It’s fair to say Tesla (NASDAQ:TSLA) investors have had more than enough to be pleased about this year. While the markets’ overall trend has been up, shares of the EV leader have completely obliterated the main indexes’ performance.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

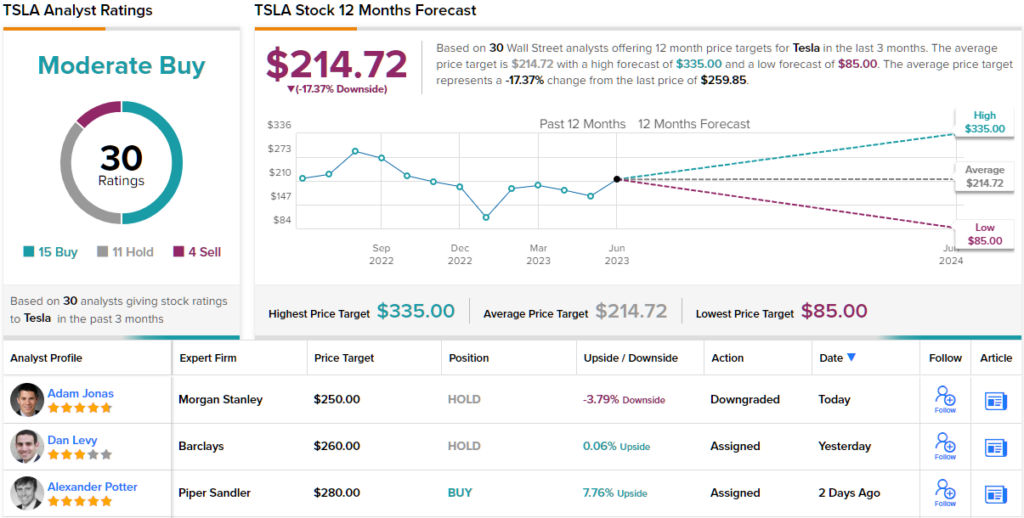

So, where to now? Well, not up from here for a while, says even one of the Street’s most prominent Tesla bulls. Morgan Stanley analyst Adam Jonas has now downgraded Tesla’s rating from Overweight (i.e., Buy) to Equal-weight (i.e., Neutral) although the price target is nudged up from $200 to $250. Still, the new figure suggests the current share price is just about right. (To watch Jonas’ track record, click here)

The reason behind the downgrade is a simple one. “While the team has defended the Tesla Overweight rating all year, I did not see this 111% YTD rally coming,” Jonas explained. “We think it’s understandable and are sympathetic to the changes in the market narrative around the name. We’re not trying to call ‘the end’ to the Tesla rally and from our discussions continue to find a significant degree of investor scepticism/lack of exposure around the name.”

Maybe so from some investors, but there’s no skepticism on Jonas’ part, despite the lowered rating. Jonas sees ongoing proof that Tesla is becoming an industrial ‘standard bearer’ for one of the biggest industrial transformations taking place in more than a century – the shift towards electric transportation and renewable energy. Tesla’s influence extends beyond just supercharging deals with companies like GM and Ford and there will be additional possibilities for collaboration in areas such as battery supply and full self-driving (FSD).

Talking of full self-driving, the recent tech run up – with Tesla included – has been fueled by AI hype, and while the company deserves to be included in the group, it’s currently hard to make a case for further gains based on that opportunity. “While we do agree with the merits of classifying Tesla as an ‘AI company,’ we would urge caution against grouping all aspects of AI (for example, LLM with vision-based neural network training) into one bucket,” Jonas summed up. “As a result, we believe that Tesla’s current valuation is relatively ‘full.’”

Jonas’ revision is amongst several that have taken place recently, although most still remain in the bull camp. The stock claims a Moderate Buy consensus rating, based on 15 Buys, 11 Holds and 4 Sells. However, the average price target tells a different story; at $214.72, the figure suggests the shares have downside of 17% in them. It will be interesting to see whether other analysts revise their models shortly. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.