Starbucks (SBUX) hasn’t been the most captivating long-term investment in recent years. The stock has been flat over the past five years, and that’s only because shares soared by more than 20% on August 13 due to the announcement of a new CEO. However, this isn’t enough to justify buying shares in a company that is declining in key markets. Given these challenges, is the stock doomed to significantly underperform benchmarks like the S&P 500 and Nasdaq Composite? I am bearish on the coffee chain’s stock and believe it will face ongoing difficulties.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Starbucks Struggles with Higher Cost of Living Impact

I’m concerned about Starbucks as the rising cost of living intensifies, putting extra strain on consumers. Despite a relatively low unemployment rate, many people are struggling to keep up with their expenses. The statistics are telling: 78% of Americans now live paycheck to paycheck, a significant jump from just over 60% a few years ago. This financial pressure forces consumers to scrutinize their spending more closely, leading many to cut back on non-essentials like Starbucks coffee.

SBUX Sees Sharp Decline in Comparable Sales, Especially in China

In light of this economic strain, Starbucks is witnessing a notable decline in comparable sales. This metric, which compares how the average Starbucks store performs this year compared to the previous year, provides a clearer picture of the company’s core business health, beyond the boost from new store openings.

To illustrate, in the U.S., comparable sales have dropped by 2% year-over-year. While there’s a possibility for recovery if economic conditions improve, the outlook is less optimistic for the company’s international market, particularly in China. Specifically, international comparable sales have decreased by 7% year-over-year. The decline is most pronounced in China, where comparable sales have plummeted by 14% year-over-year. This issue is not isolated to Starbucks; many American brands are facing similar struggles, losing market share to local Chinese competitors.

Moreover, China represents a substantial portion of Starbucks’ global portfolio. The company operates 39,477 stores worldwide, with 16,730 located in the United States and 7,306 in China. Therefore, if the trend of declining comparable sales in China continues, it could significantly impact nearly 20% of Starbucks’ total store count.

Starbucks’ New CEO May Not Be Enough to Change the Company

Given these mounting challenges, Starbucks has hired Chipotle’s CEO Brian Niccol to lead the company, starting on September 9. Niccol, who successfully transformed Chipotle (CMG) into a prominent player in the healthy fast food sector, is expected to bring a fresh perspective to Starbucks. However, I’m skeptical about whether this leadership change will be sufficient to address the company’s current struggles.

In contrast to Starbucks, Chipotle’s success under Niccol is largely due to its unique value proposition: offering healthy and substantial meals, which has driven impressive revenue and comparable sales growth. Starbucks, on the other hand, specializes in coffee, sugary drinks, and snacks, which does not provide the same value to consumers seeking health-oriented meal options.

Consequently, despite the new leadership, Starbucks faces ongoing challenges. The company’s focus on coffee and snacks leaves customers still hungry, a factor that could become increasingly significant as people try to manage their everyday expenses. This distinction highlights a potential obstacle in attracting and retaining customers in the current economic climate.

SBUX’s Valuation Is a Bit High

In addition to these challenges, Starbucks’ current valuation adds another layer of concern. The company trades at a 26.5 P/E ratio, which, while fair for some stocks, appears problematic for Starbucks at this juncture. This is especially true given that the coffee giant’s net income isn’t growing; in fact, Starbucks reported an 8% year-over-year decline in net income.

The recent declines in net income and revenue have placed further pressure on the stock. Before the announcement of a new CEO, Starbucks shares were trading in the mid-$70s, and it seems likely that the stock could return to these levels if the company fails to address its underlying issues effectively. This situation reinforces my bearish sentiment, suggesting that both the company’s operational struggles and high valuation could lead to a challenging period ahead.

Is SBUX Stock a Buy, According to Analysts?

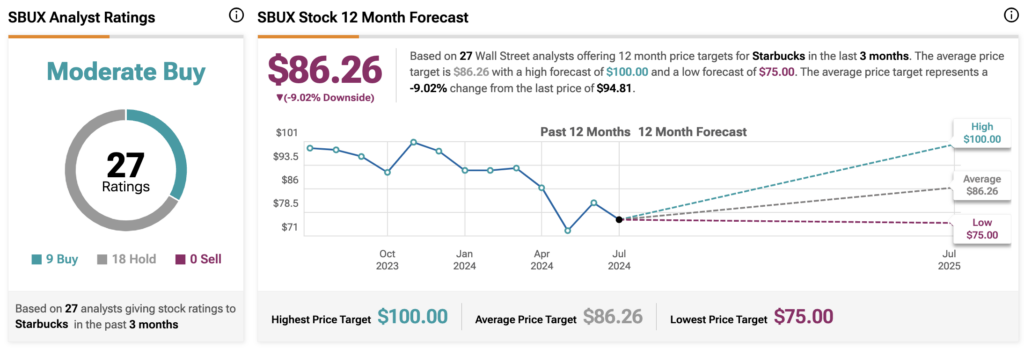

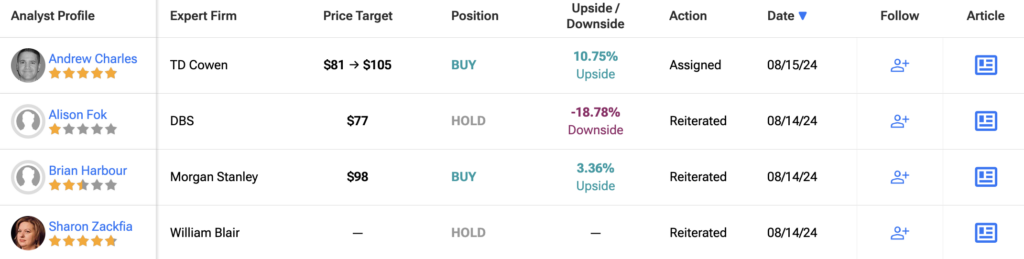

Currently, Starbucks is rated as a Moderate Buy, but the average SBUX price target of $86.26 suggests a 9% downside from current levels. With nine Buy ratings and 18 Hold ratings, the highest price target of $100 only implies a 5% upside. These factors reinforce my bearish outlook on the company’s future performance.

The Bottom Line on Starbucks Stock

Starbucks isn’t at risk of going out of business, given its nearly 40,000 stores worldwide and strong brand presence. However, this popularity doesn’t ensure a robust stock performance. The company has faced negative revenue and net income growth in recent quarters, and its stock has lagged behind the market. Moreover, declining performance in China, where local competitors are gaining ground, suggests potential for continued slow or declining revenue growth. These factors align with my bearish outlook on Starbucks’ future performance.