Three major headwinds have been combining to buffet the markets – persistently high inflation, the Fed’s rising interest rates in its ongoing battle to tame it, and the increasing worries that a recession is around the corner.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In such an unpredictable market environment, investors need to find some clear and reliable sign to indicate just which stocks are the most attractive choices to weather the volatile conditions. One of the clearest such signals comes from the corporate insiders, company officers in high posts – CEOs, CFOs, Board members – whose positions give them an inside view of company ops, along with more detailed knowledge to make predictions on their own firms’ stocks.

Being human, like the rest of us, these insiders use that knowledge when they trade their own shares – and to keep the playing field level, regulatory authorities require that they publish their insider trades on a timely basis. And when the insiders start buying up their stock in million-dollar lots, investors can track that, and make decisions based on the data.

Using the Insiders’ Hot Stocks tool from TipRanks, we have found two stocks that are showing just such large insider buys – informative buys in the million-dollar range. We can take a dive into the data, and the analyst commentary, to get a clearer picture on why they are loading up right now.

Masimo Corporation (MASI)

First up is Masimo Corporation, a healthcare company that designs, manufactures, and markets non-invasive medical monitoring technologies, with a line of devices for home monitoring and hospital automation. The company’s core products focus on pulse oximetry, the non-invasive monitoring of a patient’s blood oxygen saturation levels. Masimo is based in Irvine, California, and its Masimo SET (signal extraction technology) helps monitor over 200 million patients worldwide.

Shares in Masimo are down this year, by approximately 51%, but by far the bulk of that loss came in February, when news broke that the company had spent over $1 billion on the acquisition of Sound United, a non-healthcare company focused on audio technology. Investors were skeptical of the move, which did not appear to fit with Masimo’s technological track.

Since that announcement and the share price drop, the stock has been fairly stable – and the company has delivered on revenues and earnings. In the last quarter reported, 3Q22, the company showed a top line of $549 million, up an impressive 78% year-over-year. This included healthcare revenues of $372 million and non-healthcare revenues of $222 million. The non-GAAP net income, of $53.9 million, translated to $1 per diluted share, up 6.3% from the year-ago period. Both the total revenue and the diluted EPS came in ahead of expectations.

On the product side, Masimo has recently released its W1 Watch, a personal health tracking watch that keeps continuous records of key health data. The W1 is billed as the first of its class, a comfortable and convenient wearable personal health tracker, adaptable for use by healthcare professionals for patient monitoring or by individual health-conscious consumers.

The company has also unveiled its Stork baby monitoring system, which links with household theater and sound systems to provide parents with easy monitoring anywhere in the home – and also, to connect Masimo’s products with the Sound United buy from earlier in the year.

Turning to the insiders, we find that company CEO Joe Kiani has been buying heavily into MASI shares. Last month, he purchased 39,778 shares for $4.97 million; he has followed that up with a buy last week of another 7,040 shares, for which he paid almost $1.02 million. Kiani now holds a stake in the company worth $517.61 million.

After initially having some reservations around the Sound United acquisition, BTIG, analyst Marie Thibault has come around and is bullish on the potential of the company’s products.

She writes, “We think the W1 watch makes sense as part of a telemonitoring ecosystem and the Sound United products help complete that home care setting. The Stork baby monitor seems like a natural fit, given MASI’s reputation in pulse ox, doctor familiarity with the brand, and parents’ preference for a safe, medical-grade product. With Stork, the Sound United consumer retail channels will be an important boost for market entry. In our view, revenue contribution from new consumer health products (one point of revenue CAGR over the 2023-2028 period) was set conservatively.”

