The stock market is often a game in reverse psychology. That is, when the mood gets too euphoric, it’s often a sign it is time to sell. Likewise, when sentiment hits the skids, that could be the ultimate signal the time is right to load up the truck. And on that subject, J.P. Morgan’s Marko Kolanovic thinks we are at – or at least near – the bottom.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

The firm’s global market strategist believes the Fed’s hawkish stance has left stocks “very oversold,” and while inflation remains persistently high, it is close to peaking.

“Meanwhile,” Kolanovic went on to add, “some pre-conditions for a market bottom are falling into place.” What are these? Well, stocks are looking “increasingly cheap,” while positioning is “extremely depressed.”

With this in mind, Kolanovic’s analyst colleagues at the banking giant have pinpointed two names which they think are going for cheap right now – they see both posting some healthy gains over the coming year. We ran the tickers through the TipRanks platform to see what the rest of the Street has in mind for them. Let’s check the results.

Protagonist Therapeutics (PTGX)

One area of the biotech sector that is expanding quickly is that of peptide technology, which focuses on the components of proteins as a means of treating disease. Utilizing its own proprietary platform, Protagonist Therapeutics creates innovative peptide-based drugs to address unmet medical needs.

The company’s pipeline boasts two separate research paths, one focused on hematology and blood disorders and one for the treatment of inflammatory and immunomodulatory diseases.

The latter arm features PN-943, for which the company announced top-line data from a Phase 2 study in ulcerative colitis back in April. The company is now planning the Phase 3 study. There’s also PN-235, an IL-23R antagonist which Protagonist discovered and is being developed in partnership with Janssen, with 4 clinical studies currently taking place, including two Phase 2 studies in moderate-to-severe plaque psoriasis.

But it is the leading candidate in the hematology and blood disorders program, rusfertide (PTG-300), which is in the most advanced stages of development. The lead asset is indicated to treat polycythemia vera (PV), which is a rare blood disorder defined by an abnormally high count of red blood cells. The company is currently enrolling participants for the Phase 3 VERIFY study, a process it hopes to complete by the end of 1H23.

Although there are some treatment options for PV, there is still a significant unmet need to keep patients’ hematocrit % below 45% to lower the risk of cardiovascular or thrombotic events. The Phase 2 studies of rusfertide have shown promising results on this front, and while there have been safety concerns around the drug – a study was put on hold last year for a while after mice had contracted skin cancer following exposure to rusfertide – J.P. Morgan’s Brian Cheng thinks these are easily addressed.

“We recognize rusfertide’s safety overhang is unlikely to be lifted until top-line readout from VERIFY in 2024 (based on our est.),” the analyst said. “We point to the amended trial protocol (w/ heightened monitoring and exclusion of pts with a history of invasive cancer) that alleviates some investor concerns. Noting several SoC (e.g., HU, Jakafi) come with skin cancer warnings on their respective labels, the potential risk if true, in our view, may not be viewed as a major deterrent for use. At the current valuation, we believe rusfertide’s leads in PV and hereditary hemochromatosis (HH) are underappreciated based on the accumulated data. The ongoing partnership with Janssen for PN-235 and its search for partnership for PN-943 could further strengthen its cash runway beyond 2024.”

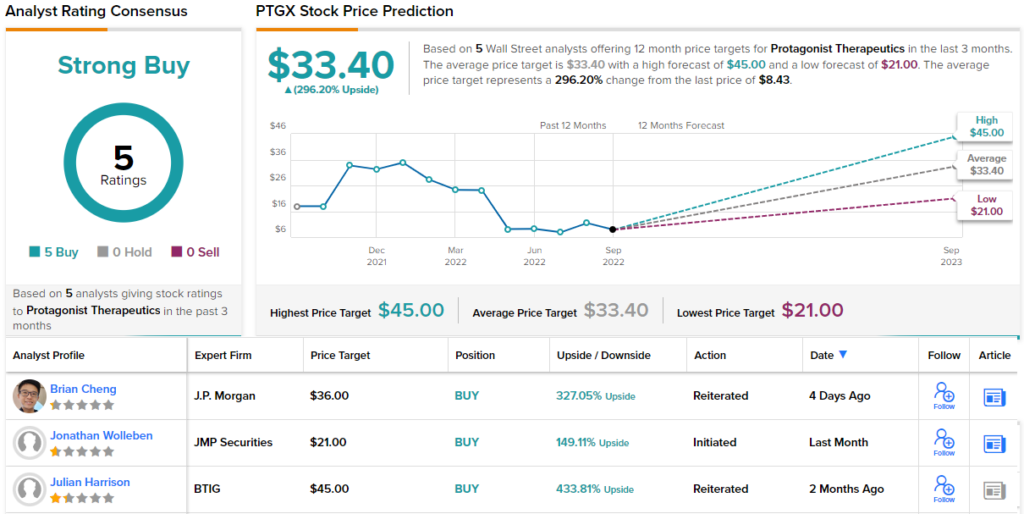

Accordingly, Cheng rates the stock as Overweight, while the $36 price target makes room for huge 12-month gains of 327%. (To watch Cheng’s track record, click here)

