Today is World Mental Health Day, a day when discussions about mental health issues surge to the forefront. Unsurprisingly, the COVID-19 pandemic led to a rise in mental health issues across the globe. Between increased anxiety about illness and a redefined work-home balance, people experienced new stresses. Many found that remote work meant longer hours with little respite, and others feared job loss.

According to a report from the U.S. Center for Disease Control and Prevention (CDC), 31% of adults in the United States suffered from anxiety or depression during the pandemic, while 26% experienced stress-like symptoms. During the pandemic, 13% of people started or increased substance use, while 11% had suicidal thoughts.

Fortunately, there are some companies that seek to address mental health issues through digital platforms.

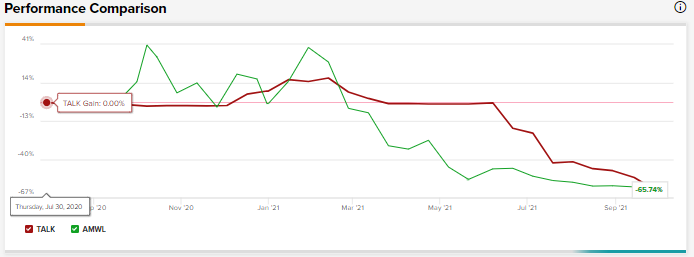

Using the TipRanks Stock Comparison tool, let’s look at two such companies, Talkspace (TALK), and American Well Corp. (AMWL), and see how Wall Street analysts feel about these stocks. (See Analysts’ Top Stocks on TipRanks)

Talkspace

Talkspace, founded in 2012, is a virtual behavioral health company that offers access to licensed mental health providers across a wide spectrum of care, including virtual counseling, psychotherapy, and psychiatry.

The company provides these services through its digital platform. Simultaneously, it uses different channels, including business-to-consumer (B2C), business-to-business (B2B), health plans, and employee assistance programs like Humana (HUM).

The B2C channel comprises consumers or members who subscribe directly to TALK’s platform, while the B2B channel consists of enterprise clients like Google (GOOGL) and Expedia (EXPE).

In Q2, the company’s net revenues jumped 73% year-over-year to $31 million, surpassing analysts’ expectations of $29.5 million. TALK’s net loss came in at $1.15 per share, wider than the loss of $0.05 per share in the same period last year. Analysts were expecting a net loss of $0.03 per share.

The company’s total active members in Q2 ballooned 40% year-over-year to around 61,500 members.

Following the Q2 results, TALK reiterated its outlook for FY21 and Q3 and now expects net revenues of $125 million and $32 million, respectively.

Last month, Robert W. Baird analyst Vikram Kesavabhotla came away bullish about the stock, after a meeting with the company’s management at the Baird Healthcare Conference. The analyst has a Buy rating and a price target of $10 (171.7% upside) on the stock.

The analyst pointed out that TALK’s B2B sales pipeline remains robust as the company anticipates adding two to three additional health plans by the first quarter of next year, bolstering its existing portfolio of six health plans.

The company’s management also highlighted the strong demand environment and a healthy broad sales pipeline.

Moreover, Kesavabhotla added, “This momentum would continue to shift the business toward B2B, where revenue is more recurring and acquisition costs are lower.”

TALK is also approaching “300 employed physicians and is on track to reach ~400 by year-end, with the goal of migrating most of the network to employed providers over time.”

Kesavabhotla believes that this strategy could differentiate TALK from other platforms.

However, the analyst cautioned that TALK’s customer acquisition costs (CAC) are on the rise, regardless of the seasonality factor. According to the company’s management, “there are structural reasons behind that rise, including the broader transition to e-commerce/digital advertising and intensifying competitive behavior.”

While the company expects these costs to normalize eventually, TALK’s management does not “have visibility into timing on that front.”

Turning to the rest of the Street, Wall Street analysts are bullish about Talkspace, with a Strong Buy consensus rating, based on four Buys.

The average Talkspace price target of $9.33 implies 153.5% upside potential from current levels.

American Well Corp.

American Well is a telehealthcare company whose Amwell Platform is a complete digital healthcare solution for its clients. It also offers specialty consultations. As of June 30, the company’s platform had hosted telehealth services for around 55 health plans that supported approximately 36,000 employers.

The company generates revenues by offering the Amwell Platform on a subscription basis, along with fee-based professional services. It also gives access to AMG, a medical group affiliate that provides clinical services on a fee-for-service basis.

In Q2, the company’s revenues stood at $60.2 million, a decline of 12.2% year-over-year, and falling short of Street estimates of $61.7 million. Net loss came in at $0.15 per share in Q2, narrower than the loss of $1.99 per share in the same period a year back. Analysts were expecting a loss of $0.19 per share.

For 2021, the company expects revenues to be between $252 and $262 million, lower than its previous range of $260 to $270 million, due to concerns emanating from the spread of the Delta variant. Adjusted EBITDA is projected to range from a loss of $154 million to $146 million. (See Insiders’ Hot Stocks on TipRanks)

Late last month, AMWL announced the appointment of Robert Shepardson as CFO and Head of Mergers & Acquisitions (M&A). Shepardson will join Amwell from Morgan Stanley (MS) on October 31; he has 30 years of investment banking and capital markets experience.

BTIG analyst David Larsen viewed the announcement as “not entirely surprising,” and commented that this indicated that the “AMWL leadership is very interested in continuing to grow through acquisitions, the company will likely continue to raise money, and AMWL values ‘strategic thinking.’”

However, the analyst worried that “this change is happening before 2022 guidance is issued, and this change may be used as a reason to re-set longer-term expectations.” Larsen is sidelined on the stock with a Hold rating.

Larsen pointed to the rising competition, industry headwinds, and a tough COVID comparison. Explaining further, the analyst added that the second quarter of last year had witnessed a massive rise in tele-health visits due to COVID-19 restrictions.

Tele-health usage is likely “to continue to remain well above pre-COVID levels, but we also believe that volume growth will slow,” he said.

Another concern for Larsen was the valuation of the stock. The analyst stated, “The midpoint of the trading range for AMWL’s IPO was $15 per share and in October the stock was trading near $40 we think due to speculation about United Health Group (UNH) wanting to potentially buy the business outright.”

It is important here to note that AMWL has tanked 66.7% year-to-date. While the analyst thinks it unlikely that a “transaction will occur,” he also believes “that the company’s overall growth rate will moderate as in-person visits get back to pre-pandemic levels.”

Turning to the rest of the Street, Wall Street analysts are cautiously optimistic about American Well Corp., with a Moderate Buy consensus rating, based on four Buys and five Holds.

The average American Well price target of $16.21 implies 90.5% upside potential from current levels.

Bottom Line

While analysts are bullish about TALK and cautiously optimistic about AMWL, based on the upside potential over the next 12 months, TALK does seem to be a better buy.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.