Tesla (NASDAQ:TSLA) will release its financial results for the fourth quarter of 2023 after the market closes on Wednesday, January 24. While higher deliveries will support its top-line growth, the electric vehicle (EV) giant’s bottom line could remain under pressure due to the lower average selling prices compared to the prior year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s worth noting that Tesla is reducing prices to help support deliveries amid a challenging operating environment. The excitement surrounding the EV market has waned due to macroeconomic challenges. Additionally, the EV sector is experiencing heightened competition, which is pressurizing margins.

Against this background, let’s look at the Street’s expectations for TSLA’s Q4.

Tesla – Q4 Expectations

Wall Street expects Tesla to report revenue of $25.63 billion in Q4, representing a year-over-year growth of 5.4%. Higher automotive sales revenue, led by increased deliveries, will support its top-line growth. However, an overall price reduction and adverse sales mix could adversely impact its top-line growth rate.

While Tesla’s top line is likely to improve, its bottom line could continue to decline due to the reduction in the average selling price of its vehicles. Nonetheless, the decline in material and manufacturing costs and the company’s cost-reduction efforts will cushion its margins. Notably, analysts expect Tesla to post earnings of $0.73 per share in Q4, down 38.7% year-over-year.

Analysts’ Ratings Ahead of Q4 Print

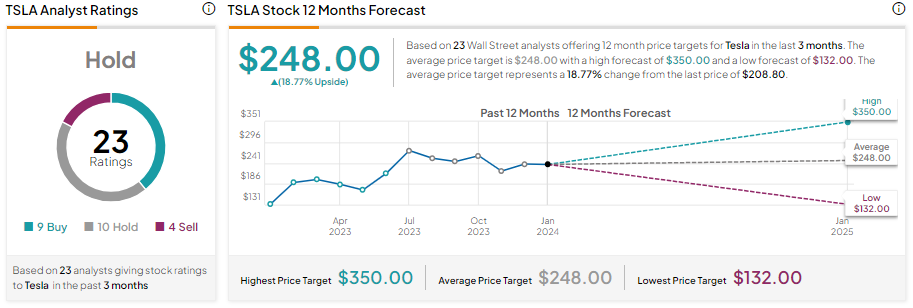

On January 22, Morgan Stanley analyst Adam Jonas lowered Tesla’s price target to $345 from $380, citing a slowdown in demand. Nonetheless, Jonas maintained the Buy rating on Tesla stock.

In a similar move, Barclays analyst Dan Levy cut Tesla’s price target to $250 from $260 and reiterated a Hold rating on January 17. The analyst expects Tesla to face volume headwinds amid softening demand.

Is Tesla a Buy or Sell Now?

Despite macro headwinds, Tesla stock has gained over 45% over the past year. However, its margins have consistently declined in the first three quarters of 2023, keeping analysts sidelined.

Overall, Tesla stock has nine Buy, 10 Hold, and four Sell recommendations for a Hold consensus rating. Analysts’ average price target of $248 implies 18.77% upside potential from current levels.

Insights from Options Trading Activity

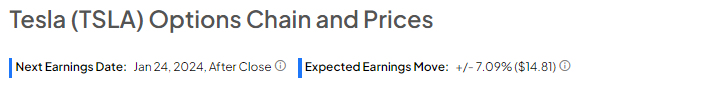

While analysts are sidelined about TSLA stock, options traders are pricing in a +/- 7.09% move on earnings, smaller than the previous quarter’s earnings-related move of -9.3%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Bottom Line

Tesla’s focus on increasing its vehicle production and delivery capabilities, reducing costs, and improving battery technologies augurs well for long-term growth. However, near-term margin headwinds and soft demand remain concerns.