By the end of 2030, global BEV (battery electric vehicle) adoption is anticipated to reach 40%. According to Needham analyst Vikram Bagri, Tesla’s (TSLA) market share of passenger vehicles could reach ~10%.

“Key to our global market share estimate is the company maintaining its high single digit share in China, one of the most mature and competitive markets for EVs,” the analyst explained. “In the West, TSLA has the industry’s most expansive charging network, which helps it maintain its strong market share.”

Furthermore, in the here and now, Bagri thinks there are several potential catalysts on the horizon.

With the removal of the 200,000-vehicle cap, the Inflation Reduction Act’s renewed eligibility for federal tax credits is one of them. Others include a potential credit rating upgrade to IG (investment grade) by the end of the year, the Cybertruck hitting the market in 2023, the charging network’s expansion and better utilization, and an increase in gross margins brought on by 4680 cells.

Another catalyst could come in the form of the Full FSD release to all North American customers in the fourth quarter, although Bagri thinks perfecting the technology “will take more time.”

So, as Bagri’s previous rating on the shares was an Underperform (i.e., Sell), is it now time to turn bullish on all things Tesla? Not quite.

Despite highlighting recent accomplishments such as “profits in the past 4 quarters and record deliveries,” Bagri refrains from giving Tesla his full backing.

This is due to “increasing competitive pricing pressure, increasing OpEx to support Gigafactory Shanghai (and later Europe) and Model Y ramps, and the automaker’s history of profitability issues.”

Additionally, as the company scales manufacturing of the Model Y and Cybertruck, Bagri anticipates there will be other “obstacles and setbacks.”

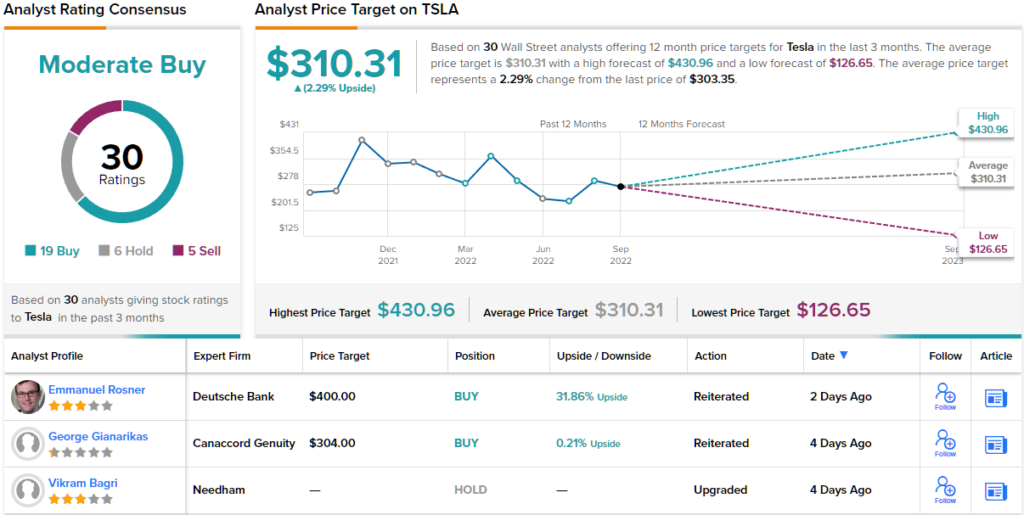

Accordingly, then, the rating is upgraded to Hold (i.e., Neutral) with no fixed price target provided. (To watch Bagri’s track record, click here)

Bagri is now on the fence along with 5 other analysts. 5 others recommend dropping the shares, but 19 other analyst reviews are positive, giving this stock its Moderate Buy consensus rating. Bagri thinks the stock is “fairly priced” and so do most of his colleagues; the $310.31 average target suggests the shares will remain rangebound for the foreseeable future. (See Tesla stock forecast on TipRanks)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.