The quick-service restaurant (QSR) industry is a great place to look if you’re looking to steady your portfolio’s sails going into yet another recession. In this piece, we’ll look at Chiptole Mexican Grill (NYSE:CMG) and Starbucks (NASDAQ: SBUX), two higher-growth QSR companies that are down more than your average fast-food stock. Undoubtedly, growth is viewed unfavorably by investors as interest rates rise. That said, Chipotle and Starbucks stand out to me as profitable growth companies that may not deserve to be as beaten down as they are. Analysts are more bullish on CMG stock, but let’s dive deeper.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It feels like we just got out of the coronavirus recession. With the economy reopening and things returning to normal, it’s disheartening to have the economic lights dimmed yet again. This time, it’s not rapid viral spread causing many to feel economic pain. It’s the return of high inflation and the Federal Reserve’s use of outsized interest rate hikes to put it out.

It’s a tough call for the Fed to make as it looks to go from a friend of the investor to more of a foe. Regardless, rapid rate hikes may very well be needed to put inflation away for good. In the meantime, investors will need to learn to deal with the harsh climate as the Fed does its best to minimize the pain we’ll all need to endure in some form or another.

As the economy begins to weaken, there’s a worry that corporate earnings could erode at a quick rate. Though there’s no escaping the economic pressure applied by 75 bps rate hikes, not all companies are destined to fold their hand going into 2023.

The recession-resilient companies have been bid up relative to the rest of the market over the past several months. The QSR companies, in particular, seem like terrific ways to weather a recession storm or the return of stagflation.

Chiptole Mexican Grill (CMG)

Chipotle stock has come such a long way since the depths of the 2020 sell-off. Shares are currently up more than 64% from their pre-pandemic highs and down around 21% off their 2021 all-time high of nearly $2,000 per share.

At 59.8x trailing earnings, Chipotle is one of the priciest QSR firms on the market. Given the recession-resilient growth to be had, it’s arguable Chipotle is deserving of such a spicy multiple. Though Chipotle boasts higher prices than a value-menu-touting firm like McDonald’s (NYSE: MCD), the trend of health consciousness seems unlikely to reverse just because a recession looms.

More affordable fast-food firms like McDonald’s may take a bit of market share from the likes of a company like Chipotle as cost-conscious consumers ditch loaded burritos for Big Macs. That said, a vast majority of consumers from fancy dine-in restaurants may make the shift to Chipotle to save money. You don’t have to pay a hefty gratuity at the local Chipotle, after all!

Further, a big chunk of Chipotle’s health-conscious consumers may be more loyal than we think. As we head into a recession year, my guess is that health consciousness will trump cost consciousness for most consumers.

With a strong balance sheet, Chipotle has the financial means to continue investing in its mobile and delivery capabilities. It’s these efforts that could allow Chipotle to leave the faltering market behind in a recession year.

Delivery, in particular, stands out as a major growth pillar that could put Chipotle above the pack. Mexican food tends not to get too soggy during the delivery process. As Chipotle’s delivery platforms improve, sales are bound to swell accordingly.

What is the Price Target for CMG Stock?

With a “Strong Buy” rating, Wall Street can’t get enough of Chipotle, and for good reason. It’s one of the few high-growth stocks still (mostly) standing after the 2022 market sell-off. The average CMG stock price target of $1,834.73 implies 19.1% upside.

Starbucks (SBUX)

With significant investments in tech (think the loyalty app and behind-the-counter technologies), Starbucks certainly seems like a tech company selling coffee. In a prior piece, I noted that cashier-less stores like the two in New York could be (along with the Chinese expansion) the next tech frontier for the coffee chain under Narasimhan’s reign.

Starbucks stock has made investors woozy over the past year and or so, plunging around 44% from peak to trough. Since bottoming out back in May, Starbucks stock has been quite robust, with 31% of gains in the books. The impressive relief bounce was sparked by greater certainty in the form of a new CEO, Laxman Narasimhan, and a compelling strategic plan.

Regardless, Starbucks stock cooled off by too much back in late spring. Amid pumpkin spice season, Starbucks stock is heating up again, and I think it’ll be tough to stop the firm, even if a 2023 recession entices consumers to cut out those tasty hand-crafted beverages.

At writing, Starbucks stock trades at a very modest 25.1x trailing earnings multiple. That’s too cheap for a company capable of putting up double-digit growth on the other side of a recession.

What is the Price Target for SBUX Stock?

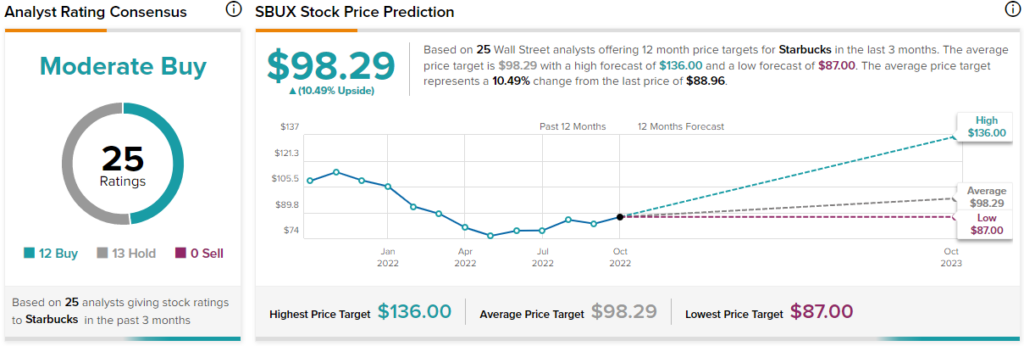

Wall Street is warming up to Starbucks, with a “Moderate Buy” rating on the stock. The average SBUX stock price target of $98.29 implies 10.5% upside potential from current levels.

Conclusion: Wall Street Sees More Upside from CMG Stock

A rate-driven recession won’t be painless for QSR companies, especially those in growth mode. Even with macro headwinds closing in, Chipotle and Starbucks seem like plays that are too cheap. At writing, Wall Street favors Chipotle over Starbucks.