It’s happening at last. On Thursday afternoon (November 30) at Tesla’s (NASDAQ:TSLA) Austin Gigafactory, Musk and Co. will hold an event to finally celebrate the first deliveries of its Cybertruck.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wedbush’s Dan Ives, a 5-star analyst rated in the top 2% of the Street’s stock pros, is looking forward to this important event for the EV leader, calling it “another historical moment” for Tesla.

“The Street is excited to see the formal vehicle launch featuring the dual-motor trim and its top-level tri-motor AWD performance model along with updates regarding production and scaling of the Cybertruck platform which is expected to be ~250k units per year by FY25,” Ives further said.

While delivery targets for FY24 have not been specified, it is projected that the company will manufacture between 2,000 and 3,000 units in the current quarter. In 1H24, it is anticipated that the company will produce its first 10,000-unit quarter, supported by a pilot production capacity of 125,000 units in Austin. The reservation count and pre-orders have reportedly exceeded the 2-million-unit mark.

At the Cybertruck’s initial unveiling in 2019, the company said the vehicle would have a starting price of $39.9k in the base single-motor RWD version, with the dual-motor AWD truck going for $49.9k, and the tri-motor AWD priced at $69.9k. Ives expects price updates on Thursday, claiming “whisper numbers” for the single motor are around ~$50k, with prices for the dual and tri-motor variants probably in the range between $60k – $80k.

Although the Cybertruck will not “significantly move the financial needle” for Tesla in FY24, Ives believes it serves as a testament to its ongoing innovation and the “mind share lead” it has established. Many OEMs, on the other hand, appear to be lagging behind, “still on the treadmill stuck in neutral.”

All told, Ives reiterated an Outperform (i.e., Buy) rating on Tesla shares, along with a $310 price target, suggesting shares have room for growth of 31% from current levels. (To watch Ives’ track record, click here)

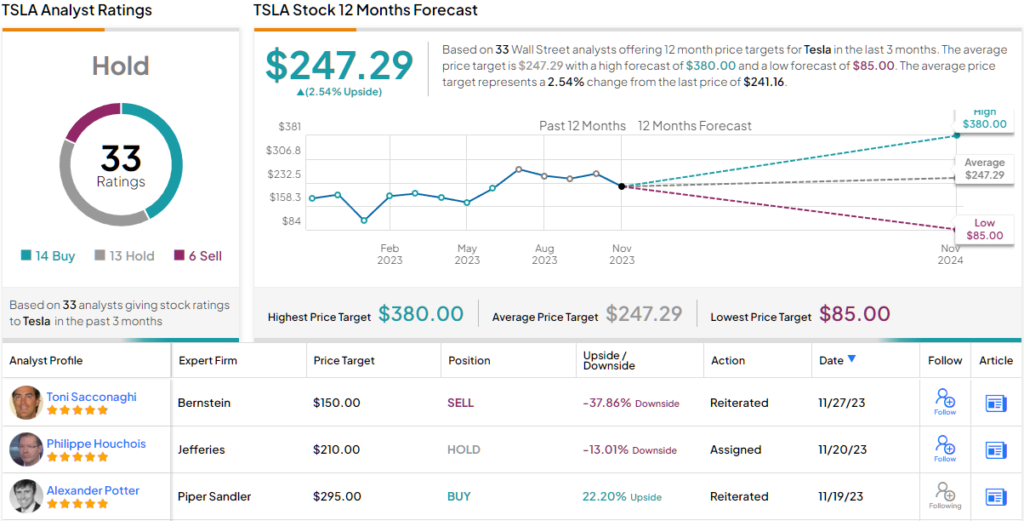

Ives is one of the Street’s biggest TSLA bulls but not all are quite as exuberant. Based on a mix of 14 Buys, 13 Holds and 6 Sells, the stock claims a Hold consensus rating. Most think shares have surged enough for now (up by 120% year-to-date) and therefore the $247.29 average target only offers modest gains of 2.5% for the year ahead. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.