Those looking on with no stake in the game can enjoy the never-ending shenanigans of the Elon Musk circus.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That the Tesla (TSLA) CEO is a mercurial, clever and ultra-charismatic chap is not in doubt, but his unreliable behavior is getting a bit too much, at least that seems to be the take of Wedbush analyst Daniel Ives.

The fact it is becoming hard to take Musk’s word on anything got further validation this week, as it turns out that in order to help fund the Twitter deal, he sold around $4 billion of TSLA shares over the last week. “For Musk who multiple times over the past year has said he is ‘done selling Tesla stock’ yet again loses more credibility with investors and his loyalists in a boy who cried wolf moment,” said the analyst, who believes the sale explains some of the “massive selling pressures on the stock of late.”

Ives, not unreasonably, says Musk is the “most important part of the Tesla story by a wide margin” and therefore each new example of his erratic behavior can deeply affect Tesla stock. And there have been plenty of those on display in his short tenure as “chief twit,” from firing half the workforce then asking some to come back, to the “head scratching” verification roll-out to his political tweets.

“When does it end?” asks an exasperated Ives. “The focus is Tesla or Twitter? Is this Twitter train wreck situation hurting/tarnishing the global brand of Musk and therefore Tesla.”

Quite likely. While Ives says his “long term bullish view” of Tesla remains, he nonetheless calls for Musk to bring an end to this “Twitter madness.”

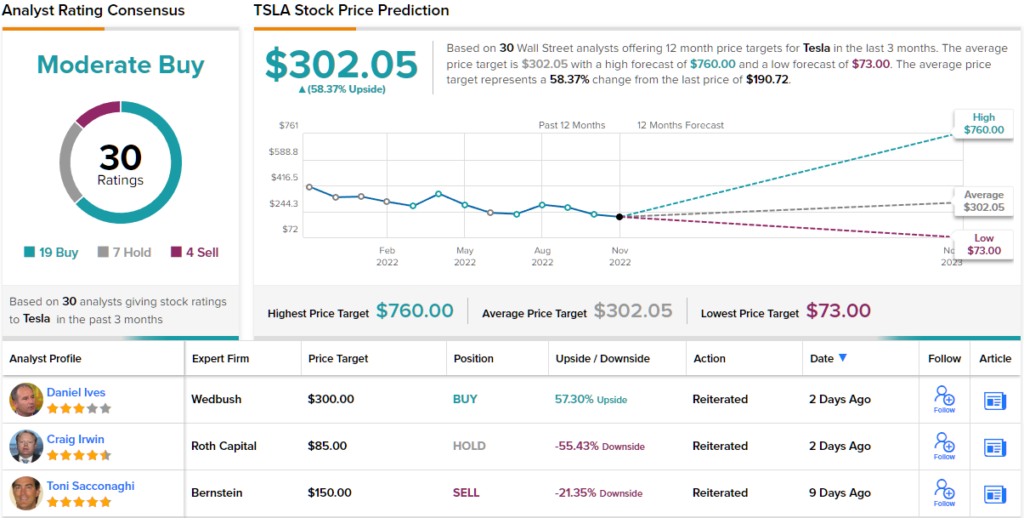

All told, for now Ives maintains an Outperform (i.e., Buy) rating on Tesla shares, backed by a $300 price target. Should the figure be met, investors will be sitting on gains of 57% a year from now. (To watch Ives’ track record, click here)

Over the past 3 months, 30 analysts have waded in with Tesla reviews. These break down into 19 Buys, 7 Holds and 4 Sells, all culminating in a Moderate Buy consensus rating. The average target is only slightly above Ives’ objective; at $302.05, the figure could generate returns of 58% over the one-year timeframe. (See Tesla stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.