Taiwan Semiconductor (NYSE:TSM) reported its Q3 results last month, with the company facing some strong headwinds. Renowned for its state-of-the-art semiconductor fabrication technology, which enables the production of some of the world’s finest microchips, Taiwan Semiconductor operates in a naturally cyclical industry. Despite these challenges, I believe the recent setback is temporary. Once macroeconomic conditions stabilize, strong demand is likely to return. Hence, I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Drove TSM’s Revenues Lower in Q3?

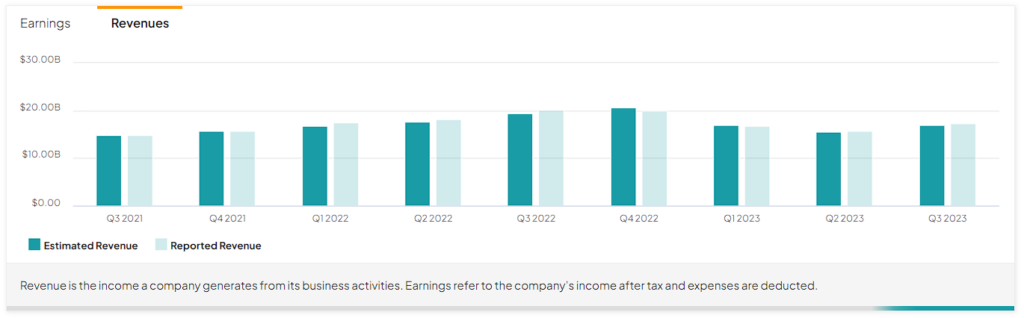

TSM’s revenues landed at $17.28 billion, 14.6% lower compared to the prior-year period. This decline can be attributed to the industry’s cyclical nature, which can easily result in modest swings in semiconductor sales over time.

Specifically, as the leading semiconductor foundry, TSM plays a pivotal role in empowering some of the world’s largest technology giants, including Apple (NASDAQ:AAPL), Qualcomm (NASDAQ:QCOM), Advanced Micro Devices (NASDAQ:AMD), and Nvidia (NASDAQ:NVDA), to breathe life into their cutting-edge chips by harnessing its proprietary technology.

Nevertheless, whether it’s smartphones, powerful GPUs, or the intricate chips that drive modern automobiles, all of these products, in turn, experience periodic fluctuations in their sales.

Evidently, despite TSM’s remarkable 33% surge in Smartphone semiconductor sales, the company together saw a 24% decline in Automotive semiconductor sales for the quarter. This cyclical pattern is illustrated further by the 15% increase in Automotive sales in Q3 of 2022. In my view, TSM’s sales are likely to continue to see swings from here, especially as the ongoing macroeconomic turmoil persists. However, such swings are likely transitory and shouldn’t scare investors away.

In a positive light, the $17.28 billion in Q3 revenues marked a 10.2% increase compared to the previous quarter, signaling a promising rebound. Moreover, the Q4 revenue guidance provided by management, ranging from $18.8 billion to $19.6 billion, suggests further sequential growth.

Profitability Remains Exceptional Despite Challenges

TSM’s impressive profitability in Q3 prevailed despite the challenges it encountered on the revenue front. It’s worth noting that companies with cyclical revenues often witness a sharp decline in net income when their top-line figures dip. This is due to their heavy reliance on operational efficiencies driven by economies of scale to drive margins higher.

However, this is not the case with TSM. Due to its proprietary, irreplaceable technology, TSM enjoys unparalleled pricing power and, thus, industry-leading margins. Consequently, the company not only effortlessly absorbed the modest revenue decline but also once again delivered a highly profitable quarter.

In Q3, TSM’s gross margin stood at 54.3%, its operating margin was 41.7%, and its net profit margin was 38.6%. Although these figures are lower compared to the higher margins of 60.4%, 50.6%, and 45.8%, respectively, from the previous year, they are still remarkable.

How many companies can boast a net income margin of nearly 40% during a quarter marked by declining sales? Certainly not many. Further, profitability is set to remain strong in Q4, with management projecting an operating profit margin between 39.5% and 41.5%.

TSM’s Valuation Remains Fair

TSM stock remains below its 2021 levels and currently trades at what I believe to be a fair valuation. While the company’s EPS is expected to decline by about 22% to $5.13 this year due to a modest decline in sales and margins, it still implies shares are trading at a reasonable forward P/E of 19.2. Simultaneously, EPS is expected to rebound by about 18% to $6.05 next year, effectively reversing the cyclical pressures of this year. This implies a forward (FY2024) P/E of about 16.2 at the stock’s current levels.

Given TSM’s unique competitive advantage and its resilience in the face of cyclical challenges (particularly when it comes to retaining fantastic margins), the current valuation likely offers an attractive opportunity for potential investors. This is especially true when considering the positive long-term outlook for semiconductor demand, which should serve as a continuous tailwind for revenues and earnings for years to come.

Is TSM Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Taiwan Semiconductor features a Strong Buy consensus rating based on nine Buys and two Holds assigned in the past three months. At $109.60, the average Taiwan Semiconductor stock forecast implies 11.4% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell Taiwan Semiconductor stock, the most accurate analyst covering the stock (on a one-year timeframe) is Gokul Hariharan from J.P. Morgan, boasting an average return of 42.2% per rating and an 88% success rate. Click on the image below to learn more.

The Takeaway

Taiwan Semiconductor has navigated through a challenging quarter, marked by a decline in revenues driven by the inherent cyclicality of the semiconductor industry. Nevertheless, the company’s impressive resilience and profitability, with strong margins despite revenue setbacks, are a testament to its unique position in the market.

While the cyclical nature of the industry may continue to present challenges in the short term, TSM’s recent rebound in revenues and promising Q4 guidance signal a brighter future. The company’s fair valuation, coupled with its enduring competitive advantage and the positive long-term outlook for semiconductor demand, underscore the stock’s bullish investment case.