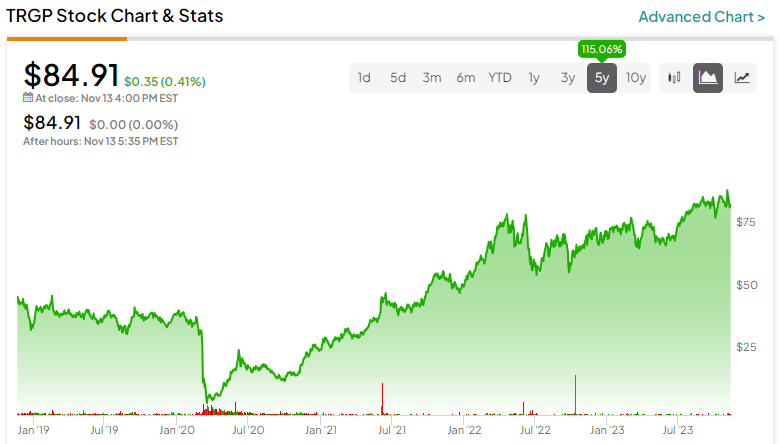

Targa Resources Corp (NYSE:TRGP), one of North America’s largest Midstream Infrastructure companies, is looking all set for an upward leap. The company announced an underwritten public offering program and plans to increase its common dividend. On top of that, it exhibited improved operational efficiency through effective cost management and capital utilization in Q3 while keeping enough firepower to ramp up its share repurchases. Given all said, I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Makes TRGP Stock Bullish?

TRGP continued to ascertain confidence in its future performance each quarter. When it reported Q2 earnings in May, it announced a $1 billion share buyback, which represented a little over 5% of its market capitalization.

On November 2, Targa made a sweeter quarterly announcement to enhance shareholder confidence by announcing a 50% increase in dividends for next year. The Board of Directors is expected to approve a dividend of $3 per share in 2024, a clear indicator of the company’s positive outlook and strong financial health, so be on the lookout.

In a significant move, the firm also announced the pricing of an underwritten public offering of $2 billion in Senior Notes last week, with the proceedings expected to be used for general corporate purposes. I believe this will further help bolster the company’s overall financial footing and provide additional resources for its growth initiatives (more on that later).

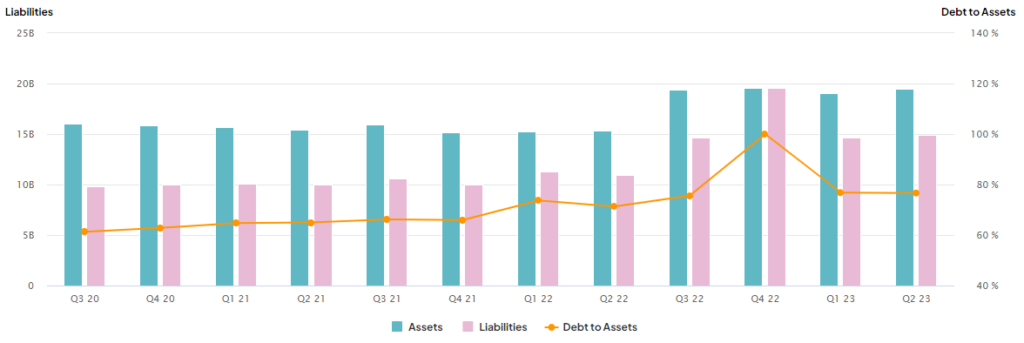

Adding to the pluses, TRGP’s EBITDA is anticipated to rise this year from $3.2 billion to $3.5-3.7 billion. In Q3, Targa increased its adjusted EBITDA by 6% to $840.2 million despite revenues falling year-over-year and missing expectations, indicating effective cost management and capital utilization. Also, the company’s debt-to-assets ratio fell to 76.67% from 76.8% quarter-over-quarter, asserting its ability to pay off its debt and revealing solid operational efficiency.

As if this wasn’t enough, Targa also repurchased shares of its own common stock during Q3 at a weighted average per share price of $83.38, tallying up to a net cost of $132.0 million. As of September 30, 2023, this left the company with $810.7 million of firepower out of the $1 billion repurchase program it announced in May. If this doesn’t demonstrate confidence, I don’t know what does.

