It’s been 3 years since Elon Musk last visited China, making the Tesla (NASDAQ:TSLA) CEO’s current trip to the country a big event.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Against a backdrop of increasing geopolitical tensions between the US and China, Wedbush analyst Daniel Ives notes that Tesla finds itself in a “tight wire act to balance its success and production within China which remains a vital market on both the supply and demand front.”

Not only that, but this visit is also taking place during a critical period for the EV leader, as it confronts growing competition from Chinese EV makers, with an EV price war taking place within the country.

Nevertheless, with Tesla’s Shanghai Gigafactory – the “hearts and lungs of the Tesla production globally” – currently manufacturing over 80,000 units per month, Ives believes it has a key advantage over its rivals due to its “production scale and scope” as it attempts to fend off the domestic competition from firms such as BYD, Nio, Xpeng, and others.

Tesla also recently announced its intention to construct a new battery factory in Shanghai that will be able to produce 10,000 new Megapacks every year. That will provide further expansion to its global battery capacity along with its US “production artery.”

Musk has already met up with China’s Foreign Minister Qin Gang and has been reported as saying he’s open to further expansion in China. While the company continues to build out its manufacturing and battery footprint in Austin and is focused on IRA tax benefits in the US, that is no surprise to Ives, who reminds investors that China remains “the golden goose EV market.”

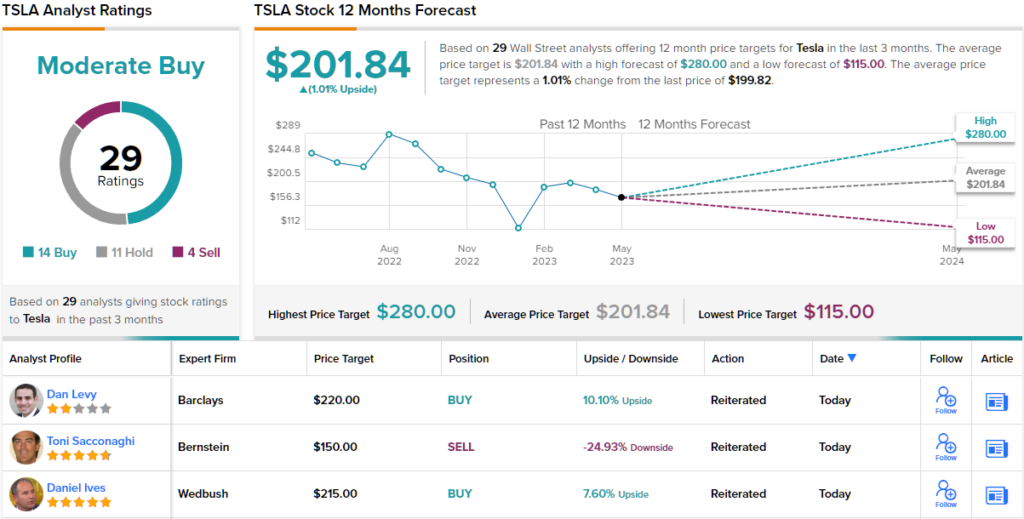

All told, Ives rates Tesla shares an Outperform (i.e., Buy) along with a $215 price target. The implication for investors? Upside of ~8% from current levels. (To watch Ives’ track record, click here)

Overall, of the 29 analyst reviews posted over the past 3 months, 13 join Ives in the bull camp, 11 remain on the sidelines and 4 implore to drive away, all coalescing to a Moderate Buy consensus rating. Considering the shares have already generated year-to-date returns of a market-beating 62%, the $201.84 average target suggests they will remain rangebound for the time being. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.