Steelmaking is a cyclical business, but I believe you can make excess returns investing in steel companies with a cost moat, strong balance sheet, and low valuation. Enter Ternium (NYSE:TX), the leading steelmaker in Mexico and an extremely well-run business headed by Italian billionaire Paolo Rocca. With an $8.8 billion working capital position, a $7.8 billion market cap, and a nearshoring tailwind, I’m bullish on Ternium S.A.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ternium is a Nearshoring Beneficiary

Companies are moving more and more of their manufacturing production to the Americas. With geopolitical tensions soaring in China and the waters surrounding it, companies want to strengthen and diversify their supply chains, and who can blame them? The last few years have been turbulent. Thus far, Mexico has been a major beneficiary with its low labor costs. As companies continue to build in Mexico, Ternium is there to provide them with steel.

In Ternium’s Q2 earnings call, management and analysts discussed this nearshoring at length. In the auto industry alone, management said that plenty of part manufacturers are moving into Mexico and that Tesla is building a factory in Mexico in a couple of years. A significant investment by Kia is also expected. This is important because auto manufacturers need steel to build factories, equipment, and automobiles. This should create a consistent stream of earnings for Ternium.

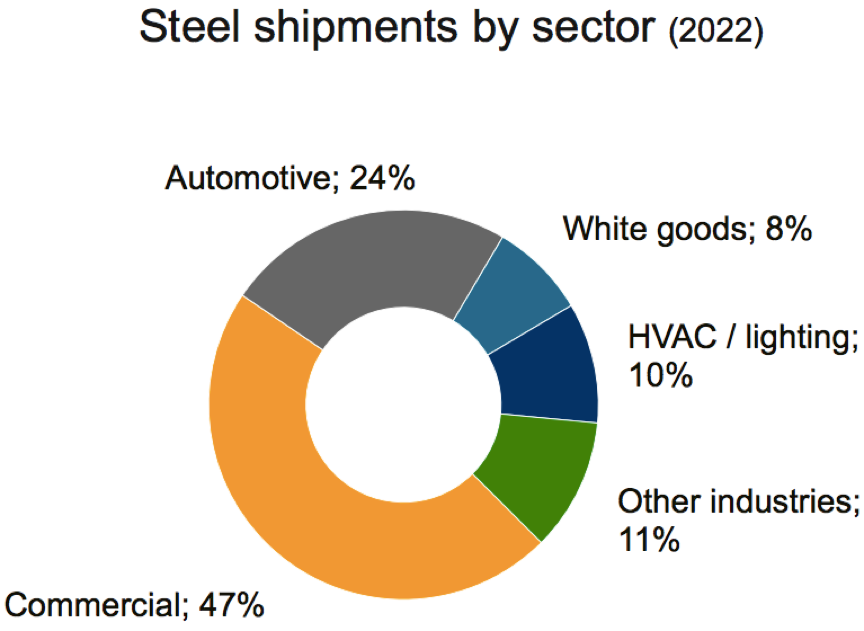

Ternium’s stock has risen on the back of strong steel prices, but, in my opinion, the enduring growth of Mexico is not yet priced in. Here are the end markets for Ternium’s steel shipments:

Source: Ternium’s August 2023 Investor Presentation

The Commercial segment would be things like infrastructure, construction, manufacturing equipment, pipelines, oil rigs, and renewable energy projects. White goods are appliances like refrigerators, ovens, and washing machines, while HVAC represents heating, ventilation, and air conditioning. These are all things that a developing economy like Mexico will need.

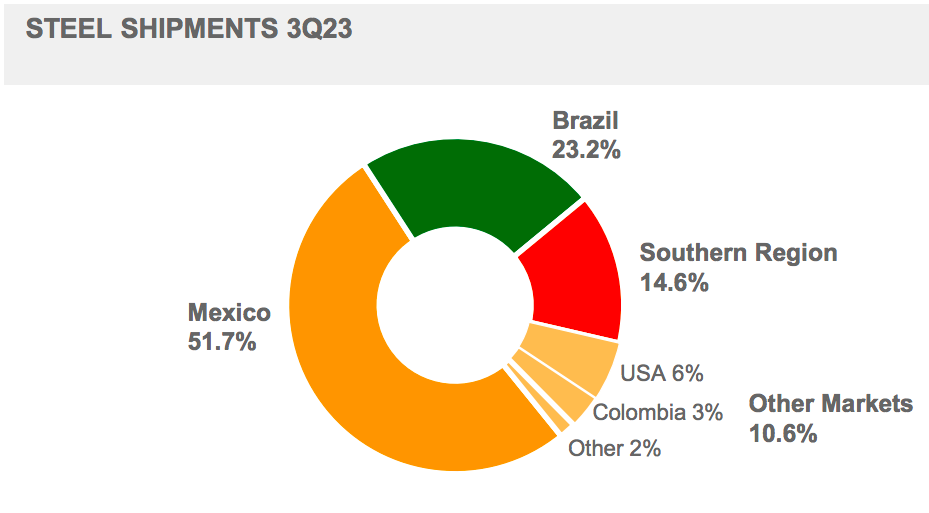

Mexico has just 1/7th the GDP per capita of a country like the United States. So, there’s tons of room for growth. The key word is “tons,” as in tons of steel. Ternium also operates in the following regions:

