Here we go again. The Q1 earnings season is now upon us and after the bell rings to bring Wednesday’s trading action to a halt, Tesla (NASDAQ:TSLA) will step up to post the quarter’s financials.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

We already know how many cars the EV leader delivered in the quarter, as Tesla announced the quarter’s haul earlier this month – the company reached total deliveries of 422,875 vs. the Street’s 421,500 estimate.

The beat can be probably be somewhat attributed to a series of price cuts made during the quarter in order to stimulate demand, and as such, heading into the print, the most important item to look out for will be the margin profile.

“We continue to strongly believe that aggressive price cuts by Tesla was a smart ‘rip the band-aid off moment’ for Musk & Co. to defend its EV turf and put an iron fence around its consumer installed base,” Wedbush analyst Daniel Ives noted. “That said, price cuts come at a price and this tug of war between volumes and margins is now the big debate on the Street heading into earnings and the rest of FY23. The bull/bear debate at the core is: When do the price cuts end for Tesla and what will margins look like on the other side of this cycle as we progress through 2023 in a choppy macro?”

So, having established that the price cuts did the job in boosting demand, the question is what margins will count as acceptable? The key threshold for the coming quarters, says Ives, is for Auto GM (gross margin) to stay north of 20%. As for when Tesla will relax its price slashing endeavors, these might not be over yet, and there could be further tweaking in selected regions, according to demand trends as well as tax credits.

Ives is of the mind that that due to the “increased scale and scope” of Tesla’s production and battery capabilities at its various factories in China, Austin, Fremont, Nevada, and Berlin, cost efficiencies have increased and that in turn could clear the way for more price cuts while keeping Auto GMs at 20%.

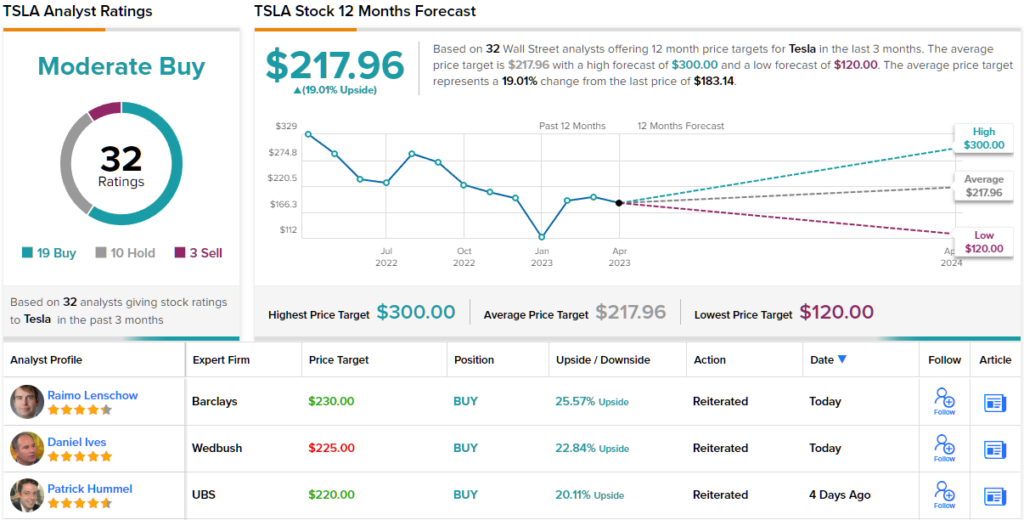

So, how does this all translate to investors? Ives maintains an Outperform (i.e., Buy) rating on TSLA, with a $225 price target. The figure implies shares will be valued 23% higher in a year’s time. (To watch Ives’ track record, click here)

Elsewhere on the Street, Tesla stock garners an additional 18 Buys, 10 Holds and 3 Sells, for a Moderate Buy consensus rating. The average target stands at $217.96, implying the shares will surge 19% over the coming months. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.