With the end of the year in sight, and tech stocks having driven the markets sharply higher this year, talk of a potential bubble on Wall Street is growing, à la 1999/2000. The AI boom has powered substantial gains across the semiconductor and software sectors, sending valuations in some high-growth names soaring to more than 50 times forward earnings. The top ten U.S. companies now account for nearly 40% of the S&P 500’s total market cap – levels that rival those seen at the height of the dot-com era.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But there’s another view circulating, too, taking the position that the current AI boom is the real deal. Covering tech stocks for Wedbush, 5-star analyst Daniel Ives describes Big Tech and AI as leaders of the ‘Fourth Industrial Revolution,’ a truly game-changing evolution of the digital/technological/industrial landscape.

“We believe tech stocks will be very strong into year-end and could be up another 10%+ into the rest of the year as the next part of this AI Revolution takes hold with upcoming tech earnings season further swaying investors this is a 1996 Moment…and not a 1999 Momen,” Ives opined. “In a nutshell, there are concerns among investors in the region around the on again/off again US/China tensions and this remains an ongoing soap opera as we saw manifest last week. There clearly could be hiccups ahead on the trade war tensions, but we instead focus on the sheer demand, AI use cases, supply chain feedback to further confirm our bullish view of the AI Revolution,”.

Taking his upbeat view of AI and tech to its logical next step, Ives goes on to choose three tech stock giants – including Elon Musk’s Tesla – as shares to buy in the coming months. Let’s give them a closer look to find out why Ives is bullish, and with some help from the TipRanks database, we can see if the general Street view aligns with Ives’ take.

Apple (AAPL)

We’ll start with Apple, a tech titan whose ecosystem remains one of the most powerful in the industry. The company’s success has long rested on its ability to combine hardware, software, and services into a seamless experience that keeps users firmly within its ecosystem.

That strategy has paid off. Apple now counts over 2.35 billion active devices globally, including more than 1.5 billion iPhones. This vast installed base forms a dependable foundation for recurring revenue through services such as iCloud, Apple Music, and the App Store. With a market capitalization of around $3.7 trillion, Apple stands among the world’s most valuable companies.

Apple has fallen a bit behind in the AI stakes, but is working to integrate AI technology into its devices and services. The company’s AI initiative, Apple Intelligence, is bringing updates and improvements to a wide range of Apple’s features across the full array of Apple’s devices. Apple Intelligence is already built into iOS 18, iPadOS 18, and macOS Sequoia.

Looking at Apple’s last earnings report, from the company’s fiscal 3Q25, we see that the revenue total of $94 billion was a record for the company’s June quarter. The quarterly revenue beat the forecast by $4.87 billion and was up 10% year-over-year. At its bottom line, Apple reported earnings of $1.57 per share, beating the forecast by 14 cents per share and increasing 12% year-over-year.

In his coverage of Apple, Daniel Ives focuses on the still-unearthed AI potential, while noting that the large device and user base forms a solid foundation.

“The elephant in the room has been the invisible AI strategy, with the biggest consumer installed base in the world of 2.4 billion iOS devices and 1.5 billion iPhones, the time is now for Apple to accelerate its AI efforts through outside partnerships… We believe the AI monetization piece could add $75 to $100 per share to the Apple story over the coming few years as it finally plays out after a very disappointing WWDC this past June. We believe no ‘AI premium’ is factored into Apple’s stock at current prices which makes this a compelling large cap tech name to own into year-end and 2026,” Ives opined.

