Taiwan Semiconductor stock (NYSE:TSM) saw a post-earnings dip despite the company’s Q1 earnings beating both Wall Street’s top and bottom line estimates. With revenues reaccelerating following the semiconductor industry taking a short breather in the second half of last year, TSM appears poised for resumed growth. Combined with the strength of its outstanding margins, TSM is expected to generate record free cash flow this year. Thus, the recent share price dip may signal a bullish opportunity.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

TSM Beats Wall Street’s Estimates; 3-Nanometer Sales Surge

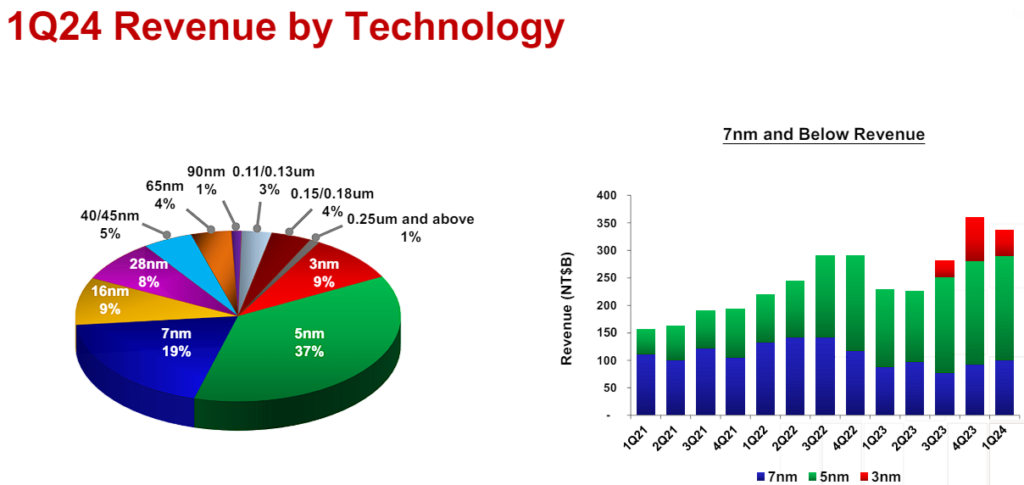

TSM’s Q1 results comfortably beat Wall Street’s top and bottom-line estimates, with its state-of-the-art 3-nanometer process technology starting to build up momentum. Revenues landed at $18.9 billion, beating consensus estimates by $890 million and growing by 12.9% (in USD) compared to last year. The quarter marked a notable acceleration from the 0%, -10.8%, -10.0%, and 3.6% revenue growth posted from Q4 going backward to Q1 of 2023, respectively. EPS also beat estimates by $0.08 to $1.38.

While TSM did experience some seasonality inherent to the cyclical nature of its business model, overall, it was an uplifting period for the industry. The company posted a considerable increase of 33% in its Digital Consumer Electronics (DCE) division and modest growth of 3% and 5% in High-Performance Computing (HPC) and Internet of Things (IoT), respectively. These increases more than offset the 16% decline seen in Smartphone sales and the collective 8% decline in some of TSM’s smaller divisions.

Rather noteworthy is the rapidly growing adoption of the 3-nanometer process technology, which is gradually comprising a larger chunk of TSM’s sales mix. In fact, 3-nanometer revenues quickly jumped from 0% in last year’s Q1 to 9% of total sales in this quarter. With demand actually exceeding initial expectations, management mentioned that they have come up with a strategy to convert some 5-nanometer tools to support production capacity for the industry-leading 3-nanometer technology.

Robust Margins to Drive Record Free Cash Flow

TSM’s monopolistic nature in the semiconductor industry has allowed the company to maintain some of the most impressive margins globally in the tech sector. In Q1, its gross margin, operating margin, and net margin were 53.1%, 42.0%, and 38.0%, respectively. The combination of strong revenue growth and juicy margins is expected to support record free cash flow for the company this year.

This may sound a bit strange, as, at first glance, these numbers appear to have worsened from last year’s 56.3%, 45.5%, and 40.7%. This can be mainly attributed to Taiwan’s 17% increase in electricity prices for industrial users last year. Even worse, from April 1st of this year, the company’s electricity price in Taiwan increased by another 25%, which management expects to erode 70 to 80 basis points from its second-quarter gross margin.

Nevertheless, R&D expenses as a percentage of revenues fell from the high-single digits to near 0% after the successful rollout of 3-nanometer technology. Further, CapEx as a percentage of total revenue has also been on the decline, coming in at 27.2% in Q1, down from the previous quarter’s 41.5% and last year’s 53.4%.

Based on this, Wall Street expects free cash flow to more than double from last year’s $9.5 billion and reach $19.9 billion this year. It will also mark a new record, exceeding FY2022’s high of $17.2 billion.

Is TSM Stock a Buy, According to Analysts?

Looking at Wall Street’s view on Taiwan Semiconductor, the stock features a Strong Buy consensus rating based on eight unanimous Buy ratings assigned in the past three months. At $154.14, the average TSM stock price target implies 18.8% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell TSM stock, the most accurate analyst covering the stock (on a one-year timeframe) is Gokul Hariharan of JPMorgan (NYSE:JPM), with an average return of 53.09% per rating and a 100% success rate. Click on the image below to learn more.

The Takeaway

Overall, I would argue that the initial market reaction to TSM’s Q1 results appears overblown. The company’s revenues have started to reaccelerate, and the company’s 3-nanometer technology promises a strong growth trajectory in the coming years.

Sure, investors may reasonably feel concerned regarding the company’s ongoing margin compression following the steep rise in Taiwan’s industrial players. However, profitability levels still remain at sector-leading levels, while smart R&D cost management and low CapEx suggest record free cash flow this year. Thus, I believe the stock’s post-earnings plunge could signal a bullish opportunity from here.