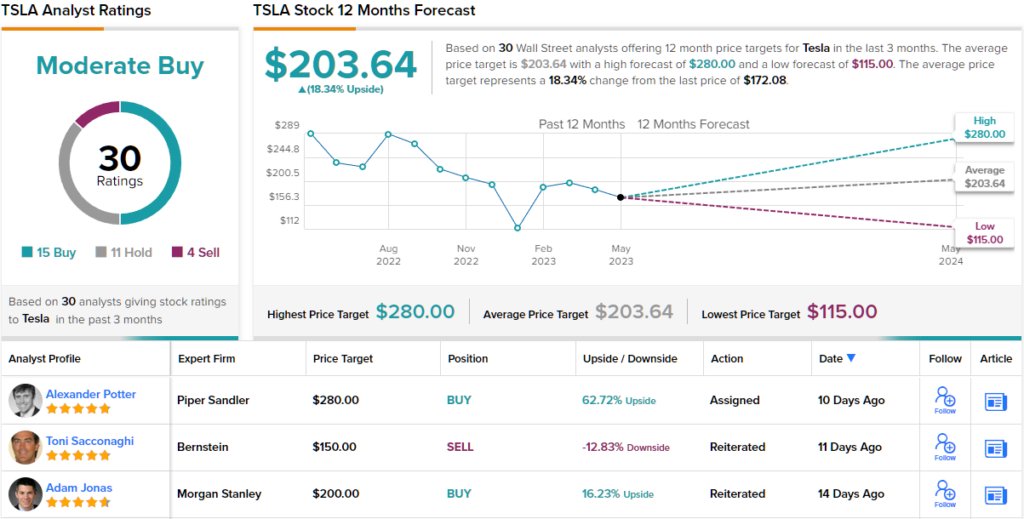

So, how does this all translate to investors? Jonas reiterated an Overweight (i.e., Buy) rating on Tesla shares backed by a $200 price target. Should his thesis play out, a potential upside of ~16% could be in the cards. (To watch Jonas’ track record, click here)

Most agree with Jonas’ overall thesis, but only just. With 15 Buys vs. 12 Holds and 4 Sells, the stock claims a Moderate Buy consensus rating. The $203.64 average target is just a smidgen above Jonas’ objective and represents one-year upside of ~18%. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.