T-Mobile US (NASDAQ:TMUS), one of the leading U.S. wireless carriers, flaunted its industry-leading customer growth in the first quarter. Nonetheless, TMUS shares are down 6% year-to-date due to concerns about a slowdown in the industry. However, Wall Street remains bullish on T-Mobile and sees strong upside potential based on the company’s focus on improving its profitability and ability to win further market share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Recent Performance

T-Mobile’s first-quarter earnings per share (EPS) jumped 177% year-over-year to $1.58 and exceeded analysts’ expectations. Moderating costs and synergies related to the company’s 2020 acquisition of Sprint helped in driving earnings growth, even as revenue declined 2.4% to $19.6 billion due to lower equipment sales.

Postpaid net customer additions in Q1 came in at 1.3 million, better than rivals AT&T (NYSE:T) and Verizon (NYSE:VZ). In particular, T-Mobile added 538,000 postpaid phone customers (net) in the quarter, outperforming AT&T’s 424,000 gain. Meanwhile, Verizon lost 127,000 phone connections under its postpaid billing plans in Q1.

Moreover, the company highlighted that its high-speed internet net customer additions of 523,000 in Q1 were better than that of AT&T, Verizon, Comcast (NASDAQ:CMCSA), and Charter (NASDAQ:CHTR) “combined for the 4th consecutive quarter.” Overall, T-Mobile’s Q1 performance helped raise the full-year outlook for postpaid net additions, core adjusted EBITDA (earnings before interest, tax, depreciation, and amortization), and free cash flow.

The merger with Sprint has bolstered T-Mobile’s position in the wireless space. Looking ahead, the company’s bottom line and free cash flow are expected to improve due to merger-related synergies. T-Mobile has increased its run rate synergy target to $8 billion in 2024. Also, the company intends to reward shareholders through buybacks and sees an opportunity to repurchase shares up to $60 billion through 2025.

Is T-Mobile Stock a Buy or Sell?

Last week, Morgan Stanley analyst Simon Flannery increased the price target for T-Mobile to $178 from $177 and maintained a Buy rating, reinstating the stock as his “top pick” in the telecom services space.

Flannery noted that after being range-bound for months, TMUS stock recently broke below the $140-$150 trading range, providing an attractive opportunity for buying the stock. The analyst anticipates the stock to break out of this range over the next few months, driven by operation and technical factors.

Flannery believes that the recent weakness in the sector creates an opportunity for the company to execute the remainder of its $14 billion buyback program at lower prices. The analyst’s bullish stance on T-Mobile is backed by the company’s solid free cash flow, recurring revenues, network leadership, and expanding market share.

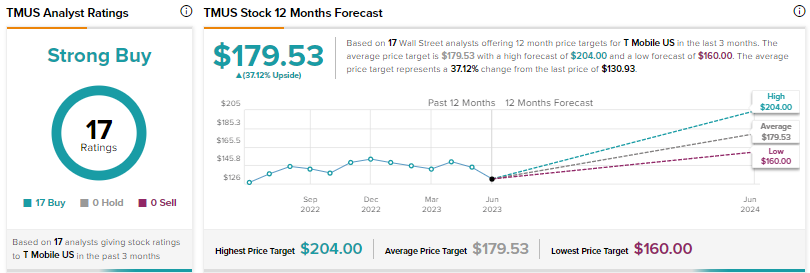

Wall Street’s Strong Buy consensus rating on TMUS is based on 17 unanimous Buys. At $179.53, the average price target implies 37.1% upside.

Conclusion

T-Mobile is beating its close rivals AT&T and Verizon when it comes to postpaid subscriber growth. The company’s focus on improving profitability through efficiency measures and cost reductions is expected to drive its shares higher over the long term. Wall Street analysts’ unanimous bullish review reflects the confidence in T-Mobile’s future prospects.