The iPhone headwinds are piling up for Apple (AAPL). Black Friday demand for iPhone 14 handsets was pitted against shortages at retailers, which have only gotten worse recently.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Heading into the climactic December period, Wedbush analyst Daniel Ives believes the tech giant might be in trouble.

“We believe many Apple Stores now have iPhone 14 Pro shortages based on model/color/storage of up to 25%-30% below normal heading into a typical December, which is not a good sign heading into holiday season for Cupertino,” the analyst explained.

While China’s zero Covid policy has been a well-known culprit impacting the supply chain, or as Ives puts it, an “absolute body blow,” the protests at major Apple supplier Foxconn’s facility in Zhengzhou amount to an additional “black eye.”

“The reality is that Apple is extremely limited in their options for holiday season and are at the mercy of China’s zero Covid policy which remains a very frustrating situation for Apple as well as the Street,” Ives went on to add.

Ives believes that due to China’s zero Covid shutdowns, Apple lacks about 5% of iPhone 14 units which should be in the supply chain and which heading into the next month, amounts to a “major shortage.”

For the Black Friday weekend, Ives thinks Apple sold around 8 million iPhones, which is below the 10 million sold during the same period last year with the gap being “mostly supply driven.”

The silver lining in all this mess is that demand still appears to be robust, with Ives noticing “strong iPhone upgrade activity through the likes of AT&T/Verizon.”

Furthermore, in-store activity has been mostly “solid” while the the online channels have also been healthy. Nevertheless, while the issues are purely to do with the supply chain, the low inventories are obviously a concern and the production woes the “albatross” with the peak holiday season at the gate.

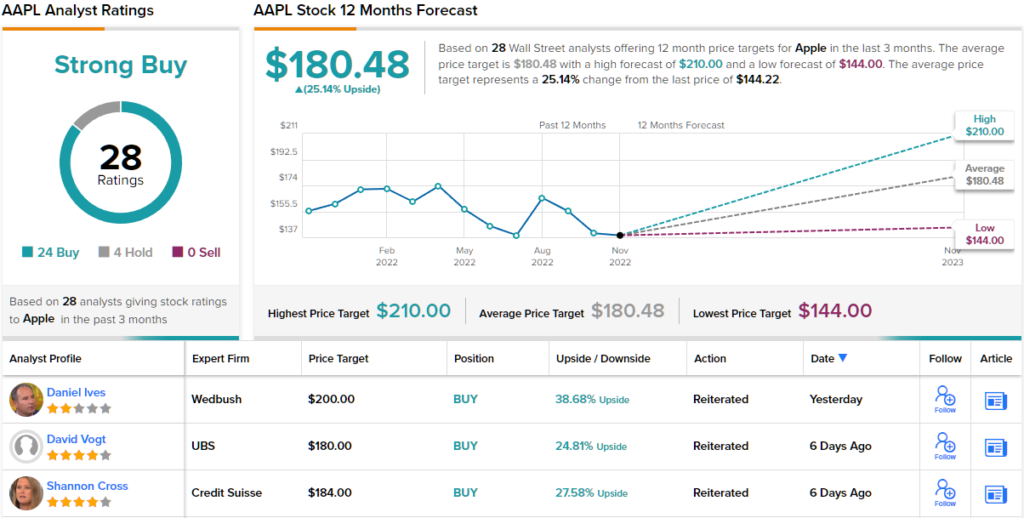

All in all, Ives keeps an Outperform (i.e., Buy) rating on AAPL shares along with a $200 price target. Should the target be met, a twelve-month gain in the shape of a 39% could be in store. (To watch Ives’ track record, click here)

What about the rest of the Street? Most are backing Apple’s chances; the stock boasts a Strong Buy consensus rating, based on 24 Buys vs. 4 Holds. The forecast calls for one-year returns of 25%, considering the average target clocks in at $180.48. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.