Things are looking for up for Tesla (NASDAQ:TSLA) stock. After a difficult 2022, the shares are up by 60% year-to-date with investors apparently keen to get on board again.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Part of the renewed enthusiasm rests on the EV leader’s efforts to stimulate demand. Following indications of a demand drop in 4Q22, the global price cuts undertaken by the company appear to be doing the trick.

Deutsche Bank analyst Emmanuel Rosner certainly thinks these are helping, noting: “We are encouraged with demand indicators that point to strong orders following the company’s price cuts. More recently, we saw reports that suggest Tesla is planning to ramp up production at its Shanghai Gigafactory over the next two months to meet rising demand following its price cuts in recent weeks.”

According to the China Passenger Car Association, in January, Tesla sold 66,051 China-made EVs, amounting to an 18.38% sequential increase and 10.37% year-over-year improvement.

Elsewhere, the company also stands to gain from the Treasury Department’s reversal of a prior IRA ruling. Previously, the Treasury had categorized the Model Y 5-seat variant as a sedan rather than an SUV. Under the new ruling, all Model Y variants will now be classified as a SUV with a MSRP (manufacturer’s suggested retail price) threshold of $80,000, compared to $55,000 beforehand, thereby making all variants eligible for the $7,500 consumer tax credit. “We note that this is considerably higher than the latest price of a Long Range Model Y, at ~$53.5k,” Rosner explained, “leaving potential room for the OEM to raise back prices as orders and demand come in strong.”

Although Rosner is not sure Tesla will raise prices in the U.S. following the change, he reckons each $1k increase in Model Y pricing would result in an additional $350 million-$400 million of profit in 2023, amounting to an uptick of around 10-12 cents to EPS.

On the back of the strong demand seen from consumers, Rosner notes that Tesla raised the price of the Model Y by $500 just a week after the initial price cuts were offered.

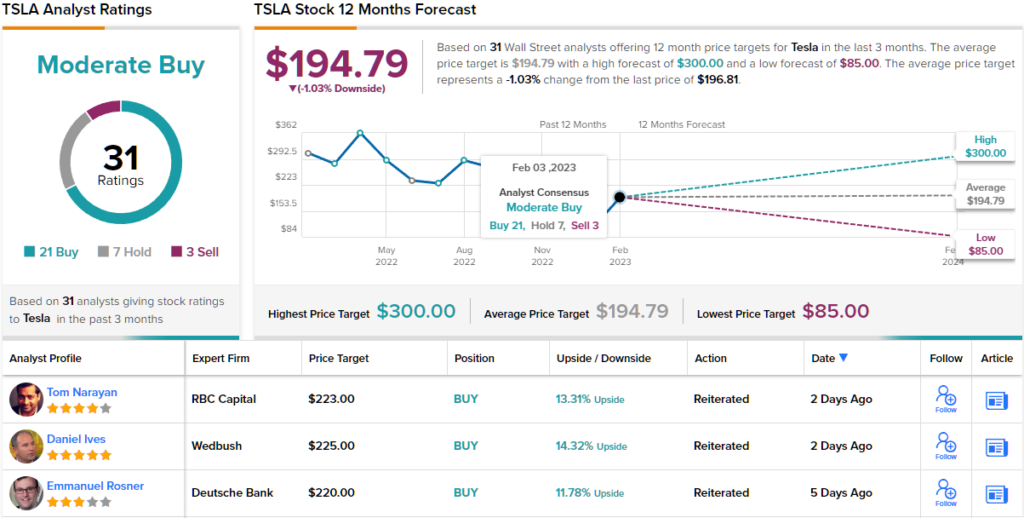

All told, the analyst sticks with a Buy rating for TSLA shares, backed by a $220 price target. Should the figure be met, investors will be sitting on returns of ~12% a year from now. (To watch Rosner’s track record, click here)

On the other hand, the Street’s $194.79 average target suggests the shares are slightly overvalued. Overall, the analyst consensus rates the stock a Moderate Buy, based on 21 Buys, 7 Holds and 3 Sells. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.