Lease-to-own, or LTO, holds a curious niche in the consumer retail sector. LTOs are companies that offer consumers a roundabout path to ownership – or sometimes just rock-bottom payment pricing – in a wide range of goods, from household furniture to various electronics to big-ticket appliances.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The LTO sector targets primarily ‘sub-prime’ consumers, allowing them to acquire desired goods through lease agreements. The leases include affordable payments for a set time, with an option to buy or renew when the term expires, or to send the item back to the store. With interest rates currently running high, LTO agreements – that allow down-scale consumers to avoid piling on debt – can bring an acquisition option to the consumer goods table.

Covering the sector for TD Cowen, analyst Hoang Nguyen sees several reasons why LTO companies are starting to look good for investors, too.

“The LTO sector is historically more cyclical than the overall market. They are also more cyclical than bank stocks, though in the long run have outperformed banks given the growth of U.S. consumers, including nonprime,” Nguyen said. “We are now positive on the industry given the confluence of factors such as continued moderation in inflation (with bumps along the way), improvement in consumer confidence, real wage growth for subprime consumers, traction in soft landing. Valuation for LTO has improved from trough, but the space is still trading at a discount below long-run average.”

We can learn just how Nguyen sees these opportunities by looking at 2 LTO names that he sees holding solid growth potential. This may be a good time to buy into these LTO stocks; according to the TipRanks database, both also hold ‘Strong Buy’ consensus ratings. Here’s a closer look.

Upbound Group (UPBD)

The first stock on our list, Upbound Group, may be familiar to some investors as Rent-A-Center; the company changed its name, branding, and stock ticker in February of last year.

Upbound Group operates through a network of 2,400 retail units across the US, including Puerto Rico, and in Mexico. The company’s retail chain does business under several brand names, including Rent-A-Center and Acima on the national scene, and more localized names such as Get it Now and Home Choice. The company is based out of Plano, Texas, and boasts a market cap of $1.81 billion.

Of interest to investors seeking a sound return, Upbound Group hiked its common share dividend in the last declaration, made in December. The payment was set at $0.37 per share, an 8.8% increase from the prior payment and giving an annualized rate of $1.48 and an inflation-beating yield of 4.4%. For the calendar year 2023, Upbound Group returned $133.1 million in cash to its shareholders, a total that included $50 million share repurchases and $83.1 million in dividend payments.

Upbound Group reported $1.02 billion in total revenue for 4Q23, the last quarter reported. This revenue total was up 3% year-over-year and beat the forecast by $25.93 million. At the bottom line, the company had a non-GAAP EPS of 81 cents per share, an earnings total that beat expectations by 4 cents per share. The company’s Acima division, its online mobile app that connects customers to retail leasing in a network of 15,000 participating stores, was a leader in the overall revenue for the quarter, showing revenues of $507.9 million and increasing its gross merchandise volume by 19% year-over-year.

Turning to Cowen’s analyst, Nguyen, we find the top-rated stock expert upbeat here, particularly noting Acima as a sales generator whose benefits outweigh the possible headwinds. Nguyen writes, “We like UPBD for its partial exposure to virtual LTO through its Acima business, which we believe has faster long-term growth potential than the store-based LTO business. Acima is also quickly adding partner locations by using its sizeable sales force, which should help GMV. Meanwhile, its store-based LTO business Rent-A-Center has been outperforming peers over the past few years through the pandemic over all relevant metrics. UPBD is also a solidly profitable business with ROE in the 30%’s, highest in the group. The Concora partnership could add material contribution to EPS once fully in the run-rate down the line. That said, we also note that the Acima business currently has regulatory issues with the state AGs and the CFPB, though these predate UPBD’s acquisition of Acima.”

