Investors are facing a storm of headwinds right now – a genuine bear market, stubbornly high inflation, rising interest rates, and increased fears of a recession in the near-term.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, Mary Callahan Erdoes, CEO of JPMorgan’s Asset & Wealth Management division, advises investors to stay invested.

“It’s actually the easiest time in the world to find alpha — there is alpha everywhere… It’s everywhere, because we are in such a state of change… While all the world is focused on all the black swan events, there will be white swans that emerge… Staying invested in these markets is one of the most important things and one of the most difficult things,” Erdoes opined.

In the meantime, her viewpoint is influencing JPMorgan’s stock pros. The firm’s analyst Brian Cheng is following this stance to its logical end, picking out stock choices that are primed for gains even in today’s unfavorable market clime. We ran three of them through the TipRanks database to gauge the rest of the Street’s sentiment. Let’s take a closer look.

Adicet Bio, Inc. (ACET)

The first stock we’ll look at is Adicet Bio, a small-cap clinical-stage biopharmaceutical firm working to develop the potential of gamma T cells as a new line of off-the-shelf therapies for cancer treatment. Current treatments using alpha beta T cells have proven efficacious against hematological cancers; Adicet aims to show that gamma T cells can bring a similar potency to the treatment of solid tumors.

Adicet’s pipeline currently features no fewer than 8 drug candidate programs, including one being conducted in partnership with Regeneron. Most of the candidates are still in preclinical stages of development, but the leading track, ADI-001, has entered human clinical trials.

ADI-001 has received the FDA’s Fast Track designation, an important regulatory milestone, and as of the May 31, 2022 data cutoff date, the clinical trial program has shown that ADI-001 has met a 75% complete response (CR) and objective response rate (ORR) across all doses tested in the Phase 1 trial. The drug candidate has showed a favorable safety and tolerability profile in the treatment of patients with relapsed or refractory non-Hodgkin’s Lymphoma (NHL).

In addition to its positive start in human clinical trials, Adicet also boasts a solid balance sheet. The company has over $304 million in cash and liquid assets available, as of the end of 2Q22. Management states that this should fund the company’s ops into the beginning of 2025.

In his coverage of this stock, JPMorgan’s Brian Cheng writes: “The company’s lead asset has shown signs of differentiation that could make its approach stand out from other cell therapy products. We are at the early innings of Adicet’s story in cancers as the company paves a first-in-class path with its line of γδ1-based products. Fundamentally, its approach offers a multitude of potential advantages in cancer-killing activities, safety (with less rejection risk), and natural homing tendency into tissues.”

“We believe the platform has under-appreciated potential to take off from this initial testing ground to solid tumors, where cell therapy has not yet gained sufficient ground. As such, we see Adicet with attractive expansion potential beyond the initial set of indications in the near term,” the analyst added.

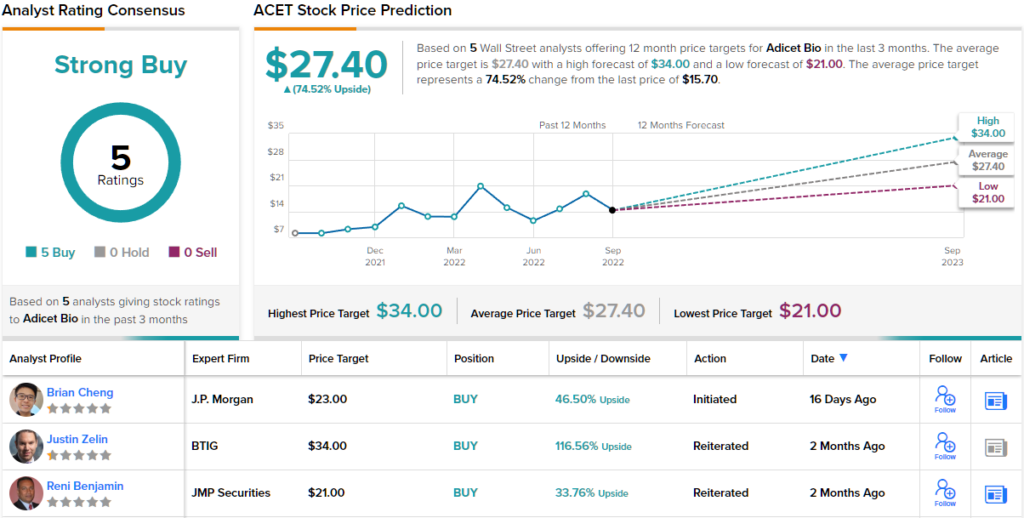

Cheng complements these comments with an Overweight (i.e. Buy) rating, and a price target of $23 to suggest a one-year upside of ~46%. (To watch Cheng’s track record, click here)

