Leading up to Tesla’s (NASDAQ:TSLA) Q1 report, all the talk revolved around whether the EV leader can reach its gross margin target of 20%, a number the company promised not to go below throughout the year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In short, Tesla failed to make the 20% benchmark, delivering a gross profit margin of 19.3%. That represents the measliest profit margin generated by the company since the end of 2020, when the pandemic played havoc with its operations.

The soft GMs reflect Tesla’s attempts to boost demand, whereby the company has enacted a series of price cuts on its models. The efforts might have helped the company sell a record number of cars in the quarter yet have not only impacted the margin profile but have also affected the top-line. Revenue increased by 24.2% year-over-year to $23.3 billion, but that missed the Street’s expectations by $60 million and also represented a $1.3 billion drop from the previous quarter’s haul.

Understandably, investors didn’t seem too thrilled with the results. Yet, Morgan Stanley analyst Adam Jonas thinks that while the bears are feasting, he’s not sure they should be. “Breaching 20% might be seen by bears as what they have been waiting for,” Jonas said. “However, we would argue that the competitive position of Tesla in a lower priced EV world might be even stronger.”

In fact, it is a line in the opening paragraph of Tesla’s Q1 shareholder letter that Jonas finds most telling: “…we aim to leverage our position as a cost leader.” That also chimes with Tesla CEO Elon Musk’s take, who said the company believes that “pushing for higher volumes and a larger fleet is the right choice here, versus a lower volume and higher margin.” Musk believes that eventually, via autonomy, the company will be able to “generate significant profit.”

And what is Jonas’ take on the matter? “We believe the Q will further fuel the debate on whether cutting price is the right strategic avenue for Tesla,” he opined. “We continue to be positive on the Tesla story but believe investors will have to 1) expect volatility in the short to medium term,2) be patient on margins and 3) expect that global price cuts are not done yet.”

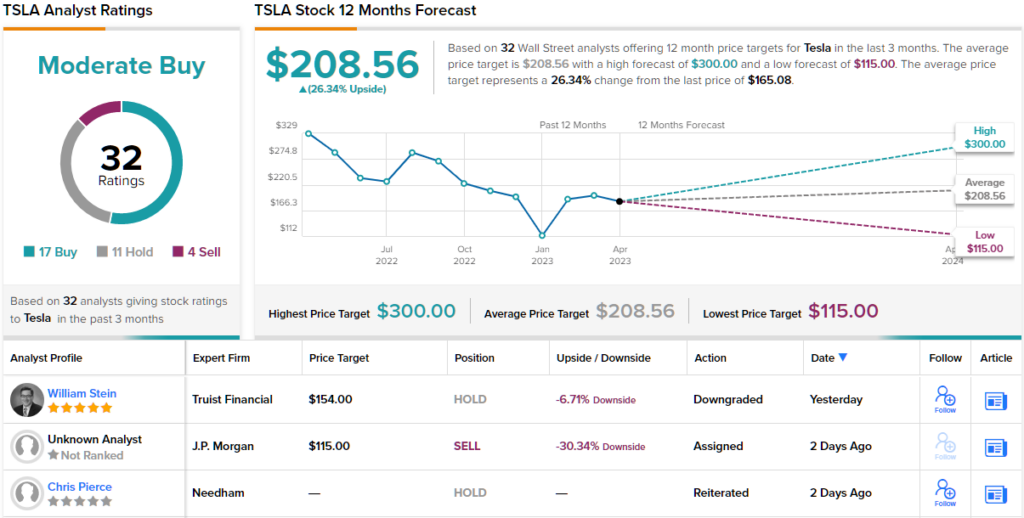

All told, the results don’t alter Jonas’ stance. The analyst reiterated an Overweight (i.e., Buy) rating backed by a $220 price target. Meeting that figure could now generate one-year returns of 33%. (To watch Jonas’ track record, click here)

Elsewhere on the Street, the stock garners an additional 17 Buys, 11 Holds and 4 Sells, for a Moderate Buy consensus rating. The $208.56 average target closely resembles Jonas’ objective. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.