Quantifying his stance, Ives gives AAPL an Outperform (i.e., Buy) rating, along with a $310 price target that points toward a gain of 25% on the one-year horizon. (To watch Ives’ track record, click here)

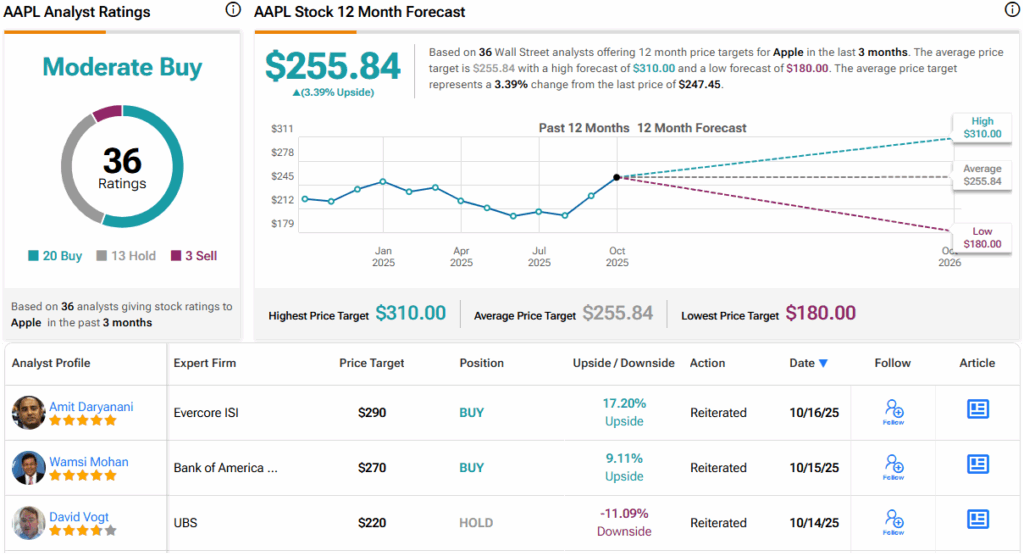

Overall, Apple’s Moderate Buy consensus rating is based on 36 recent reviews that include 20 to Buy, 13 to Hold, and 3 to Sell. The stock is priced at $247.45, and its $255.84 average target price implies a modest upside of 3% for the year ahead. (See AAPL stock forecast)

Tesla (TSLA)

Next up is Tesla, another of the tech world’s giants. With a market cap of about $1.4 trillion, Tesla ranks eighth among the trillion-dollar companies on Wall Street. Though its revenues still come primarily from electric vehicles, the company’s towering valuation reflects something far larger than car sales – it’s driven by investor belief in Tesla’s potential as an AI powerhouse.

Under CEO Elon Musk, Tesla is pushing aggressively into artificial intelligence, aiming to make its vehicles fully autonomous while developing broader AI applications across robotics and neural network training. These efforts have positioned the company less as a traditional automaker and more as a leader in the race toward the next generation of intelligent machines.

On the automotive side, Tesla is already making headway in the autonomous vehicle segment. The company is working to develop FSD software, full self-driving, and has used it to equip its Robotaxi program. The Robotaxi, a self-driving ride-call service, was launched in June of this year in Austin, Texas, using the Tesla Model Y car as the hardware platform. The initial launch included a human monitor in the front seat of the car, able to take control in the event of an emergency. After launching in Austin, Tesla expanded the Robotaxi service to the San Francisco Bay Area.

Looking ahead, Tesla has acquired testing licenses in Arizona and Nevada, allowing the company to perform pre-launch validations. Tesla is also looking to expand the service into Colorado and Illinois, targeting the cities of Aurora and Chicago.

After automated self-driving cars, the next logical step for AI technology is robotics, and Tesla has an active AI-based robotics program. The robot program, dubbed Optimus, is one of Tesla’s most ambitious projects. Optimus, which was unveiled as a concept in 2021 and as a physical prototype in 2022, is a humanoid robot capable of moving and walking in a world scaled and shaped around the human body. The Optimus robot is designed to perform manual labor that humans find difficult or boring, including repetitive tasks performed over extended time frames, heavy lifting in difficult situations, or operating in unsafe or toxic environments. Optimus’s AI tech is designed to enable motion planning and computer learning and is backed up by advanced sensor systems.

Earlier this year, Musk said that he planned to build thousands of Optimus units by the end of this year, with ramped-up production during 2026. That has not materialized, with Musk fingering the trade dispute with China, and consequently bunged-up supply chains, as a causative factor. However, Musk is still predicting that, in the mid-term, Tesla’s revenue stream will come to depend on Optimus, predicting that the robot may eventually account for as much as 80% of revenues.

