Iconic Seattle-based coffee company Starbucks (NASDAQ:SBUX) faces investor scrutiny these days, with consumers boycotting its stores due to accusations of mistreatment of employees and tensions in the Middle East. Shares have dipped by 11% over the past year, underperforming the S&P 500 (SPX), which has risen 21% during the same period. However, I see the cup as half full and brimming with potential. This is due to strong growth prospects and a cheap valuation, forming a promising blend for bullish optimism.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What’s Keeping Starbucks Stock Under Pressure?

Starbucks is weathering a storm of controversy as employees, former baristas, and Palestinian advocacy groups nationwide unite in boycotts. At the heart of the turmoil is a legal battle between Starbucks and its workers’ union, Starbucks Workers United, over a pro-Palestinian social media post during the Israel-Hamas conflict.

The company alleges trademark infringement, while the union countersues, claiming defamation and seeking to retain its name and logo. Starbucks distanced itself from the union’s stance, condemning terrorism and violence. At the same time, tensions escalated during a nationwide boycott event, coinciding with Red Cup Day, where Starbucks employees protested alleged unfair labor practices.

The controversy has spilled into stores, with customers even confronting employees and sending violent messages to Starbucks. As calls for a boycott gained momentum on social media, Starbucks faces a complex challenge in restoring its image and managing the impact of legal disputes and broader issues of labor practices and its political stance.

In the face of these events, the market is anticipating headwinds for the company’s upcoming results, encompassing the period from November to January. In a recent analysis, JPMorgan (NYSE:JPM) analyst John Ivankoe downgraded Starbucks’ initial Q1 U.S. comparable sales growth forecast from 6% to 4%. Projections from Wall Street forecast the company’s sales in its upcoming Q1-2024 results to reach $9.67 billion, notably below the $9.88 billion estimate for this quarter around the same time last year.

Reflecting on these developments, it becomes evident why investors have been offloading their Starbucks shares. Whether driven by funds aiming to uphold a positive image for their clients or investors genuinely foreseeing a potential downturn in sales and profits due to the ongoing boycott, the prospect of holding Starbucks stock lacks its usual allure.

Starbuck’s Growth Remains Robust, Nonetheless

Despite the ongoing havoc, Starbucks’ growth remains robust. Take the company’s upcoming Q1-2024 results, for example. Despite heavy downgrades among Wall Street analysts, as I just mentioned, it still implies year-over-year growth of 11%. What company is in the midst of heavy consumer boycotting yet is still expected to deliver double-digit growth?

From my perspective, the extensive media coverage of Starbucks’ boycott may significantly influence investors closely monitoring the company’s developments. However, the average consumer is likely unaware of such a movement or indifferent to getting involved.

I know it’s anecdotal evidence, but every Starbucks location I pass by in Athens, Greece, these days is bustling with customers. To put it simply, even if there is a boycott taking place in certain isolated regions, it certainly doesn’t appear to be a widespread phenomenon, especially when it comes to Starbucks’ international locations.

In the meantime, the company continues to open more stores and maximize same-store sales, pointing to near-double-digit growth throughout this year. For context, the company ended Fiscal 2023 with 38,038 locations, up 6.5% compared to the previous year, while global same-store sales in its existing locations grew by 8%. With aggressive store openings set to continue this year and overall sales growth expected to remain strong, Starbucks is anticipated to deliver total sales of $39.48 billion in Fiscal 2024, up 9.8% versus last year.

Shares of Starbucks Appear Cheaply Valued Now

With Starbucks stock lagging lately despite continuing to post revenue and earnings growth, its valuation appears to be hovering at rather cheap levels now. I believe this is going to make bulls return to the stock sooner rather than later.

As highlighted earlier, Starbucks is poised for robust sales growth, which is anticipated to approach 10% in Fiscal 2024. At the same time, the company’s management is committed to extending margins this year. Consequently, Wall Street analysts anticipate that EPS growth will outpace the overall increase in revenue.

Projections indicate EPS of $4.12 for Fiscal 2024, implying a strong year-over-year surge of 16.4%. Despite this, the implied forward price-to-earnings ratio of 22.7 seems cheap, in my view. Numerous companies in the S&P 500 trade at comparable or loftier multiples, often without the luxury of double-digit growth. Furthermore, few can rival the brand strength that Starbucks commands, which inherently attracts a premium.

In my view, a P/E ratio nearing 25 appears to better align with Starbucks’ growth potential. But even if we assume that Starbucks’ existing forward P/E persists and stock returns align with EPS growth, the stock appears poised for strong returns. This is supported by Starbucks’ projected double-digit EPS growth in the medium term.

Is SBUX Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Starbucks has a Moderate Buy consensus rating based on eight Buys and 11 Holds assigned in the past three months. At $108.83, the average SBUX stock prediction implies 18.3% upside potential.

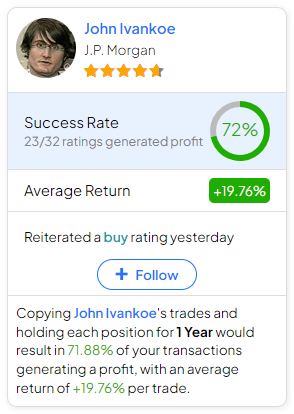

If you’re wondering which analyst you should follow if you want to buy and sell SBUX stock, the most accurate analyst covering the stock (on a one-year timeframe) is John Ivankoe from JPMorgan, with an average return of 19.83% per rating and a 75% success rate.

The Takeaway

While Starbucks is currently grappling with challenges stemming from controversies and boycotts, its growth prospects and undervalued stock suggest a potential turnaround. The ongoing issues, particularly related to labor disputes and geopolitical tensions, have impacted the stock negatively. However, the company’s strong global presence, aggressive expansion plans, and robust sales growth forecast for Fiscal 2024 indicate resilience.

With its forward P/E ratio appearing cheap compared to its growth potential, Starbucks might reattract bullish investors, signaling upside potential.