The earnings train is leaving the station and the big names are now on board. Tomorrow after the close, Tesla (NASDAQ:TSLA) will deliver Q1’s financial report.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Earlier this month, the EV king presented its delivery numbers for the quarter, so one big metric is already out of the way. However, the one item of most interest to investors and Wall Street’s analyst corps alike, will be that of the gross margins.

On its Q4 earnings call, Tesla said it could achieve 20% gross margins (ex credits), but for Morgan Stanley analyst Adam Jonas that seems “like a very long time ago.” Meanwhile, to kickstart demand, Tesla has executed a series of price cuts, and these have evidently helped in selling cars (the company beat the Q1 delivery estimate) but the lower prices are expected to eat into the margin profile.

Jonas cites conversations with investors who have offered a “range of gross margin” estimates, going from as low as 17% to as high as 24% with claims that “sharply lower” spot lithium prices in China and software and lease accounting could boost the margin.

With no clear indication as to how things will turn out, Jonas feels that Tesla earnings expectations “are at a crossroads.”

“Will investors see the industrial logic (masterstroke?) of leading the industry in price cuts rather than following it?” he asks. That remains to be seen. As for Jonas’ view, he believes Tesla could probably “eke out a decent 1Q result.”

That said, it could be “a different story” as far as attaining that 20% clean auto gross margin target is concerned. “’The world has changed’ with respect to EV demand weakening relative to EV supply,” notes Jonas. Nevertheless, that doesn’t mean the long-term Tesla bull has suddenly turned bearish. Compared to most other EV-related players, Jonas still thinks Tesla represents a “better risk-adjusted investment opportunity.”

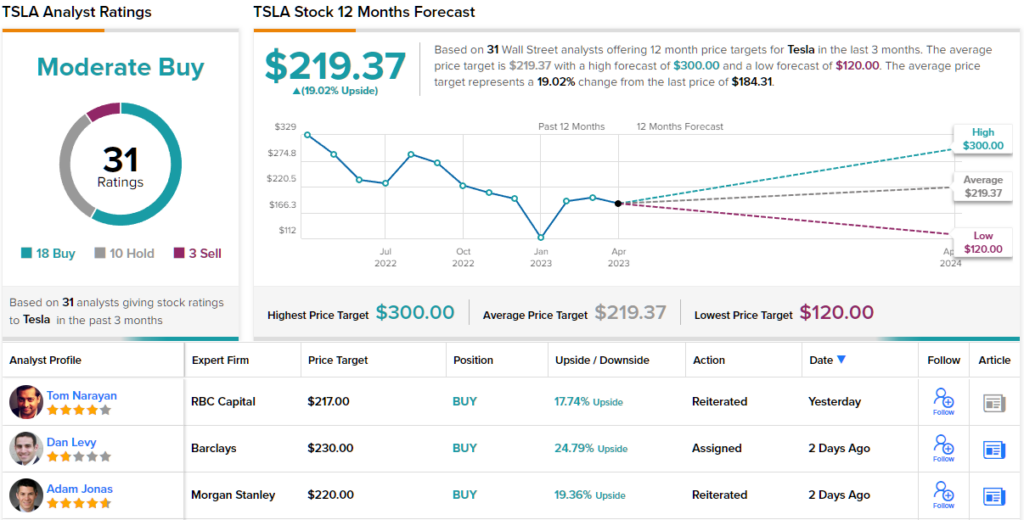

As such, Jonas reiterated an Overweight (i.e., Buy) rating on Tesla shares, along with a $220 price target. Should that figure be met, investors could see returns of 18% a year from now. (To watch Jonas’ track record, click here)

And what about the rest of the Street’s take? With an additional 18 Buys, 10 Holds and 3 Sells, the analyst consensus rates this stock a Moderate Buy. The average target clocks in at $219.37, almost identical to Jonas’ objective. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.