US stocks took a sharp plunge yesterday, wrapping up what has been Wall Street’s worst month in 2024. The downturn was spurred by hotter than expected labor data, heightening investor anticipation for the Federal Reserve’s upcoming interest rate decision.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Despite this setback, the S&P 500 still boasts a 5.5% gain for the year. In fact, there’s optimism from at least one strategist who thinks the index still has plenty room to run.

Jay Hatfield, CEO of Infrastructure Capital Advisors, believes the S&P will hit 5,750 by the end of this year, a potential gain of ~14% from current levels.

“We are bullish notwithstanding the fact that our economy is strong, because Europe is very weak. And US investors have a very strong tendency to ignore the rest of the world, which makes all the sense in the world with equities, because you have NVIDIA. All the best companies are here. And everybody looks to the US for equities,” Hatfield opined.

Hatfield isn’t the only bull in town; across Wall Street, the experts are picking out the stocks poised for future growth. We’ve used the TipRanks database to pinpoint two such picks, both Strong Buys, according to the analyst consensus. Let’s delve into the details.

Live Nation Entertainment (LYV)

We’ll start in the entertainment industry, with Live Nation Entertainment. This company is a major player in entertainment, specializing in producing live events, particularly concerts. The company is known for bringing live performance artists to stages around the world, playing any genre at any scale, from multi-day, multi-stage festivals to small local clubs.

The company has a market cap of more than $20 billion, and some numbers will show the scale of Live Nation’s activities. The company produces approximately 44,000 concerts every year, including more than 100 festivals, in more than 45 countries. And – these events play to more than 121 million fans annually. It’s a huge base, and the company sells over 550 million tickets to its events.

Investors may be more interested in Live Nation’s financial performance. The company generated $22.7 billion in total revenue last year. Zooming in to the most recent report, we see that Live Nation had 4Q23 revenues of $5.84 billion, up 36% year-over-year and more than $1 billion over the analyst forecasts. Adjusted operating income increased by 20% YoY to $116.9 million.

That’s the background. In the foreground, we can look at the forecast for the upcoming 1Q24 earnings, slated for tomorrow (Thursday, May 2). Revenue is expected to come in at or near $3.28 billion, which would represent 4.8% year-over-year growth.

In an interesting development, Live Nation is facing ongoing antitrust actions from the US Department of Justice. The stock fell recently after a WSJ report stated the Justice Department is getting ready to file an antitrust lawsuit against the company.

However, the recent slip in share price may represent a chance to buy in, at least so far as Deutsche Bank analyst Benjamin Soff is concerned. The analyst writes, backing up his stance, “We believe the company will deliver consistent double digit growth in adj. operating income in the coming years based on (1) strong secular fundamentals, including robust demand and increasing supply, paired with (2) a focus on developing specific value-add initiatives to improve monetization across the business. Meanwhile, (3) we believe the most likely outcome of a potential regulatory investigation will be pro-consumer reforms to various industrywide business practices, which shouldn’t be materially disruptive to Live Nation’s business opportunity; and not a more drastic structural remedy. In this context, we would look to the recent pullback in the stock as a buying opportunity.”

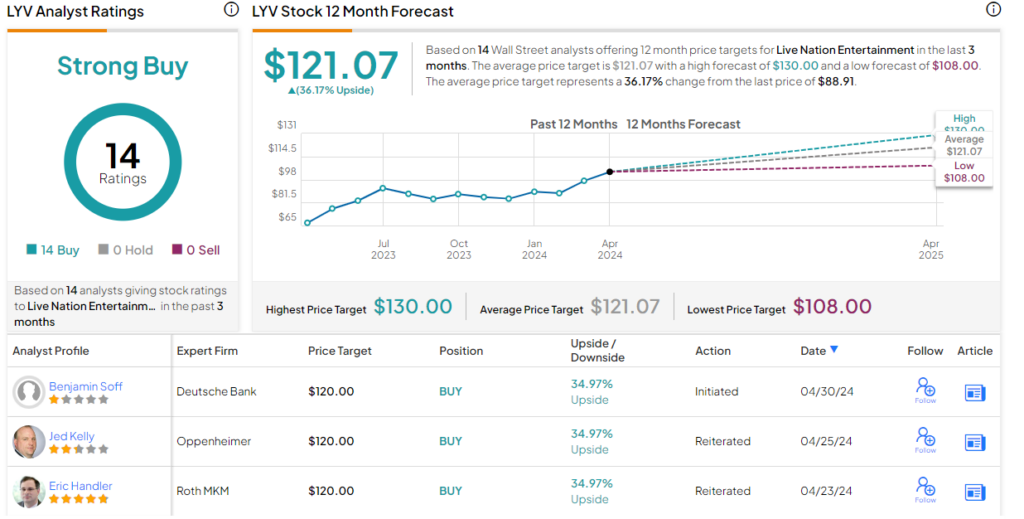

For Soff, this adds up to a Buy rating, and his $120 price target implies a one-year gain of 35% for the shares. (To watch Soff’s track record, click here)