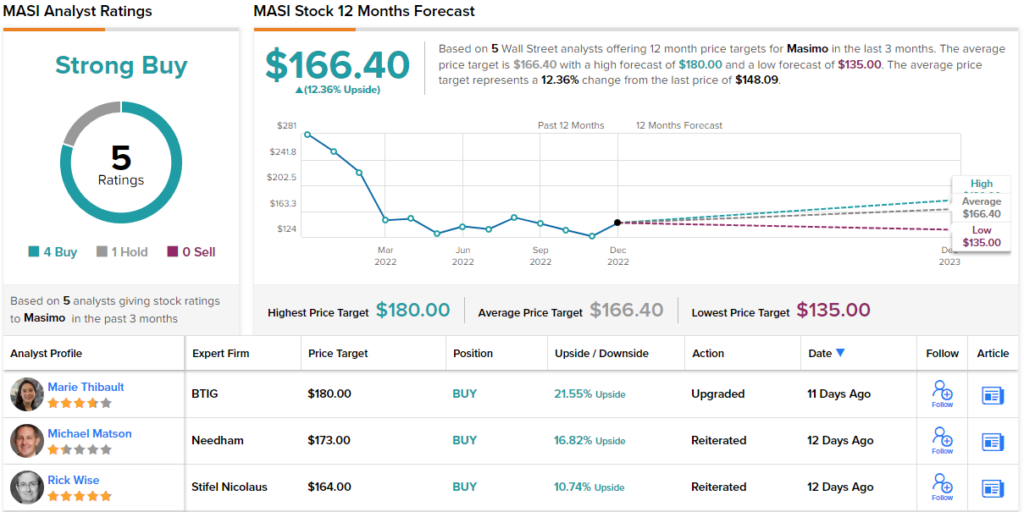

Taking this stance forward, Thibault rates the shares a Buy, with a $180 price target that suggests a one-year upside potential of 21%. (To watch Thibault’s track record, click here.)

There are 5 recent analyst reviews on this stock, and they break down 4 to 1 in favor of Buy over Hold for a Strong Buy consensus rating. The shares are priced at $148.09 and have an average price target of $166.40, implying a 12% upside on the one-year horizon. (See Masimo’s stock forecast at TipRanks.)

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.

Victory Capital Holdings (VCTR)

Next up is Victory Capital, a holding company in the asset and investment management field, operating through a network of subsidiaries. Victory provides a full range of services to its clients, including investment advice, fund administration, and general asset management. Overall, Victory has some $161.5 billion in total AUM as of this past November 30. This is up from the Q3 total of $147.3 billion.

Last month, Victory reported its 3Q22 results. The top and bottom lines were both down slightly y/y, but both came in above the estimates. Revenues were reported at $207.3 million, compared to $226.3 million in the year-ago quarter, while adjusted earnings, at $1.19 per diluted share, were down from $1.25 reported in 3Q21. The EPS, however, was significantly above the $1.07 forecast, beating it by 11%.

Despite the y/y drop in revenue and earnings, the company Board felt confident enough to authorize a common share dividend of 25 cents. This marked the fourth quarter in a row with the dividend at this rate, and the annualized payment of $1 gives an above-average yield of 3.7%. The company has been gradually increasing the dividend payment over the past 3 years.

Victory’s major insider buy came from company Chairman and CEO David Craig Brown, who bought 60,000 shares last week. These are now worth more than $1.63 million and have boosted his holding in the firm to just over $60 million.

Brown is not the only bull here; Kenneth Lee, a 5-star analyst with RBC Capital, is also upbeat about Victory’s prospects. Following the Q3 print, he wrote, “We remain impressed that VCTR continued to show resiliency in margins, in a challenging quarter with meaningful market volatility. VCTR’s adjusted EBITDA margin was 50.0% in the quarter, above our 48.8% estimate. Recall, management’s long-term EBITDA margin guidance of 49%, which includes potential impact from ongoing re-investments (VCTR continues to build out its digital capability, especially within the direct investor business). We note that VCTR’s operating model, which has roughly 2/3 of operating expenses variable, enables the company to flex expenses during market drawdowns.”

Looking ahead for the stock, Lee sees reason for an Outperform (Buy) rating, while his price target, at $34, indicates confidence in 25% upside over the next 12 months. (To watch Lee’s track record, click here.)

This asset manager gets a Moderate Buy consensus rating from the Street’s analysts, based on 9 recent analyst reviews – that include 5 to Buy, 2 to Hold, and 2 to Sell. With shares priced at $27.20 and an average price target of $30.56, this stock has a 12% upside potential by the end of next year. (See Victory’s stock forecast at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.