Tesla’s (TSLA) ascent to ‘tera-cap’ status has been built on several factors. Supported by a favorable economic backdrop, investors could see the company’s core EV and energy storage businesses as built to ride – or indeed, lead – a rising secular trend. Then, of course, at the front of it all stands Elon Musk, the headline hogging Super-CEO to whom the rules of normal business behavior do not apply.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But times have changed, as noted by Morgan Stanley’s Adam Jonas. “Tesla shares are currently in the throes of bearish sentiment momentum. Investors appear increasingly concerned over the potential for effects on consumer sentiment that could impact Tesla’s business near term,” the analyst said.

Aside from the precarious economic uncertainty engulfing the global markets, there are more Tesla-specific issues on investors’ minds. The most obvious is that Musk is a controversy magnet, a trait only exacerbated by the dubious goings on at his newly-owned Twitter, which in a rather understated way, Jonas says could “affect some consumers’ sentiment regarding Tesla.”

The ongoing controversies could also drive away potential commercial partners. Not to mention, the company needs to stay on good terms with the US and Chinese governments as the “industrialization of renewable ecosystems and on-shore battery development requires close cooperation with sovereign entities.”

Add up all this bearish sentiment, in addition to anticipated price cuts to Tesla’s vehicle line up and the shares could be pushed toward Jonas’s “$150 bear case” before the end of the year. However, this is where Jonas dons his Tesla bull outfit, noting that such a scenario could present a “window of opportunity opening for prospective Tesla investors.”

“Tesla shares would trade at approximately 12.5x EV/EBITDA and 23x PE on our FY25 forecast (SBC burdened) which we see as excellent value for a self-funded, 20 to 30% top-line grower in top position to benefit from re-architecting the US on-shore/near-shore/friend-shore renewable supply chain at scale,” the analyst explained.

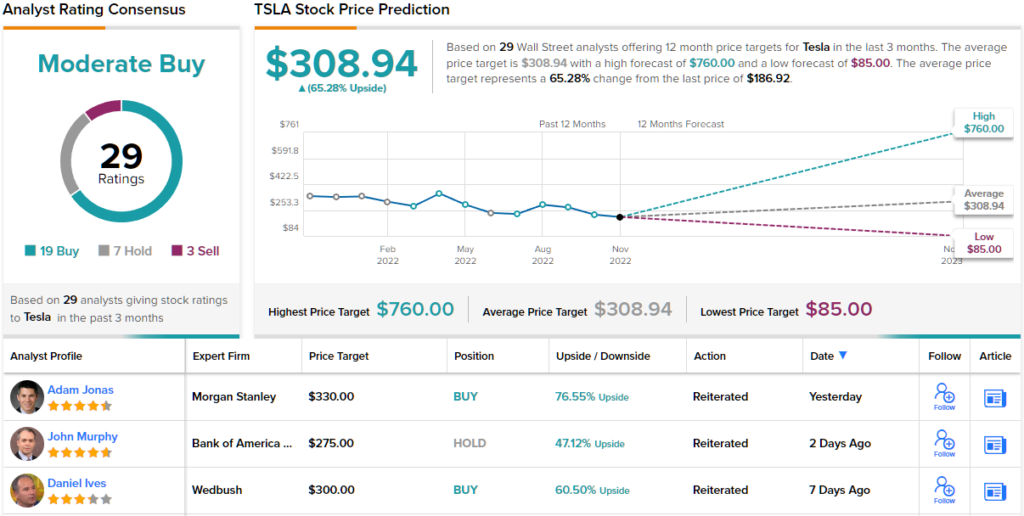

To this end, Jonas sticks with an Overweight (i.e., Buy) rating backed by a $330 price target. Should the figure be met, investors will be pocketing returns of ~77% a year from now. (To watch Jonas’s track record, click here)

Among the analyst community, the majority are on Morgan Stanley’s side. Factoring in 19 Buys, 7 Holds and 3 Sells, the EV giant has a Moderate Buy consensus rating. The average target remains a positive one; at $308.94, the figure makes room for 12-monht gains of ~65%. (See Tesla stock forecast on TipRanks)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.