Telus (NYSE:TU) and Boeing (NYSE:BA) are among the stocks that have been most recommended by Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

U.S. inflation is still much above the Federal Reserve’s target, and global demand is showing signs of slowing. As the world braces for a recession in the coming months, Analysts’ Top Stocks tool by TipRanks could help, giving a comprehensive view of the stocks that Wall Street analysts have been recommending currently.

Telus (TU)

Telecommunications company Telus is benefiting from its focused efforts on customer retention as well as increased demand for premium bundled offerings. This was reflected in its third-quarter customer growth metrics. Total customer net additions for the quarter were 347,000, higher than the prior-year quarter’s figure of 320,000.

The company has remained committed to consistently returning cash to shareholders via dividends. The quarterly dividend was recently raised by 7.2% to C$0.3511 per share, which will be paid on January 3, 2023, to shareholders of record on December 9 this year. Telus’ dividend yield of 4.9% is much higher than its sector’s average yield of 0.9%.

With a market cap of around $30 billion, the company is well capitalized to steer through headwinds. Moreover, Telus is positive that the rapid broadband expansion program and the integration of its recently acquired assets of Lifeworks, a digital and in-person wellbeing solutions provider, will boost its operating momentum.

What is the Price Target for Telus Stock?

Bulls on Wall Street are running for TU stock, with a Strong Buy rating based on seven Buys and two Holds. The average Telus price target of $25.09 indicates 18.15% upside potential from the current price.

Boeing (BA)

At first glance, the world’s largest aerospace company, Boeing, doesn’t seem to be doing too well. It experienced an earnings miss and alarming losses recorded in the third quarter, and it also reported low deliveries in October. Nonetheless, the company is equipped with solid orders, which rose month-over-month, and will provide a backbone for the company.

Shares of the company are down 21% year-to-date but are on an upward trajectory after its earnings release on October 26, despite the dull earnings. Why? Because investors like numbers, and Boeing gave them just that. The company provided its first guidance in almost four years.

The company expects free cash flows of $1.5 billion – $2.5 billion in 2022, $3 billion – $5 billion in 2023, and $10 billion in 2025 and 2026. The free cash flows will be used to fund the debt accumulated during COVID-19 and the two major crashes and subsequent grounding of the 737 MAX jet.

Additionally, investors were also buoyed by Boeing’s third-quarter free cash flow, which came in at $2.9 billion, beating Wall Street’s expectation of $1 billion.

What is the Price Target for Boeing Stock?

Kenneth Herbert of RBC Capital Markets reiterated his Buy rating and $170 price target on BA stock, saying that the “current skepticism from investors provides an opportunity for the stock, so long as Boeing can execute on its updated guidance targets.”

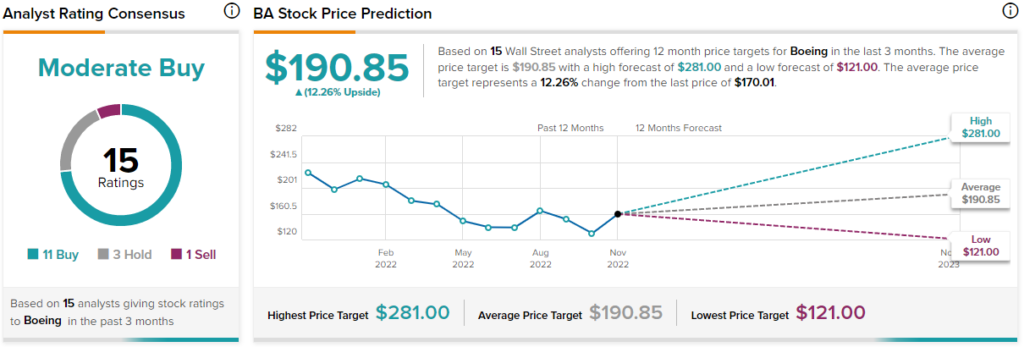

According to Wall Street, Boeing is a Moderate Buy based on 11 Buys, three Holds, and one Sell. The average price target for Boeing stock is $190.85, indicating 12.26% upside potential over the next year.

Ending Thoughts

It is important to invest in companies that have a solid long-term growth path and not get deterred by near-term headwinds. Both Telus and Boeing may have a few challenges in the way in the coming months but are poised favorably for long-term growth.