SunPower (NASDAQ:SPWR) was once a highly promising business for solar industry investors. Yet, the chances of a rise-and-shine moment are getting dimmer every day, as the news surrounding SunPower is downright alarming. I don’t want to see SunPower fail, but I am bearish on SPWR stock after reviewing all of the relevant facts and circumstances.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Headquartered in California, SunPower provides solar power equipment and services, mainly for residential applications. Because the federal government and some local governments offer incentives for people to install solar equipment in their homes, it might seem like a no-brainer to buy and hold SunPower stock.

However, solar companies aren’t all equally good, and investors need to be selective when picking stocks in this sector. As we’ll discover, SunPower has specific issues that aren’t likely to be solved anytime soon, so prospective shareholders should definitely learn about SunPower’s persistent problems.

An Unfortunate Period for SunPower

SunPower’s loyal investors haven’t had much luck during 2023’s final few months. It’s just been one problem after another for SunPower and its shareholders. Usually, I like to root for underdog companies, but this one’s difficult to defend.

SPWR stock has been on a relentless downtrend all year long. To a certain extent, this can be attributed to high interest rates, which put pressure on solar companies like SunPower.

However, even with the challenges that SunPower can’t control (like high interest rates), there are also company-specific issues that investors should be aware of. For example, the Nasdaq (NASDAQ:NDAQ) exchange issued a warning to SunPower in November because the company failed to submit its quarterly Form 10-Q in a timely manner. Certainly, that’s not a good sign.

Also in November, SunPower released its preliminary third-quarter 2023 financial results. SunPower CEO Peter Faricy admitted in the press release, “We are reducing our 2023 guidance due to lower-than-expected consumer demand as well as delayed revenue recognition from longer cycle times.”

So now, SunPower’s management expects the company to incur a GAAP net loss of $165 million to $175 million. Furthermore, SunPower posted its fourth consecutive quarterly EPS estimate miss and lost a GAAP-measured $32 million in 2023’s third quarter (according to the company’s preliminary results).

Despite these glaring red flags, Faricy declared that SunPower “is competing effectively in a difficult market.” Is that really the case, though? Let’s see what else has taken place in 2023’s final quarter and determine whether Faricy’s sunny disposition is warranted.

A One-Two Punch of Negative News for SunPower

Recently, SunPower’s shareholders got hit with not just one but two alarming pieces of news. First, just a week ago, Barron’s reported that SunPower “entered into an amendment and waiver to its credit agreement with lenders,” including Bank of America (NYSE:BAC) and Citigroup’s (NYSE:C) Citibank.

In other words, SunPower’s creditors gave the company more time to pay off its debts. In a bearish note, Truist Securities analyst Jordan Levy warned that this waiver/amendment probably won’t “provide equity investors much confidence over the near term.” Levy also raised the topic of a likely future stock sale (and, by implication, share-value dilution), stating, “Until a more concrete solution is established, we see a potential equity raise continuing to act as a headwind to shares.”

That wasn’t even the biggest bombshell, though. Yesterday, the company issued a dreaded “going concern” warning. Apparently, SunPower’s management believes that since the company wouldn’t be able to meet its debt obligations if the lenders demanded repayment right now, “Substantial doubt exists about the Company’s ability to continue as a going concern.”

Interestingly, this “going concern” admission could, at least in theory, cause SunPower’s creditors to demand immediate repayment. As Raymond James analyst Pavel Molchanov explained, “This technically qualifies as an ‘event of default’ that, in theory, could enable the lenders to call in the loan.” However, Molchanov feels that this scenario, in which SunPower’s creditors would demand immediate loan repayment, is unlikely.

In any event, SunPower stock dropped like a rock yesterday after the release of the “going concern” news. It’s an awful way for SunPower to cap off an already distressing quarter and a relentlessly challenging year for the company’s shareholders.

Is SPWR Stock a Buy, According to Analysts?

On TipRanks, SPWR comes in as a Hold based on two Buys, 12 Holds, and six Sell ratings assigned by analysts in the past three months. The average SunPower stock price target is $4.68, implying % upside potential.

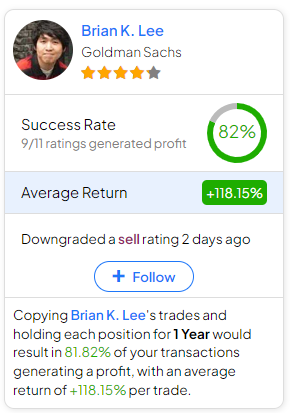

If you’re wondering which analyst you should follow if you want to buy and sell SPWR stock, the most profitable analyst covering the stock (on a one-year timeframe) is Brian K. Lee of Goldman Sachs (NYSE:GS), with an average return of 118.15% per rating and an 82% success rate. Click on the image below to learn more.

Conclusion: Should You Consider SPWR Stock?

I’m not going to make a hard-and-fast rule that every company that issues a “going concern” warning is toxic. Yet, it’s a bright red flag amid a quarter filled with red flags for SunPower.

Thus, even if you’re bullish on solar power in general, there’s no need to pick SunPower as the specific company to bet on. When all is said and done, I usually like underdog stocks, but I just can’t recommend taking a long position in SPWR stock.