TipRanks understands the value of expert guidance in the investment landscape. That’s why we offer the Top Hedge Fund Managers tool, which enables users to closely monitor the investment choices of leading financial minds. In this article, we will focus on leading hedge fund manager Gavin M. Abrams of Abrams Bison Investments’ top technology pick, TD Synnex (NYSE:SNX).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based on TipRanks’ ranking system, which prioritizes both average returns and success rates, Abrams emerges as the seventh most successful hedge fund manager among the 483 evaluated, offering investors a compelling track record.

Investors should note that Abrams’ portfolio has exhibited exceptional performance, with a cumulative gain of 407.83% since June 2013, and an average return of 7.39% over the past 12 months. Technology stocks hold a dominant position within Abrams’ portfolio, accounting for 43.62%, while financials represent the second largest allocation at 31.15%.

With this background, let’s explore what the Street is saying about Abrams’ key pick.

TD Synnex

TD Synnex is a global technology distributor that provides a wide range of IT products and services, offering solutions for businesses and technology resellers. With an exposure of 24.82%, SNX occupies the first position in Abrams’ portfolio.

The company’s focus on leveraging artificial intelligence (AI) in its offerings bodes well for the near term. In this regard, SNX recently partnered with Centific, a provider of AI and data services. Moreover, the company increased its dividend by 14%, which reflects financial strength and its commitment to shareholder returns.

On Wednesday, analyst Ruplu Bhattacharya from Bank of America Securities reiterated a Buy rating on SNX stock with a price target of $120. The analyst is optimistic about the company’s performance in the second half of Fiscal 2024, supported by a boost in billings and revenues. Growth optimism hinges on new client onboarding and an IT spending rebound, especially in Endpoint Solutions.

Is SNX a Good Stock?

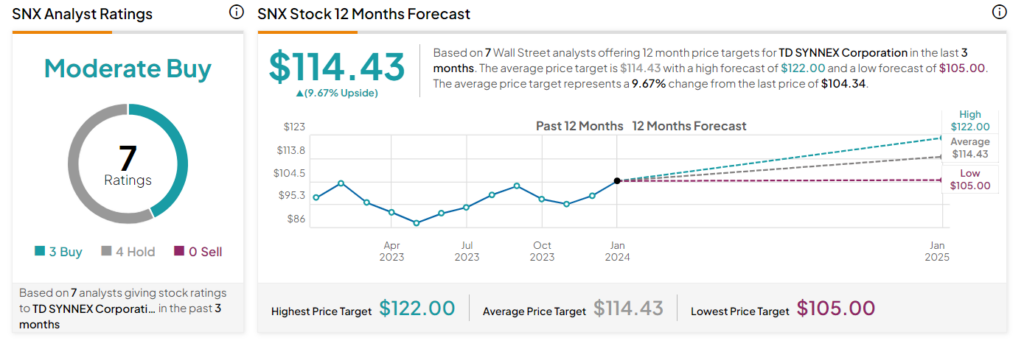

SNX stock has a Moderate Buy consensus rating based on three Buys and four Holds. Further, the average price target of $114.43 implies a 9.7% upside potential to current levels. In the past six months, shares of the company have gained 7.7%.

Bottom Line

The remarkable track record of Abrams’ portfolio serves as a compelling validation of his allocation approach. For more ideas on Top Expert Picks, investors can visit the TipRanks Expert Center and make informed investment decisions.