Musk made that prediction against a backdrop of falling automotive revenues. In 2Q25, the last quarter reported, Tesla’s revenue came to $22.5 billion. This was down 12% year-over-year, a decline that was led by a 16% year-over-year drop in automotive revenues. The auto segment came in at $16.7 billion. Tesla reported $3.05 billion in revenue from “services and other,” for a 17% gain that partly offset the automotive loss. The total revenue beat the forecast by $408 million. Tesla’s earnings were reported as a non-GAAP EPS of 40 cents, meeting expectations but declining 23% year-over-year.

When we check in again with Ives, we find that the Wedbush tech expert is bullish on Tesla’s AI initiatives. He says of the company, “The AI valuation will start to get unlocked in the Tesla story and we believe the march to an AI driven valuation for TSLA over the next 6-9 months has now begun in our view with FSD and autonomous penetration of Tesla’s installed base and the acceleration of Cybercab in the US representing the golden goose for Musk & Co. We believe Tesla could reach a $2 trillion market cap early 2026 in a bull case scenario and $3 trillion by the end of 2026 as full scale volume production begins of the autonomous and robotics roadmap. Importantly we believe the China story is starting to improve markedly for Tesla which should be a tailwind for Musk & Co into 2026.”

To this end, Ives gives Tesla an Outperform (i.e., Buy) rating, with a $600 price target that suggests a one-year gain of 40%.

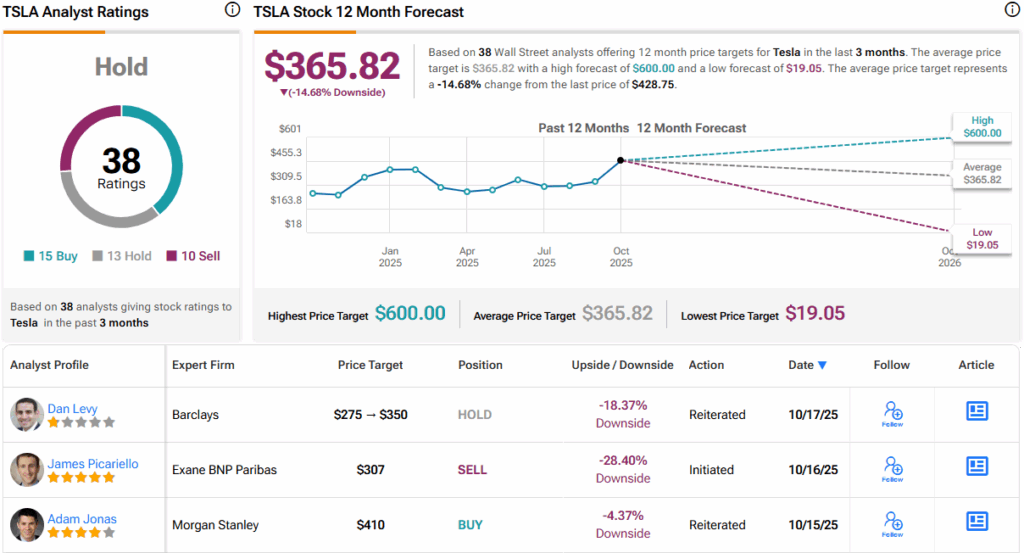

While Ives is bullish, Tesla gets a Hold (i.e., Neutral) rating from the analyst consensus, based on 38 recent reviews that break down to 15 Buys, 13 Holds, and 10 Sells. The stock is currently priced at $428.75 and has a $365.82 average target price, implying a downside for the next year of 15%. (See TSLA stock forecast)

Salesforce (CRM)

Last on today’s list of Wedbush picks is Salesforce, the global leader in customer relationship management (CRM) cloud software. Over the past few years, Salesforce has evolved from a traditional CRM provider into a broad enterprise AI platform, weaving intelligence and automation across its ecosystem.