The Deutsche Bank view is no outlier – Live Nation’s 14 recent stock reviews are all positive, giving the shares a unanimous Strong Buy consensus rating. The stock is trading for $88.91, and its $121.07 average target price suggests it will appreciate by 36% on the one-year horizon. (See LYV stock forecast)

Janus International Group (JBI)

The second stock on our list, Janus International, deals with something so everyday common that we normally don’t think about it – just doors. Janus works with commercial and industrial construction companies and contractors, providing solutions for doors and entryways. That sounds simple, but doors and entryways come in a wide range of types and models, and can incorporate cutting edge technology in both materials and electronics.

Janus’ product lines include rolling steel doors, of the type commonly seen in self-storage facilities, as well as smart entry systems, hallway systems, and various doors and entries for light industrial and commercial buildings. The company deals primarily with enterprise customers.

In addition to its doors and entries, Janus is notable for its smart entry systems, dubbed Nokē, designed for the self-storage market. The smart entry system includes a Bluetooth electronic lock, along with a control system giving total access to the user’s storage unit from a connected smart device. For storage facilities, this means that they no longer have to worry about customers losing keys or gate codes. In addition, the system provides added security through the use of motion sensors inside every door.

In its last earnings report, covering 4Q23, Janus reported a top line of $263.7 million, down 5.7% from the prior year quarter – and missing the forecast by over $21 million. At the bottom line, the company’s non-GAAP EPS of 24 cents per share was 2 cents below expectations – but also up 2 cents year-over-year. The company will report 1Q24 earnings on May 9.

Despite missing the forecasts on its Q4 results, Janus’ stock has caught the attention of Jefferies analyst Philip Ng, who outlines several reasons why the company is in a solid position to expand its business and lock in gains going forward. The 5-star analyst writes of Janus, “We believe JBI is an undervalued quality small growth name & find the risk:reward compelling. With a MSD organic growth profile and 27% EBITDA margins, it compares favorably to its peers & trades (8.7x 2024E EV/ EBITDA) at a noticeable discount… JBI’s backlogs remain solid, & with storage occupancy rates (90%) above mid-cycle (~85%), this is driving demand for new capacity. With the permitting & other construction delays during COVID now behind the industry, JBI has seen strong demand in new construction. As interest rates come down, it should support more new construction activity. Separately, with 60% of self-storage facilities at 20+ years old, it should drive a solid pipeline of R3 projects.”

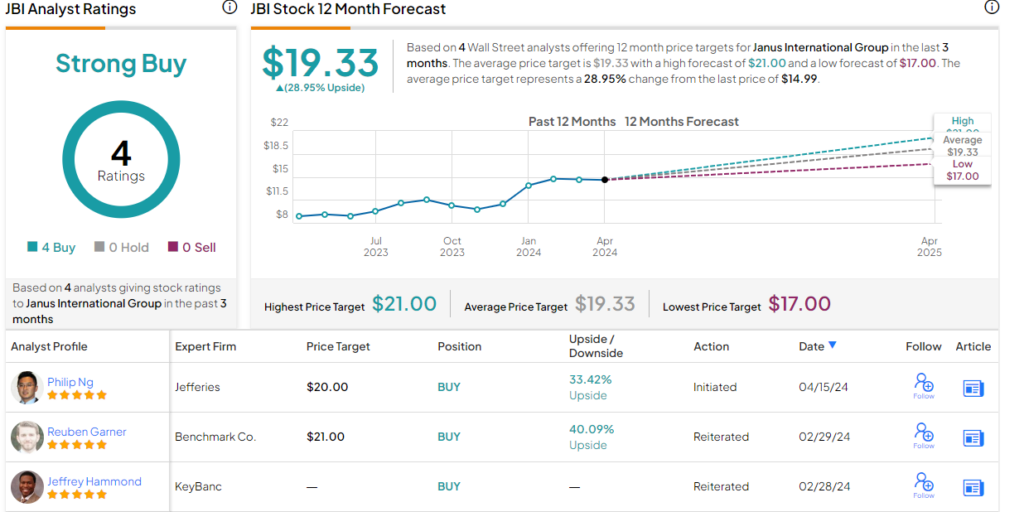

These comments back up Ng’s Buy rating on the stock, and his $20 price target shows his confidence in an upside potential of 39% for the coming year. (To watch Ng’s track record, click here)

Ng’s view is in-line with the other recent analyst reviews of this stock; all four of the recommendations on file are positive, for a Strong Buy consensus view. The shares are currently trading at $14.41 and their $19.33 average price target indicates room for a 34% share appreciation over the next 12 months. (See JBI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.