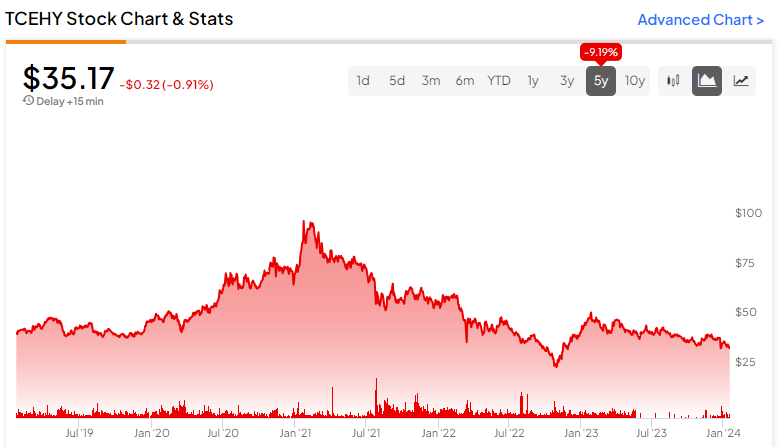

Tencent stock (OTC:TCEHY) may have found a bottom after enduring a long downtrend. With a 29% dip in the past year and a 65% decline from its 2021 high, China’s social media and tech giant has underperformed the market. The ongoing downturn echoes a broader trend of pressure on Chinese equities. However, the downtrend has led to a widening valuation gap, where the stock price significantly understates the company’s intrinsic value and strong results. Thus, I’m bullish on TCEHY stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What’s Keeping Tencent Stock Under Pressure?

Tencent shares have faced persistent downward pressure since reaching their peak in February 2021. Now hovering at $35.68, Tencent stock is lingering at levels seen in the summer of 2017. This persistent stagnation starkly contrasts the broader market and most tech giants resembling Tencent, which have not only recovered in recent months but have also achieved new all-time highs.

Apparently, Tencent appears to have succumbed to the prevailing trend of investors divesting from Chinese equities, irrespective of their underlying financials. Whether it be Chinese ADRs trading on American exchanges or their actual shares traded on the Hong Kong Stock Exchange, China-based companies have experienced continuous market turbulence for years at this point.

To provide perspective, Hong Kong’s Hang Seng Index sustained its decline for the fourth consecutive year in 2023, with losses further extending into January. The index has now retraced all the way back to its 2009 levels, instigating panic among investors.

This trend can be attributed to various factors. Initially, a slower-than-expected recovery following the reopening of the Chinese economy post-stringent pandemic-induced lockdowns has significantly impacted investor sentiment. Furthermore, the real estate crisis in China has exacerbated the situation, with Chinese property companies listed in Hong Kong ranking among the year’s worst-performing stocks.

Lastly, China’s regulatory crackdown on tech firms in recent years has cast a shadow on tech stocks, particularly affecting industry giants like Tencent, Alibaba (NYSE:BABA), and NetEase (NASDAQ:NTES).

Caught in the grip of formidable bearish trends, it becomes evident why no bullish catalyst has managed to divert Tencent stock from its ongoing descent.

Strong Results to Highlight Valuation Gap

While many Chinese companies, especially in certain sectors such as real estate, as mentioned earlier, have indeed been posting weak results, Tencent’s results have remained robust. I believe that Tencent’s robust results against its declining stock are set to highlight the valuation gap, which could possibly reverse investor sentiment toward the stock. Consequently, I support the idea that Tencent stock may have bottomed at its current levels.

For context, let’s look at Tencent’s most recent results and its profit expectations for this year, which highly contrast the stock’s underlying performance.

For the third quarter, total revenues rose by 10% year-over-year to $21.5 billion, fueled primarily by a robust performance in payment volumes due to a resurgence in domestic consumption and a rebound in the company’s ad business.

Specifically, FinTech and Business Services revenues grew by 16%, driven by busier commercial payment activities and elevated revenues from wealth management services. Online Advertising revenues saw an even more noteworthy uptick of 20% versus the prior year, driven by strong demand in video accounts, Tencent’s mobile ad network, and Weixin Search.

The Value-Added-Services segment also demonstrated resilience, with a 4% increase in revenue. Domestic Games revenues grew by 5% despite China’s “Minor protection program” policy. International Games revenues rose by 14% as well.

As you can see, despite the Chinese government’s crackdown on big tech, Tencent’s extensive industry diversification and widespread geographical presence render it resilient, insulating its performance from adverse effects.

Regarding profitability, Tencent once again exhibited excellent margins, which stood at 49% and 24% on a gross and net basis, respectively. EPS, thus, landed at $0.51, pushing the consensus EPS estimates for Fiscal 2023 to $2.25.

This doesn’t only imply a staggering 31.1% increase from last year’s EPS, but it also suggests that shares are trading at about 15.7x 2023’s expected earnings. In the meantime, consensus EPS estimates for Fiscal 2024 project further growth of 17% to $2.64, suggesting another even humbler forward P/E of 13.5x.

Due to Tencent’s lasting sell-off, which starkly contrasts its underlying EPS growth, the valuation gap of the stock has widened to levels of concern. Despite a discount in Tencent’s valuation being expected compared to its American peers due to higher regulatory and governance risks, the company’s current and forward valuation multiples seem to have been compressed to an absurd extent.

Thus, I believe Tencent presents a compelling margin of safety, potentially serving as a deterrent against further share price losses.

Is TCEHY Stock a Buy, According to Analysts?

Taking a look at Wall Street estimates on the stock, Tencent Holdings has received two Buy and one Hold rating in the past three months. At $52.08, the average Tencent Holdings stock forecast implies 48.38% upside potential.

The Takeaway

Overall, Tencent’s recent stock performance reflects broader challenges Chinese equities face, including economic recovery concerns, the real estate crisis, and regulatory crackdowns. Despite these headwinds, Tencent’s strong financial results showcase resilience with strong numbers across all decisions.

Tencent’s robust EPS growth, despite persistent declines in share prices, has further widened the stock’s valuation gap, potentially signaling a shift in investor sentiment. The expanded margin of safety may now encourage previously hesitant investors to consider entering the market.

In any case, given Tencent’s sustained double-digit percentage earnings growth, it seems unsustainable for the stock to continue its downward trend. Inevitably, the market will likely undergo a reevaluation and assign a reasonable multiple to the stock that hints at promising upside prospects.