Is TRGP Stock a Buy, According to Analysts?

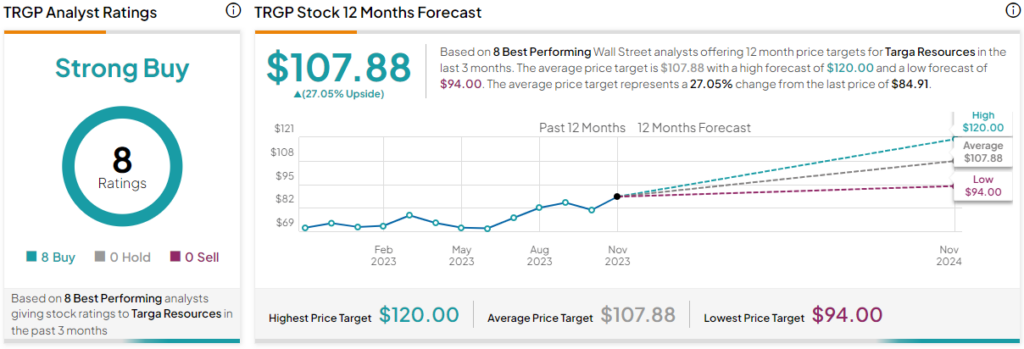

Targa Resources has caught the attention of several financial analysts, not just me. The stock comes in as a ‘Strong Buy’ based on the ratings of the eight best-performing Wall Street analysts. At $107.88, the average TRGP stock price target implies upside potential of 27.05%.

Multiple major analysts have increased their price targets for Targa Resources in the past 10 days. Truist Financial has raised the price target for Targa Resources to $105 from $95, maintaining a Buy rating on the shares. The firm noted that Targa is beginning to see the “fruits of its previous labor” and remains leveraged to what Truist believes to be the highest growth regions in the future.

Bank of America (NYSE:BAC) also increased its price target from $101 to $105. The bank’s analysts argued that Targa’s “weak quarter” was offset by a 50% dividend increase, which absolutely matches my base case, too. The stock now trades at about a 3% dividend yield, which is why some long-only and income funds do not own the units.

Wells Fargo (NYSE:WFC) was another firm that raised its price target on Targa Resources, upping it to $109 from $105 while maintaining an Overweight (Buy) rating on the shares. The firm noted that despite third-quarter results being in line and 2023 EBITDA guidance maintained at the lower end of the range, it remains bullish on Targa due to its commitment to returning more cash to shareholders.

Meanwhile, five-star analysts Gabe Moreen and Elvira Scotto of Mizuho Securities and RBC Capital, respectively, reiterated their Buy rating on November 2.

The price target increases and positive ratings underscore the strong confidence in Targa’s future performance and potential for growth.

Are There Expanding Opportunities for Targa?

Despite missing earnings, the company highlighted operational achievements, including record natural gas liquid (NGL) pipeline transportation volumes and the completion of an expansion at the liquified petroleum gas (LPG) export facility.

It achieved higher inlet volumes of around 150 million cubic feet per day at the beginning of the fourth quarter, surpassing the previous record-breaking period. This growth in volume underscores Targa’s ability to capitalize on opportunities and meet rising demand.

Targa’s operational developments look promising, too. Its robust operational presence in the Permian Basin, one of North America’s most productive hydrocarbon resource reservoirs, allows it to exploit the region’s abundant resources.

In fact, it is constructing several new plants in the Permian Midland and Permian Delaware regions to enhance its production capacity. The new facilities are set to increase its export capacity significantly, as the company sees strong demand through the coming months. This strategic move holds particular significance as we approach winter when the demand for liquefied natural gas (LNG), especially in Europe, typically surges.

These ongoing projects and infrastructure expansion initiatives, such as the recently completed one million barrel per month LPG export increase at Galena Park, point towards a deliberate and strategic growth strategy I don’t want to leave behind.

The Takeaway: Targa is Gearing Up for Growth

Targa Resources appears to be on a strong footing for growth and upward price action as the energy sector continues to evolve. As a reliable, forward-thinking player ready to seize opportunities and deliver exceptional results, TRGP is well-positioned to capitalize on the current market conditions. Lastly, let’s not forget to mention its robust financial fundamentals, expansion strategies in place, and growing confidence among financial analysts and shareholders.