The Trans Mountain pipeline expansion stands to be a massive deal in the turbulent world of Canadian energy stocks and the Canadian economy at large. Undoubtedly, it’s been a long and windy road for the project, which links Edmonton to the British Columbia coast, with the latest round of delays coming courtesy of various technical issues. Indeed, delays are the last thing that the project needs, as it has been plagued with regulatory hurdles and excessive spending.

That said, for investors patient enough to wait for technical woes to resolve themselves, I think there’s value to be had as the economics of Canada’s oil sands look to improve over time.

The price of Western Canadian Select (WCS) crude prices has tended to go at quite the discount to WTI (West Texas Intermediate), the “flavor” of oil that most everyday American investors are likely most familiar with. When you hear of oil prices, you probably look straight to WTI.

These days, it’s going for just shy of $73 per barrel, while WCS goes for some amount lower at $54. In recent years, the WCI-to-WTI discount has shown subtle signs of narrowing. However, more recently, the discount has somewhat widened again.

Of course, there are numerous reasons why we see fluctuations in the prices of both WTI and WCS. One of the main factors lies in the fact that heavy Canadian crude requires a great deal of processing. That takes a lot of money and effort, and a discount seems more or less warranted.

Trans Mountain to Triple Capacity to the Pacific Coast

Once the Trans Mountain expansion project is finally complete (currently pinned for the second quarter of 2024, but expect it to give way for further surprise delays), we’ll see more Canadian crude (around 890,000 barrels per day, almost tripling the capacity) headed to the Pacific coast and likely more production capacity for Canada’s top oil producers.

For now, producers may be unhappy over the charges to ship crude via the Trans Mountain pipeline. In due time, however, things could pan out well for both sides. The Canadian government is looking for its investment to pay off.

Without further ado, let’s use TipRanks’ Comparison Tool to take a closer look at two Canadian oil stocks — SU and CNQ — that can benefit from the expansion and may be worthy of stashing on a watch list.

Suncor Energy (NYSE:SU) (TSE:SU)

Some Americans may know Suncor Energy as the little-known Canadian oil company that Warren Buffett’s conglomerate Berkshire Hathaway (NYSE:BRK.B)(NYSE:BRK.A) owned for a brief period of time. Though Berkshire no longer owns the stock (it hasn’t for many years now), I still think it’s a deep-value energy play.

It’s worth considering if you’re looking for a way to benefit over the long term from the completion of Canada’s Trans Mountain pipeline expansion. Due to the low price of admission, I’m bullish on the stock.

The stock has gone flat for around two years, moving choppily around the mid-C$40 levels. Despite its status as one of the crude production heavyweights, the stock has been weighed down by a handful of tough headwinds and headlines in recent years (think safety concerns, runoff spills, and pollution violation headlines). More recently, though, management seems to have been improving on some fronts, with the CEO recently touting the firm’s improved worker safety track record as a part of its latest quarterly commentary.

Looking ahead, Suncor is expected to increase production and capital expenditures (to C$6.3-6.5 billion) by almost $1 billion ahead of original estimates. That’s a big vote of confidence for a company that I believe ought to be worth more than 7 times trailing price-to-earnings.

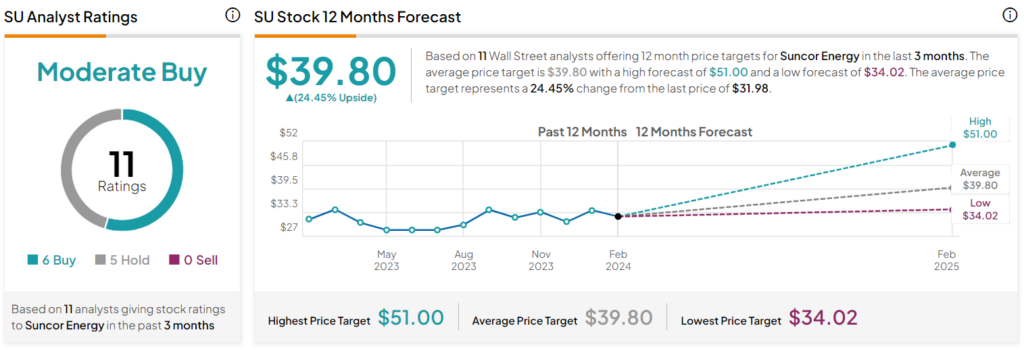

What Is the Price Target of Suncor Stock?

Suncor stock is a Moderate Buy, according to analysts, with six Buys and five Holds assigned in the past three months. The average SU stock price target of $39.80 implies 24.45% upside potential.

Canadian Natural Resources (NYSE:CNQ) (TSE:CNQ)

Canadian Natural Resources stock has been a higher-flyer relative to Suncor, now up more than 200% over the past five years. The company hit record output back in December 2023. As CNQ continues soaring in the face of a somewhat “mild” environment for oil, analysts have been steadily raising their targets for the firm. I share the bullishness of the analyst crowd.

Canadian Natural Resources stock was one of the newest picks from the top-pick list of Bank of Montreal (NYSE:BMO). With a $95.00 per share price target on CNQ stock, representing a whopping 58.4% upside potential, it’s hard to find a bigger bull on Wall Street right now.

With a bountiful, growing 4.9%-yielding dividend and a still fairly cheap price-to-earnings ratio of 12.7, value investors may wish to watch the Canadian energy giant closely as we move into a year that could be eventful for Canada’s energy scene.

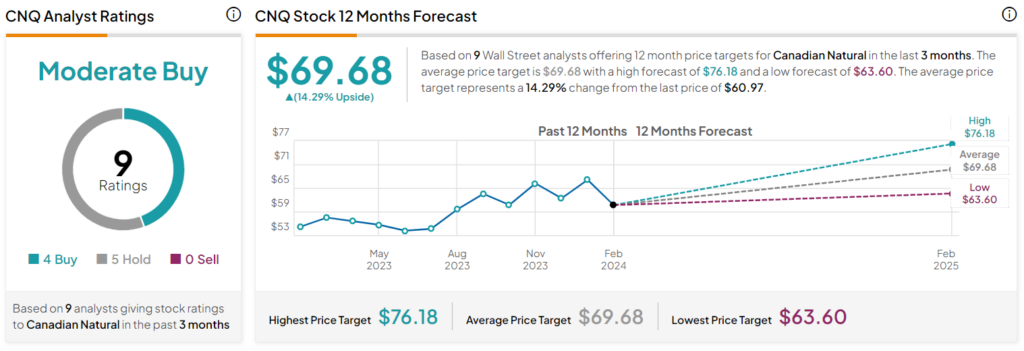

What Is the Price Target of Canadian Natural Resources Stock?

Canadian Natural stock is a Moderate Buy, according to analysts, with four Buys and five Holds assigned in the past three months. The average CNQ stock price target of $69.68 implies 14.3% upside potential.

The Takeaway

The Trans Mountain pipeline isn’t just a big deal; it’s the only pipeline to connect the Pacific coast to the heart (or at least pretty close to it) of Alberta’s oil sands. This bodes quite well for the long-term prospects of the Canadian energy juggernauts, many of which are still to trade at modest valuations ahead of the looming completion of the pipeline. Overall, between Suncor and CNQ, analysts see more upside (~24.5%) in Suncor stock.