At the center of this transformation is Agentforce, a new agentic AI suite designed to augment human productivity with autonomous digital agents that can handle customer service, sales, and workflow tasks around the clock.

This month, Salesforce announced an expanded partnership with OpenAI, enabling users to access Agentforce 360 directly through ChatGPT. The integration allows natural language interactions with Salesforce data and customer conversations, streamlining how businesses extract insights and manage support.

Salesforce also deepened its strategic collaboration with Google, linking Google’s Gemini models with Agentforce 360 to enhance personalization and performance across marketing, sales, and service functions.

In its fiscal 2Q26 report, which covered the quarter ending this past July 31, Salesforce reported revenues of $10.2 billion, for a 10% year-over-year gain and beating the forecast by $98.4 million. The company reported a non-GAAP EPS of $2.91, which was 13 cents per share above expectations.

Looking ahead, Salesforce reaffirmed its long-term ambition to surpass $60 billion in annual revenue by FY2030, emphasizing the company’s conviction that AI-driven innovation will remain a key growth engine.

Finally, we turn to Daniel Ives’ view, which centers on the potential gains Salesforce expects to realize from the agentic capabilities it is adding to the platform.

“CRM has grown sales capacity by 20% y/y while ensuring a steady increase in productivity across its accounts to reduce its time to sell within a higher SKU cohort for an improved consumption flywheel. With ~40% of work at Fortune 1000 companies looking to be elevated by AI by 2029, Salesforce is looking to capitalize by integrating agentic capabilities into the platform while still in the early stages of building the AI path forward… We believe that the current risk/reward on CRM is compelling with the installed base opportunity still underappreciated by the Street with CRM expecting to have 20k paying Agentforce customers on its platform by FYE26,” Ives commented.

These comments back up Ives’ Outperform (i.e., Buy) rating on the stock, and his $375 price target suggests that the shares have a 52.5% potential upside on the one-year time frame.

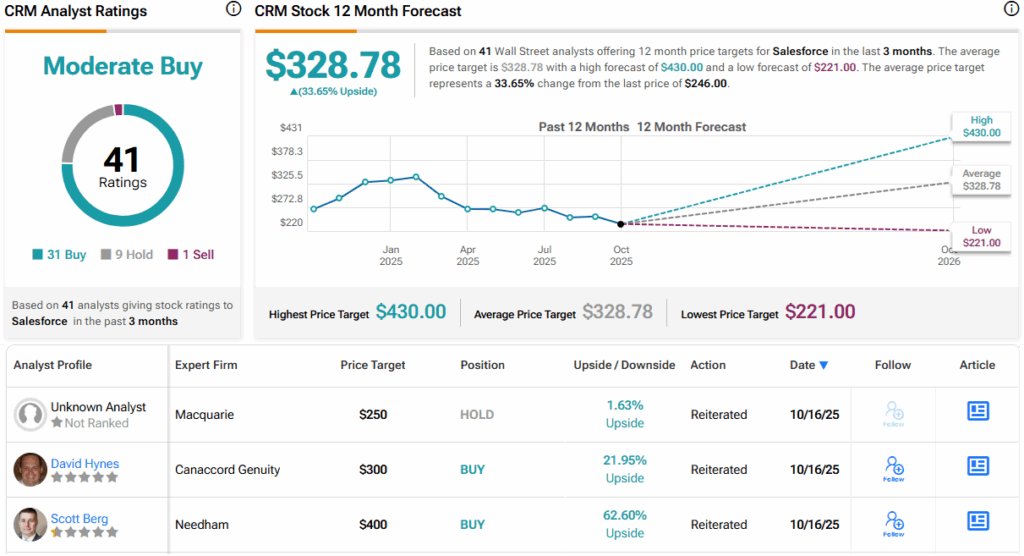

All in all, the 41 recent analyst reviews for Salesforce include 31 to Buy, 9 to Hold, and 1 to Sell, giving the stock a Moderate Buy consensus rating. CRM is currently trading for $246, and its $329.86 average target price implies that a 34% gain is waiting for the stock. (See CRM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.