JPMorgan is hardly the only Wall Street firm to come down on the bullish side here. ACET shares have 5 recent reviews and they are all positive, for a unanimous Strong Buy consensus rating. The stock is selling for $15.70 and its $27.40 average price target is even more aggressive than JPM’s, implying an upside of ~75% for the year ahead. (See ACET stock forecast on TipRanks)

Xencor, Inc. (XNCR)

The second stock we’ll look at, Xencor, is a biopharma firm working on new antibody and cytokine drug candidates through its proprietary XmAb protein engineering platform. The company boasts that it has 20 programs in the clinical trial phase, including several at the Phase 2 stage.

Xencor’s tech platform is designed to create subtle changes in an antibody’s Fc domain, to create a ‘plug-and-play’ structure that can be substituted in almost any antibody, to create precision drugs to target specific oncological or autoimmune conditions.

Working through partnerships, Xencor has several FDA-approved drugs already on the market. These include Ultomiris, in partnership with Alexion, in the treatment of paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome; and Monjuvi, in partnership with MorphoSys, which is approved for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma.

At the clinical stage, the leading drug candidate, vudalimab, is undergoing two Phase 2 trials. One trial is evaluating the drug against clinically-defined high-risk metastatic castration-resistant prostate cancer as well as some gynecological cancers; the second trial is studying vudalimab in combination with chemotherapy or a PARP inhibitor. This second trial is dependent on tumor subtypes to determine which combo treatment is used. The company is expected to release data by the end of this year.

Through the first half of this year, Xencor’s cash position improved modestly; the company saw its cash holdings increase from $664 million as of the end of 2021 to more than $679 million as of June 30 this year. The company’s received royalties and milestone payments totaled $113.7 million in 1H22, and offset the $105 million in operations spending during that time.

In analyst Brian Cheng’s view, this is definitely a biotech worth a second look.

“The company is building on the past successes of its platform in approved products, such as Monjuvi, Ultomiris, and sotrovimab. Xencor’s ability to execute and willingness to pivot (at an opportune time) are attractive qualities that, in our view, will continue to differentiate the company… We believe the company is near an inflection point, where we will begin to see clarity across its earlier stage products,” Cheng wrote.

“Against the backdrop of steady revenue from partners, the data catalysts within the next 12 months in our view pose an attractive risk/reward profile and provide potential to further unlock the underlying fundamentals,” the analyst summed up.

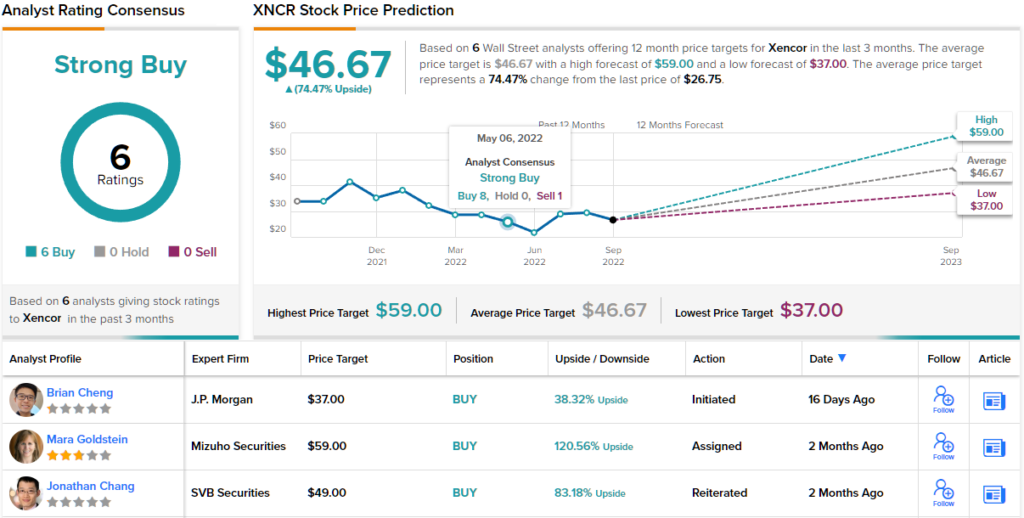

That upbeat outlook leads Cheng to set an Overweight (i.e. Buy) rating on this stock, and his price target of $37 implies that a one-year gain of ~38% lies ahead for this company.

