Tesla (NASDAQ:TSLA) delivered its best-ever quarterly revenue haul in Q2 and beat the Street’s profit expectations. However, that wasn’t enough to stave off some hungry bears who sent shares plummeting by 7% in Thursday’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The EV leader generated revenue of $24.93 billion in Q2, amounting to a 47.3% year-over-year increase whilst beating the Street’s forecast by $200 million. Adj. EPS of $0.91 also came in ahead of the analysts’ expectation for $0.81.

However, total gross margins hit 18.2%, the lowest seen for the past 5 quarters and below the consensus estimate of 18.6% as automotive gross margins of 19.2% also missed the Street’s call for 19.5%. Additionally, operating margins came in at 9.6%, also the lowest margin delivered over the last five quarters.

While the series of price cuts didn’t affect profits to the extent some prognosticators had feared, the shares were down following the earnings call and into Thursday’s open. Investors were seemingly disappointed with a lack of details regarding the Cybertruck specs and timeline for deliveries while no clear picture on automotive gross margins stabilizing or improving over the near-term was offered either. Shutdowns due to factory improvements are also set to impact production during the third quarter.

Nevertheless, for Wedbush analyst Daniel Ives, Tesla hit the nail on the head on the metric that really mattered. “The all-important automotive gross margins ex credits came in at 18.1% which was above the Street’s estimate of 18.0% and whisper numbers of ~17.5% as we believe Tesla is seeing steady demand post price cuts in the US and China with margins now in stabilization mode that should bottom over the next 1-2 quarters,” the 5-star analyst said.

In fact, Ives points to comments made around FSD (full self-driving) with the company confirming for the first time that it is already talking to one OEM about licensing FSD technology. To us,” Ives said, “this is the ‘golden vision’ as Tesla is now monetizing its super charger network with batteries and AI/FSD next adding to the sum-of-the-parts story for Tesla.”

All told, Ives views the earnings report as a “major step in the right direction,” and one that merits a price target hike. Ives’ objective moves from $300 to a Street-high $350, suggesting the shares will gain ~29% over the next 12 months. The top analyst maintained an Outperform (i.e., Buy) rating on the shares. (To watch Ives’ track record, click here)

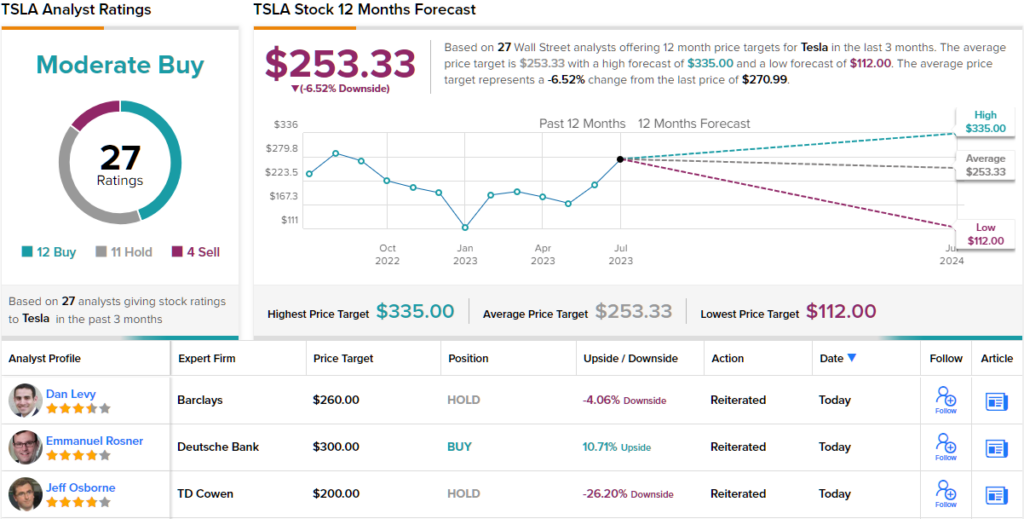

Overall, of the 27 analyst reviews submitted on TSLA, over the past 3 months, 12 say Buy, 11 recommend to Hold while 4 implore to turn away, all coalescing to a Moderate Buy consensus rating. That said, the $253.33 average target suggests the shares are currently trading 6.5% above their true worth. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.