While shares of SoFi Technologies (NASDAQ:SOFI) have shown signs of a rebound with a 7.5% increase this month, they still remain 25% below the peak they reached in July.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Mizuho analyst Dan Dolev, the stock’s weakness has been down to investor concerns about SOFI’s constrained lending capacity, raising the possibility of an equity raise. However, there is no need to be worried, says the analyst.

“We are not concerned and see 6-7 quarters of lending runway without the need to raise capital,” Dolev opined. “Our analysis of SOFI’s balance sheet shows ample capacity to originate personal & student loans for 5-6 quarters, even without selling loans.”

As of the second quarter, the company’s total risk-based capital stood at approximately $3.3 billion, which accounts for 15.8% of the roughly $20.7 billion in risk-weighted assets. Under the assumption SOFI doesn’t take any additional steps to increase its capacity, such as selling loans or raising equity, and continues to keep a 2.5% buffer over the minimum total capital ratio of 10.5% (bringing the minimum requirement for SOFI to 13%), Dolev calculates that this would translate to approximately $14.3 billion. This is in contrast to the approximately $13 billion in total originations in fiscal year 2022. In other words, it would be equivalent to around 6 quarters of lending, considering the $2.4 billion net loan growth from the second quarter of 2023 on a quarter-over-quarter basis.

Additionally, by SOFI selling ~10% of its 2Q23 annual run-rate originations (vs. 35-40% in 2022), Dolev sees an even longer lending runway of about 7 quarters. “Moreover,” Dolev goes on to add, “management has guided to positive GAAP net income by year-end. We estimate that every $100m of GAAP net income adds $750-800mn of incremental lending capacity.”

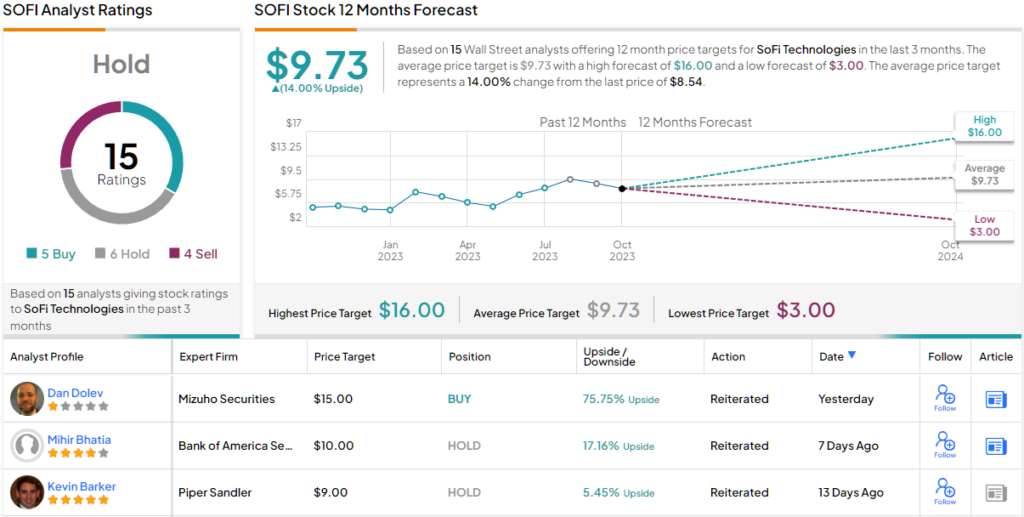

As such, Dolev remains one of the Street’s most prominent SOFI bulls, recommending a Buy rating, backed by a $15 price target. The implication for investors? Upside of 76% from current levels. (To watch Dolev’s track record, click here)

On the Street, there are differing views regarding SoFi’s prospects. Based on a mix of 5 Buys, 6 Holds and 4 Sells, the stock claims a Hold consensus rating. Going by the $9.73 average target, a year from now, shares will be changing hands for a 14% premium. (See SOFI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.