Overall, from the 6 unanimously positive analyst reviews on record for Xencor, it’s clear that Wall Street is in broad agreement about the bright future for this biotech. The shares are trading for $26.75 and their $46.67 average price target indicates potential for a robust 74% upside over the next 12 months. (See Xencor stock forecast on TipRanks)

Intellia Therapeutics (NTLA)

Last up is another biopharma. Intellia works with gene editing, attacking genetic disease conditions at their source. The company uses CRISPR gene editing technology in the pursuit of both in vivo and ex vivo research tracks. Several of Intellia’s drug candidates have reached the clinical research stage, while more are progressing through the pre-clinical phases. The sheer number of research tracks gives Intellia plenty of ‘shots on goal,’ an attractive feature for research-heavy biotech.

Intellia’s two leading drug candidates are NTLA 2001 and NTLA 2002. The first, NTLA 2001, is under testing as a treatment for ATTR amyloidosis. Initial data from the ongoing Phase 1 study, announced last month, was positive. The drug candidate showed ‘deep and sustained’ TTR reductions, and important milestone in treatment, at the 28-day mark. In addition, the drug candidate was well-tolerated at two dose levels.

NTLA-2002 also showed positive Phase 1 interim clinical data, which was made public in mid-September. NTLA-2002, which is being tested as a treatment for Hereditary Angioedema, or HAE, showed plasma kallikrein reductions of 65% and 92% at two doses, 25mg and 75mg, at the 8-week mark. The drug was administered as a single dose, and was well tolerated at both doses tested. The Phase 2 dose-expansion study is planned for 1H23.

Turning back to JPM’s Brian Cheng, we again find him bullish on this biotech play. He writes, “We think NTLA is attractively positioned given its versatility and validation in clinics. The early clinical data from ‘2001 in transthyretin amyloidosis (ATTR) and ‘2002 in hereditary angioedema (HAE) provided strong proof of mechanism as first-in-class therapies. More importantly, the improvement in HAE attacks reported last week was the first confirmation in a relevant outcome measure. We think the data reads through to the rest of the portfolio and bolsters its potential in addressing the underlying cause of many diseases.”

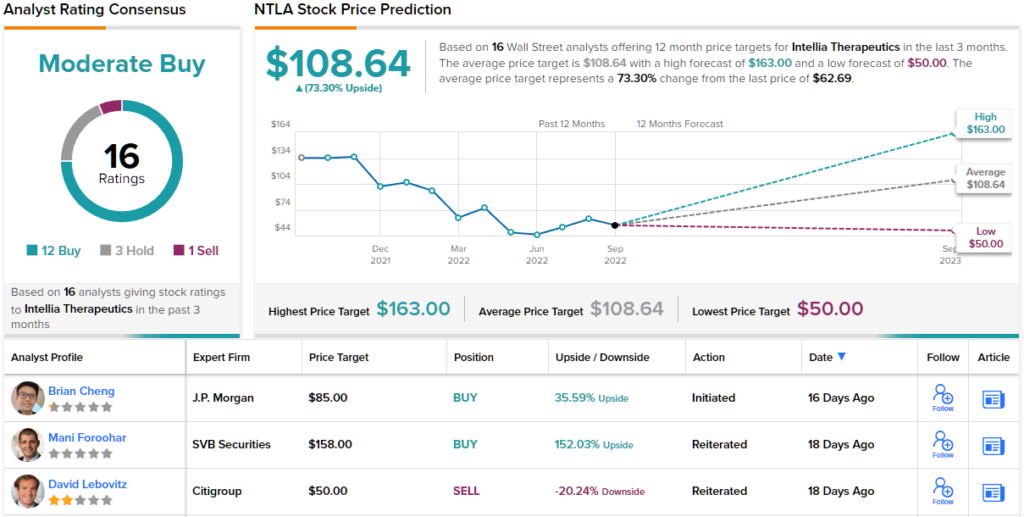

To this end, Cheng is placing an Overweight (i.e. Buy) rating on NTLA stock, and he backs that with an $85 price target – implying an upside of ~36% on the one-year time horizon. (To watch Cheng’s track record, click here)

Overall, most on the Street keep a bullish stance when considering the NTLA’s prospects; the analyst consensus rates the stock a Moderate Buy, based on 12 Buys, 3 Holds and 1 Sell. The stock is trading at $62.69 and its $108.64 indicates a 73% one-year gain lying ahead for NTLA. (See NTLA stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.