With a rich library of intellectual property and content, World Wrestling Entertainment (NYSE:WWE) stock looks like a long-term winner in an environment where content is king. I’m bullish on the stock as competition between streaming platforms and legacy media companies heats up. Many of these platforms are willing to pay up for content that draws eyeballs (and subscribers) to their platforms.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

WWE CEO Nick Khan said that “there is more interest than ever in owning content and intellectual property” and that the company has “a unique opportunity to explore a wide range of value-maximizing alternatives.”

To this point, WWE is exploring a sale of the company, giving the stock significant upside potential as an acquisition target. Even if there is no sale, WWE is attractive in its own right as it puts up record results and achieves new success internationally.

No Shortage of Suitors

If WWE does end up pursuing a sale, there is no shortage of suitors. Viewership for WWE properties like Smackdown and Raw is up 6% and 2%, respectively, at a time when overall TV viewership is down 18% year-over-year. This makes WWE and its large fanbase incredibly attractive to legacy media providers.

Companies like Disney (NYSE:DIS), Comcast (NASDAQ:CMCSA), Paramount Global (NASDAQ:PARA), and Warner Brothers Discovery (NASDAQ:WBD) could all be interested in WWE. WWE’s content would bolster their own content offerings and provide more firepower to their various streaming services.

Tech giants that have entered the media landscape with the rise of streaming, such as Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN), would also be logical homes for WWE. In recent years, Apple has paid for the rights to select Major League Baseball games and recently struck a 10-year, $2.5 billion deal to broadcast Major League Soccer. Amazon is now famously the home of Thursday night NFL games.

Endeavor Group (NYSE:EDR), the parent company of UFC, could be another intriguing potential suitor. The entertainment company could likely find some interesting synergies between UFC and WWE.

Firing on All Cylinders

WWE recently reported full-year earnings for Fiscal 2022, and the company is firing on all cylinders. WWE reported record revenue of $1.3 billion, which was 18% higher than the year before. At the same time, operating income increased by 11% to a record $283.3 million. Adjusted OIBDA (operating income before depreciation & amortization) increased 19% to an all-time high of $384.6 million. Additionally, this year’s upcoming Wrestlemania has already set records for ticket sales.

The company also has significant monetization opportunities via sponsorships. At the recent Royal Rumble, Mountain Dew staged WWE’s first-ever sponsored match, the “Mountain Dew Pitch Black Match.” Meanwhile, Applebee’s sponsored the event’s countdown clock. Both of these sponsorships amounted to seven-figure deals.

WWE also has a significant runway to expand internationally. Viewership for its Crown Jewel event in Saudia Arabia viewership was up 70% year-over-year. International viewership for prime events, in general, is up 17% year-over-year.

The market has recognized WWE’s strong performance — the stock is up about 59% over the past year at a time when the S&P 500 (SPY) is down 6% over the same time frame.

WWE’s Premium Valuation is Worth It

The stock isn’t cheap after its run over the past year and now trades at 33 times earnings. However, WWE looks like the type of stock that may be worth paying a premium for. There will likely be a bidding war to acquire the company involving any number of deep-pocketed suitors or increased prices for rights to its content in the event that there is no deal.

Furthermore, the stock trades at 5 times sales, which is lower than the 7 times revenue that Endeavor Group paid for UFC in 2016, making WWE palatable from a price-to-revenue perspective.

Is WWE Stock a Buy, According to Analysts?

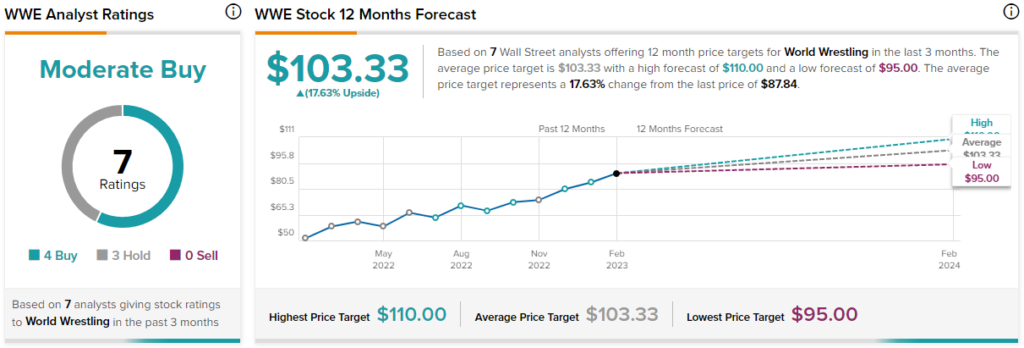

Turning to Wall Street, WWE stock is a Moderate Buy. Of the seven analysts covering the stock, four call it a Buy, and three call it a Hold. No analysts currently have a Sell rating on WWE. The average WWE stock price target of $103.33 implies upside of about 17.6% versus current levels.

Looking Ahead

Whether there is a sale or not, WWE stock continues to look like a long-term winner. The company has a lot of content that draws in viewers at a time when various media platforms are in a race to own the rights to compelling content. This could result in the company being taken over for a premium or continuing to increase earnings and revenue as media entities pay more for the rights to its content over time.

In an arms race for content, I’d rather own the company providing the content to the platforms than the platform itself.