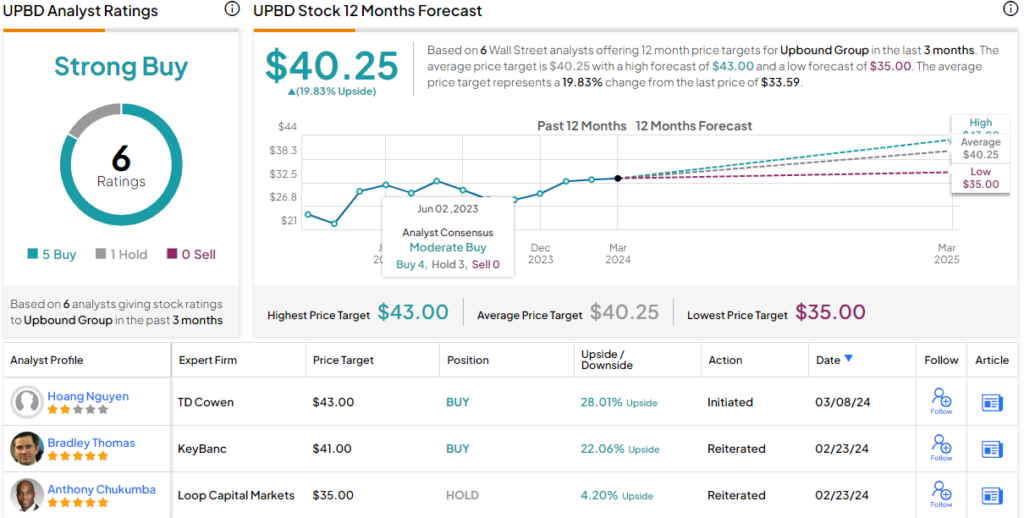

Tracking this forward, the analyst puts an Outperform (Buy) rating on the shares, and a $43 price target that implies an upside potential for the coming year of 28%. (To watch Nguyen’s track record, click here)

There are 6 recent analyst reviews on file for UPBD, and they break down 5 to 1 in favor of Buy over Hold – for a Strong Buy consensus rating. The shares are trading for $33.59 and their $40.25 average target price indicates room for 20% share appreciation in the next 12 months. (See UPBD stock forecast)

PROG Holdings (PRG)

The second LTO stock we’ll look at is PROG Holdings, a rent-to-own company that does business through four divisions, each offering a specialized service. Progressive Leasing provides a combination of eCommerce, app-based, and in-store lease-to-own options giving consumers flexible solutions for a variety of competitive, transparent payment choices for all kinds of merchandise. Vive Financial is a financing service, providing credit access to sub-prime lending customers. Four Technologies is a financial tech company, providing ‘buy now pay later’ options for retail consumers; and Build, another fintech subsidiary, offers a wide range of credit building tools to its customers. Together, these subsidiaries have made PROG Holdings a $1.4 billion leader in the LTO sector.

Taken together, these business lines brought PROG a total of $577.4 million in revenues during 4Q23, the last period reported. While that total was down 5.7% from 4Q22, it did beat the analyst forecasts – by $13.42 million. The company’s earnings were also sound, and at 72 cents per share, the non-GAAP diluted EPS was 3 cents per share better than had been expected.

In a move that should spark investor interest, PROG announced with its Q4 report that it is reinstituting a quarterly common share dividend payment. The company used to pay dividends, but suspended them at the end of 2020, during the COVID crisis. The reestablished dividend payment was set at 12 cents per common share and scheduled for a March 28 payout. At an annualized rate of 48 cents, the dividend gives a modest forward yield of 1.5%. PROG accompanied the dividend with a newly announced $500 million share repurchase authorization. The dividend and repurchase announcements together indicate management’s confidence in the company’s ability to return capital to shareholders.

Nguyen, writing on PROG Holdings, appreciates the company’s sound performance in the LTO sector. He says of the firm and its stock, “We like PRG’s Progressive Leasing as a pure-play virtual LTO provider, which has faster long-term growth than store-based LTO model. PRG has also demonstrated more stable performance vs peers through the pandemic. Progressive Leasing is also a leader in LTO for enterprise accounts with a strong retention record, and enterprise accounts offer more business stability, though have long sales cycle. PRG is also a solidly profitable business with ROE in the low-to-mid 20%… PRG has tended to be conservative with guidance over the past year, and so we believe the initial 2024 guidance has room for upside.”

These comments back up the analyst’s Outperform (Buy) rating, while his $37 price target suggests the shares will add another 16% this year.

Overall, the Strong Buy consensus rating on PROG is based on 4 recent analyst reviews that include 3 to Buy and 1 to Hold. The shares have a current trading price of $31.95 and their $37.33 average target price points toward a 17% increase on the one-year horizon. (See PROG’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.