People who’ve stayed invested in Tesla (NASDAQ: TSLA) have done well over the past decade but not so well in 2022 so far. There’s a lot to discover and discuss with Tesla lately, but the important thing is to stay focused on the company’s financials, which seem to indicate improvement, so I am bullish on Tesla stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla is a California-headquartered electric vehicle (EV) manufacturer with a CEO who is best described as a lightning rod. Elon Musk is either a genius or just erratic; financial traders on social media either seem to love him or hate him.

There could be a middle ground here, though. Musk could be an erratic genius with a flair for attracting the media’s attention. It’s a problem, however, when the CEO’s statements distract investors’ attention from Tesla’s core business. By sticking to the hard facts and ignoring the drama – and by noting the interesting value proposition in downtrodden Tesla stock – we can construct a moderately bullish case for a long position.

Steer Clear of Politics When Trading Tesla Stock

With the November U.S. midterm elections in progress right now, it’s easy to let our emotions get the best of us. However, investment decisions are serious and should be based on information more than feelings. This is true even for Tesla stock, which has a large following of investors who may have an emotional attachment to the company and its CEO.

The problem is, Musk isn’t making it easy to separate the man from the company. Just recently, he posted on Twitter, “To independent-minded voters: Shared power curbs the worst excesses of both parties, therefore I recommend voting for a Republican Congress, given that the Presidency is Democratic.”

You might have noticed that Twitter doesn’t even have a U.S. stock symbol anymore because Musk owns the social media platform now. Furthermore, he’s been using Twitter as a soapbox to publish his opinions, which are sometimes polarizing.

Whether you’d like to divest your Tesla shares due to Musk’s words and actions is a personal decision. An objective investor, however, might choose to concentrate first and foremost on Tesla’s ability to sell vehicles, generate revenue, and earn a profit. If those pieces of the puzzle are in place, then other considerations – including political ones – don’t need to be top priorities.

Tesla Stock Has Been Demolished, but the Company is Still Profitable

For several years, the complaint that Tesla stock was too pricey was a valid one. The share price has come down a lot recently, though, so value investors should find the stock more attractive now. Besides, Tesla’s results indicate growth in the company’s top and bottom lines.

Again, there are a lot of distractions taking place, even beyond Musk’s controversial tweets. For instance, Tesla increased certain China-based insurance incentives for vehicle orders but decreased others. Apparently, the idea is to convince buyers to place their orders sooner.

Also, Tesla recalled 40,000 vehicles in the U.S. due to possible “loss of power steering assist when driving on rough roads or after hitting a pothole.” This problem was itself a mere pothole, however, as Tesla has already released a software update to address this recall.

It’s fine to be aware of these developments, but Tesla’s financials should be top-of-mind for prospective investors. As it turns out, Tesla’s in growth mode, and that’s good news. During 2022’s third quarter, the automaker increased its revenue to $21.45 billion, compared to the year-earlier quarter’s $13.76 billion. Plus, over that same time period, Tesla’s net income attributable to common stockholders rose from $1.62 billion to $3.29 billion – not too shabby, considering the high-inflation macro backdrop.

Is TSLA a Good Stock to Buy, According to Analysts?

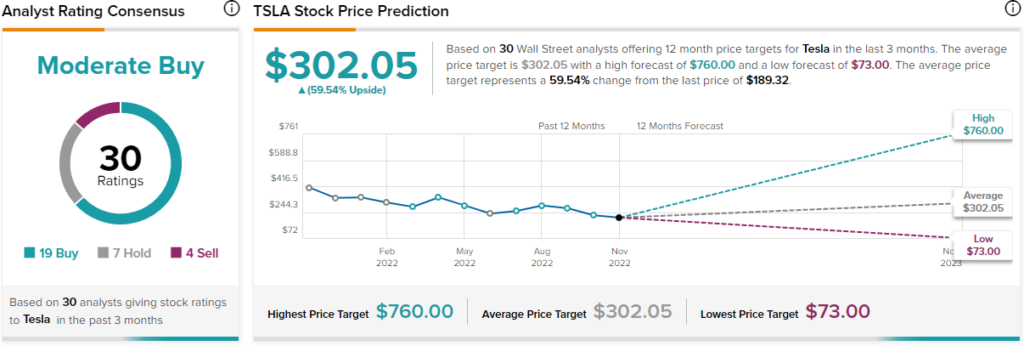

Turning to Wall Street, TSLA stock is a Moderate Buy based on 19 Buys, seven Holds, and four Sell ratings. The average Tesla stock price target is $302.05, implying 59.5% upside potential.

Conclusion: Should You Consider Tesla Stock?

You might have personal reasons for choosing not to invest in Tesla stock, and that’s fine. The important thing is to understand what’s driving your decisions and whether you might be missing out on a buying opportunity.

When we turn our attention to the established facts, we can conclude with certainty that Tesla stock is lower than it’s been in a while and that the company is making progress on the financial front. Therefore, if Musk’s musings don’t bother you too much, it might be time to consider a small position in Tesla stock.