Well, it’s official. Federal Reserve chair Jerome Powell has signaled that the central bank is considering a lower rate hike in December. After bumping up rates by 75 basis points at time in four hikes from June to November, Powell’s comments today indicate that the Fed is leaning toward a rate increase of 50 basis for the December FOMC meeting.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Noting that the Fed still holds to its policy of targeting a 2% inflation rate, Powell also said, “It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. The full effects of our rapid tightening so far are yet to be felt.”

In response to all of this, markets jumped on Wednesday. The S&P 500 gained 3.09%, while the Nasdaq added a whopping 4.41%.

Among the winners, NIO and HZNP showed substantial gains, in the neighborhood of 20%. We’ve used the TipRanks platform to find out just where they stand. The results are interesting – these are Strong Buy stocks with notable support from Wall Street analysts. Let’s take a closer look.

NIO Inc. (NIO)

First up is NIO, a leading manufacturer in China’s electric vehicle (EV) market. While many EV companies are still in design and development stages, Nio has been making deliveries since 2018 and currently has 6 consumer model EVs on the showroom floors. The company has also introduced Battery-as-a-Service to the EV sector, giving customer faster, more economical options for swapping out vehicle battery packs.

In today’s trading, NIO shares have jumped ~22% after a briefing by Chinese health officials pointed to a further move away from Covid Zero and bolstered reopening optimism.

“We are optimistic that the worse may finally be over, further supported by the government’s gradual pivot away from COVID zero,” Deutsche Bank analyst Edison Yu noted.

Looking at some internal factors, Nio at the start of November released its October delivery numbers – and showed a whopping 174% year-over-year increase in monthly vehicle deliveries, with the total for October coming to 10,059. For the year-to-date, the company has delivered 92,493 vehicles, a gain of 32% y/y. Quarterly results were correspondingly solid. At the top line, Nio showed revenues of $1.82 billion, for a 19.7 y/y gain, and the company had $7.2 billion in cash reserves as of the end of September 30, 2022.

Overall, Nio is showing important increases in vehicle deliveries, and Yu sees that as a vital element in the company’s story.

“With competition intensifying, we are encouraged by NIO’s aggressive product refresh cadence. All three gen-1 ‘866’ SUV models will be revamped in the first half of next year, accompanied by 2 new models. This means NIO will be offering 8 models going into 2H23. One of the new models will be a Tesla Model Y competitor which we are calling the ES5 and assuming a starting price of 330-340k RMB… Factoring in this faster new model cadence, we tweak up our deliveries forecast by 10,000 units to 270,000 for 2023E,” the analyst wrote.

Extrapolating from this stance, the Deutsche Bank analyst gives NIO stock a Buy rating, and his $21 price target implies a one-year gain of 64%. (To watch Yu’s track record, click here)

EV’s are hot ticket these days, and 16 Wall Street analysts have published reviews of Nio shares recently. These break down 12 to 4 in favor of Buys over Holds, giving the stock a Strong Buy consensus rating. Shares are trading for $12.78 and their $20.11 average price target suggests room for 55% growth in the year ahead. (See NIO stock forecast on TipRanks)

Horizon Therapeutics (HZNP)

Next up is a biopharma company with both an active research pipeline and a line-up of commercial-stage approved medications. Horizon Therapeutics’ pipeline features no fewer than 10 research programs, including multiple ongoing clinical trials. That research portfolio does not come cheap, but in Horizon’s case, it is supported by a profitable portfolio of 11 approved medications available on the market. Where most biopharma research companies operate at a loss, Horizon offers investors both a stable revenue stream and consistent quarterly EPS profits.

Shares in Horizon were up 27% on the last day of November as Big Pharma companies including Amgen, Janssen, and Sanofi have all expressed interest in acquiring the company – although it must be noted that the discussions are ‘highly preliminary.’ While no offers have been made yet, making it impossible to even guess at a potential purchase price, Horizon’s shareholders will certainly benefit if three potential buyers engage in a bidding contest over the company.

A possible bidding contest underlies the bullish case for HZNP in the eyes of BMO analyst Gary Nachman. He writes, “We have believed for some time HZNP could be an attractive acquisition target for large biopharma companies given its strong portfolio of orphan drugs (mostly ophthalmology/immunology led by Tepezza/Krystexxa with significant peak potential), as well as robust underappreciated early-mid pipeline and good balance sheet. We believe large biopharma suitors mentioned could all make sense, and could see others also potentially jumping in.”

In Nachman’s view, this potential provides solid support for Horizon, which he rates as Outperform (i.e. Buy). His $117 price target implies a gain of ~17% for the stock by the end of next year. (To watch Nachman’s track record, click here)

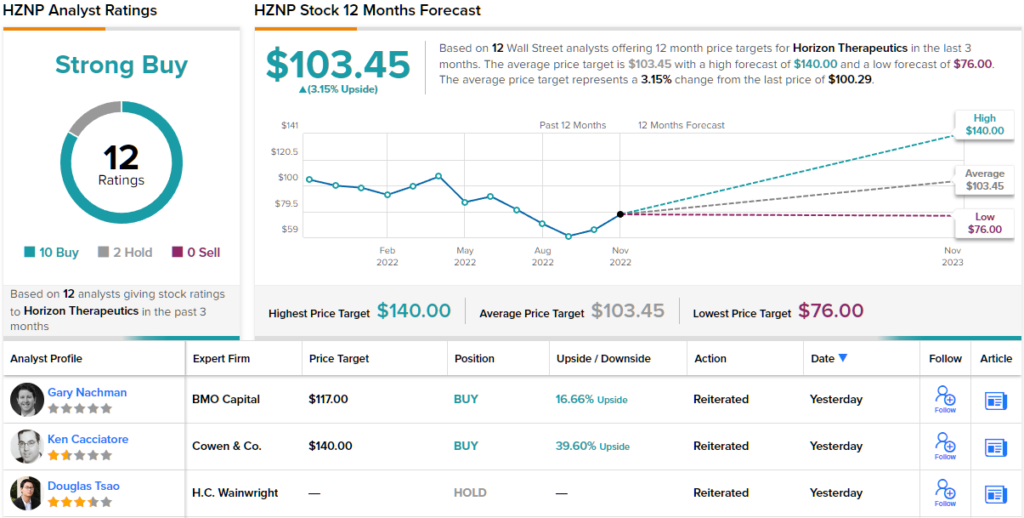

Of the 12 recent analyst reviews on HZNP stock, 10 are to Buy and just 2 are to Hold, resulting in a Strong Buy consensus viewpoint. The stock’s sudden surg has pushed its price, now at $100.29 per share, almost up to the average price target of $103.45. (See HZNP stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.