On Wall Street, there’s widespread agreement with Cheng’s prognosis; all other 4 reviews are positive too, making the analyst consensus a Strong Buy. The average price target stands at $33.4, suggesting shares will climb 296% higher in the year ahead. (See Protagonist Therapeutics stock forecast on TipRanks)

iRhythm (IRTC)

We’ll stay in the healthcare neighborhood for our next stock, although it is one with a rather different value proposition.

With the use of wearable biosensing tech, cloud-based data analytics, and machine learning capabilities, iRhythm’s goal is to revolutionize the clinical diagnosis of cardiac arrhythmias. The company states that it aims to be the first port of call for first-line ambulatory electrocardiogram (ECG) monitoring for patients at risk for arrhythmias.Its flagship product is Zio, a wearable patch that detects cardiac symptoms and has gained quick adoption due to ease of use and accurate data readings.

Revenues have been steadily increasing over the past few years, a trend that continued when the company delivered its most recent set of results.

In 2Q22, the top-line rose by 25.6% year-over-year to $102.1 million, in turn beating the Street’s call by $1.59 million. On the bottom-line, adj. EPS of -$0.79 beat the consensus estimate of -$0.90. The company also raised it full year 2022 revenue guidance from $415 million to $420 million at the mid-point, a target it reiterated at its recent investor day. iRhythm also said it expects to generate more than $1 billion in revenue in 2027, which suggests a ~20% CAGR from the mid-point of 2022’s outlook.

While competition is heating up in the space, J.P. Morgan’s Allen Gong thinks iRhythm’s product has an edge.

“There continues to be a significant opportunity for longer-term monitoring to grow and represent the vast majority of the ambulatory cardiac monitoring market as traditional holter and event monitors fall further out of favor, a trend that should accelerate as larger players lend their voices to the cause,” Gong wrote. “Overcoming relationships with these competitors represents a challenge in certain accounts, but a superior offering from Zio and its algorithm has helped it hold market share at ~70%, with physicians disagreeing with the conclusions drawn by competitive offerings up to 30-40% of the time compared to only ~1% of the time for Zio.”

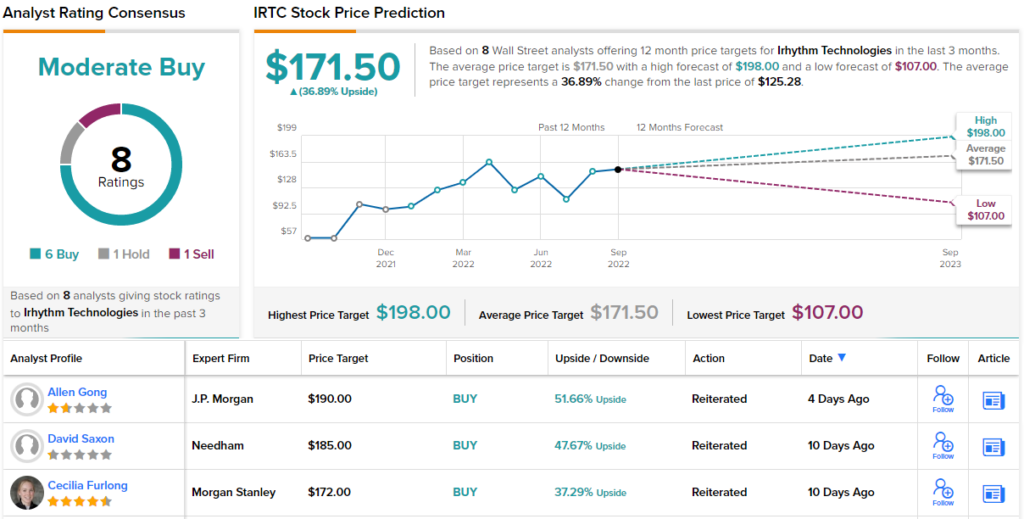

To this end, the analyst has an Overweight (i.e., Buy) rating on the shares, while his $190 price target could yield returns of 51% in a year’s time. (To watch Gong’s track record, click here)

And what about the rest of the Street? Barring 1 Hold and Sell, each, all 6 other ratings are to Buy, making the consensus view a Moderate Buy. The forecast calls for one-year gains of 37%, considering the average price target clocks in at $171.5. (See iRhythm stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.