Source: Ternium’s August 2023 Investor Presentation

A Competitor Shutters Its Doors

Another tailwind for Ternium is the shutdown of AHMSA, which closed its operations in late 2022. AHMSA was Mexico’s largest integrated steel plant. One analyst speculated it could take one and a half to four years to get it back up and running after a myriad of internal issues and a January 2023 bankruptcy.

So why does this matter? Because someone has to fill the production hole left by AHMSA, and it’s likely to be Ternium. AHMSA had $2.65 billion in sales in 2021. AHMSA’s bankruptcy is also a testament to Ternium’s moat (competitive advantage), which we’ll discuss next.

The Cost Moat

Ternium claims it is “vertically integrated, from iron ore mines to service centers.” So, it can exert control over the entire manufacturing process, providing itself with some of its own iron ore (a key commodity used to make steel) and delivering its finished goods to customers.

With Ternium’s intelligent management, efficient technology, robust supply chain, strategic positioning, and low costs, the company has maintained about a 22.5% gross margin on average through the cycle (from 2007 to 2023). Competitors Gerdau (NYSE:GGB), ArcelorMittal (NYSE:MT), and Nucor Corporation (NYSE:NUE) had gross margins in the high single digits to mid-teens over the same period.

Ternium has a large market share in Mexico and Argentina, giving it substantial power. The company can also sell its low-cost goods across the border into the United States.

Uptrending Steel Prices, Strong Earnings

Ternium’s free cash flow profile has been pretty strong, with the exception of 2017 (due to a change in working capital). On the net income side, the company has averaged $1.02 billion of earnings from 2013 to 2022. Over that time frame, steel prices have also trended higher, rising from $655/ton at the beginning of 2013 to $744/ton at the end of 2022 and $943/ton now.

Ternium has slightly increased its level of production and long-term assets over that period, so I estimate that the company’s normalized earnings are around $1.1 billion ($5.60 per share). This implies a normalized P/E ratio of 7x versus the current P/E ratio of 24.8x for the S&P 500 (SPX).

Headed into Q4 earnings, Ternium should benefit from elevated steel prices. HRC steel prices above $750/ton look sustainable, given the enormous increase in the money supply from 2019 to today.

What About Growth?

Ternium is by no means a fast-growing company. But, it does have the tailwinds of nearshoring in Mexico, the closure of a major competitor’s plant, the construction of its own $2.2 billion plant in Northern Mexico, and rising steel prices.

South America should continue to see its infrastructure and economic output expand over time. Also, over the very long term, the price of steel tends to increase alongside inflation, which is a boon for revenues and profits.

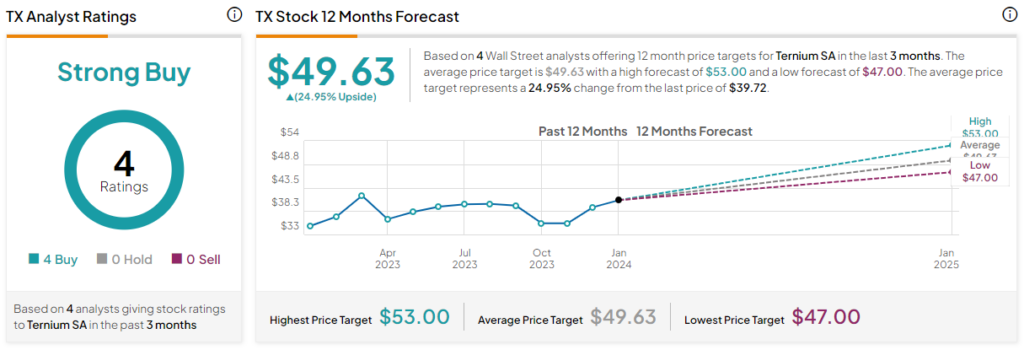

Is TX Stock a Buy, According to Analysts?

After a recent upgrade from Bank of America (NYSE:BAC), all four analysts covering Ternium now give it a Buy rating. The average TX stock price target is $49.63, implying upside potential of 24.95%. Analyst price targets range from a low of $47.00 per share to a high of $53.00 per share.

The Bottom Line on TX Stock

Ternium SA stock certainly looks undervalued, given its cost moat, strong balance sheet, and nearshoring tailwinds. It may also benefit in the short term as steel prices remain elevated relative to historical levels and a major competitor in Mexico closes down.