Shares of coffee giant Starbucks (SBUX) have been written off by many investors amid its slip. The stock shed around 44% of its value from peak to trough over a perfect storm of headwinds. Though the odds of a recession are rising, it seems as though the Seattle-based firm is already priced with such a hard-landing of a downturn in mind.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The COVID-induced headwinds, unionization attempts, the slowdown in China, and inflationary pressures have taken a toll on the stock. Like most other firms battling the same set of headwinds, Starbucks seems in great shape to make it through the storm. Undoubtedly, margins have taken a hit, yet demand has stayed relatively robust.

In the latest quarter, sales remained strong in the U.S. market, with 12% in same-store sales growth. Though the Chinese market saw a sales slump as a result of COVID lockdowns, recent reopenings in Shanghai are encouraging. Now that Chinese consumers can return to their local Starbucks, it’s likely that sales could overshoot to the upside in coming quarters.

For Starbucks, it’s not just about the passing of macro storm clouds that has me bullish on the stock. Under the leadership of Howard Schultz, the company has undergone quite a bit of positive change. The company is betting big on its stores and employees, which should help steady the ship and allow it to sail through a second half that could be just as choppy.

Schultz’s share repurchase pause was met with great selling pressure. However, I think Schultz is redirecting capital towards worthier endeavors. By betting on stores and partners, Starbucks is more than capable of accelerating a turnaround — one that may cause SBUX stock to heat up far quicker than anyone expects in the face of an economic recession.

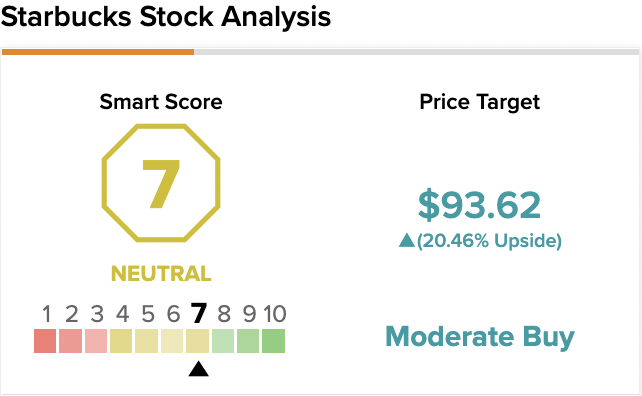

On TipRanks, SBUX scores a 7 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

Starbucks’ Bets Could Lead to Long-Lasting Margin Expansion

Starbucks’ margin woes aren’t going to dissipate anytime soon. Many firms have crumbled under the weight of higher input costs and upward pressure on wages. Undoubtedly, such pressures will normalize with time. As they do, Starbucks could be on a path back to all-time highs as its investments gradually begin to pay off.

At this juncture, it could take another 18 months for margin pressures to pass. All the while, Starbucks will be leaning out to reduce the impact of macro pressures. The company is in the process of leaning out, with a greater focus on streamlined operations, shuttering of less profitable locations, and the increased use of technology.

For investors, the suspension of the buyback program and added expenses by investing in partners are less encouraging. However, over the next three to five years, such moves could buy the company enough time to let its other margin-enhancing investments work their magic.

Recently, Starbucks recently launched its second pickup-only location in the Canadian market. Such a leaner store concept can help Starbucks reduce recent margin erosion and lead to long-lasting margin enhancement. It’s not just pickup-only stores that can help Starbucks get leaner. As the firm continues rollings out new technologies, a larger portion of its operations will become more automated.

For now, unionization is a significant pressure point that could incentivize greater spend on efficiency-driving and automation technologies. Though such tech efforts won’t offset nearer-term headwinds, they will help Starbucks become a far more profitable firm in the longer run.

Leveraging Tech to Keep Demand Strong

Automation and more efficient operating tech isn’t the only thing that Starbucks has going for it. The company’s digital app and loyalty program have paid off big-time. With just shy of 27 million active American users, Starbucks can take customer engagement to another level. It’s not just about driving store traffic, but also keeping customers in the know about new products.

Starbucks is the place to go for intriguing new seasonal drink offerings. Further, food items could be a growth category that helps the firm drive per-visit spending. With such a strong and tech-savvy brand, it’s hard not to be bullish on Schultz’s long-term turnaround plan, even if it means dealing with another year of macro headwinds and a potential recession.

I view Starbucks as a tech-driven company that just happens to sell coffee and baked goods. As Schultz doubles down on efforts to turn the firm around, it’s just a matter of time before the stock heats up again on the back of improving margins and sales.

Wall Street’s Take

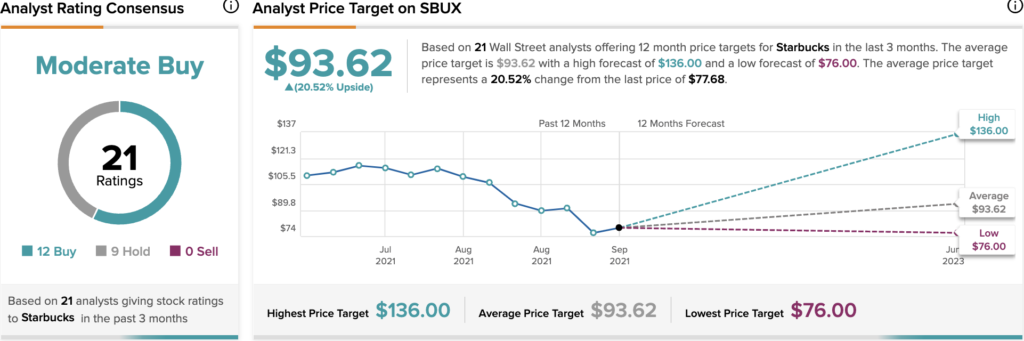

According to TipRanks’ analyst rating consensus, SBUX stock comes in as a Moderate Buy. Out of 21 analyst ratings, there are 12 Buy recommendations and nine Hold recommendations.

The average Starbucks price target is $93.62, implying an upside of 20.52%. Analyst price targets range from a low of $76 per share to a high of $136 per share.

The Bottom Line on Starbucks Stock

Starbucks has endured a tough time, with a hostile environment that’s hurt its margins. The COVID pandemic and ensuing inflation headwinds have been a perfect storm for Starbucks shareholders. Still, the company is persevering and is continuing to invest in efforts to improve long-term fundamentals.

As Schultz’s efforts begin to pay off while he looks to groom the next CEO, I think there’s never been a better time to give Starbucks the benefit of the doubt. The Starbucks of the post-pandemic era looks a lot leaner, more efficient, and far tech-savvier. These are reasons to stick by the stock.

Read full Disclosure