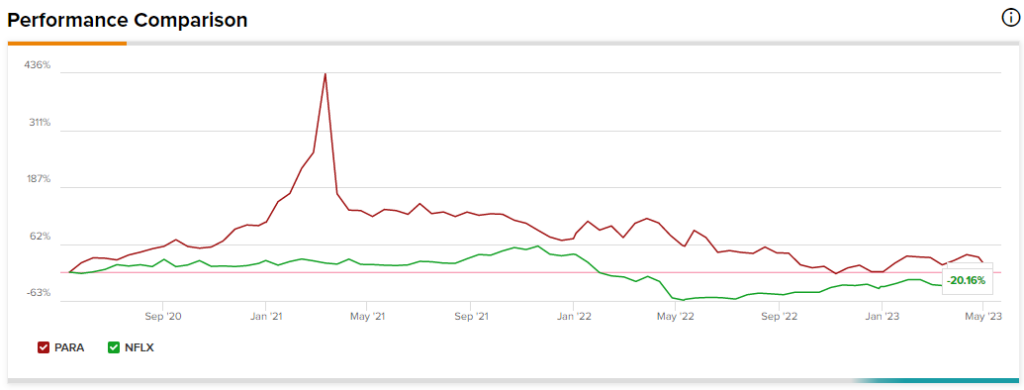

It’s tough to escape the gravitational pull of the streaming slump, with Paramount and Netflix shares continuing to feel the pressure of the ever-crowded industry. Undoubtedly, streaming isn’t as exciting as it used to be.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

At the latest Berkshire Hathaway (NYSE:BRK.B) annual shareholders meeting, Warren Buffett commented on the challenges of the streaming industry. Undoubtedly, the streaming market has become very competitive in recent years. With higher competition comes competitive pricing.

Buffett acknowledged that he doesn’t know where prices are headed in the competitive landscape but did note that a lot of streamers are unlikely to back away in the face of competition. “There are a bunch of companies who don’t want to quit,” said Buffett.

Therefore, let’s look at two remarkable streamers — PARA and NFLX — unwilling to back down without a fight.

Paramount Global (NYSE:PARA)

Paramount is fresh off a brutal quarterly report that sent shares slumping nearly 30%. Undoubtedly, Paramount is one of Berkshire’s tiny holdings — but one that has not panned out.

Despite the pressure points in the streaming market, I still view Paramount as a deep-value stock that may reward those who are patient with it. Though I have no idea when shares will rally again, I’m staying bullish as the share price continues to contract.

Recently, Paramount announced that it is slashing 25% of its U.S. workforce. The company is also shutting down MTV News. Indeed, it’s the end of an era.

Media firms have not shied away from cuts amid the latest streaming slump. After a massive (nearly 80%) dividend cut and a colossal quarterly fumble, it seems like Paramount is looking to shift gears to drag the ailing firm out of the funk.

“It’s not good news when any company cuts its dividend dramatically,” said Buffett.

Looking ahead, Paramount faces a tough uphill battle. The company needs to strive to be more efficient without making it considerably less competitive. Paramount still has impressive shows, including Yellowstone (and its spin-offs). That said, it remains to be seen how Paramount can keep subscribers coming back as it looks to take drastic action to bring down expenses.

After a record daily drop, PARA stock trades at a staggering 0.5 times price-to-book ratio, making it one of the cheapest plays in streaming. Despite this, analysts are in no rush to upgrade the name. Paramount finds itself in a rare category, a stock that boasts a “Moderate Sell” consensus rating.

What is the Price Target for PARA Stock?

Paramount stock has five Buys, three Holds, and a whopping 10 Sell ratings from analysts in the past three months. Still, the average PARA stock price target of $19.67 implies 31.05% upside potential.

Netflix (NASDAQ:NFLX)

Netflix is a streaming heavyweight that suffered a major fall from grace last year. Despite the challenges in streaming, Netflix more than doubled (101%) over the past year, thanks to the broader tech relief rally and hot shows like Beef and The Night Agent. Clearly, Netflix has been doing a stellar job of delivering on the front of quality and quantity. Just how long this can last remains to be seen. In any case, Netflix still stands out as one of the hardest subscriptions to cancel, at least in my view.

Though Netflix’s fortress of content will help it sail ahead of peers, I’m in no rush to buy Netflix stock (I’m neutral) anytime soon despite its plunge from 52-week highs. The stock trades at 35.1 times trailing price-to-earnings, making it one of the priciest stocks in the FAANG cohort.

Looking forward, Netflix has a strong slate of upcoming content, with a new season of Black Mirror in store for the summer and a slew of South Korean content (Netflix plans to invest $2.5 billion in the region) to land over the next several years. South Korean content has been a huge success for Netflix. Whether we’re talking about Squid Game or Physical 100, I’m starting to think Netflix has a wider moat in South Korea than it does in America.

Netflix seems to have a sound strategy to help it hold its ground as streaming peers like Paramount begin to feel more of a pinch. Should shares of NFLX get hit with a more significant pullback, I’d be inclined to give the name a second look.

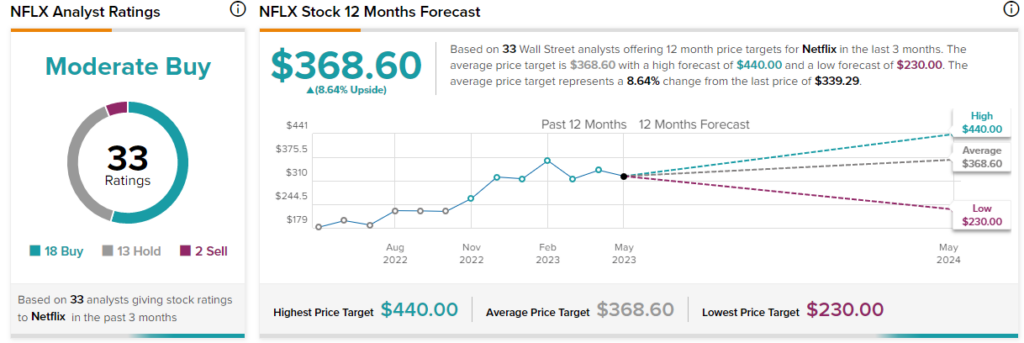

What is the Price Target for NFLX Stock?

With 18 Buys, 13 Holds, and two Sells, Netflix is viewed favorably by Wall Street, giving it a Moderate Buy consensus rating. The average NFLX stock price target of $368.60 implies a modest 8.6% gain, however.

Conclusion

More players have dived into the industry with fat content budgets. With that, more money will be chasing a limited (perhaps shrinking due to the rise of other forms of entertainment) number of viewers.

In such a market, it’s tough to tell which firm will come out on top in three to five years. Regardless, Wall Street overwhelmingly prefers Netflix to Paramount.