On the surface, coffee shop powerhouse Starbucks (NASDAQ:SBUX) might seem a risk not worth taking, with shares slipping over 9% after reporting earnings last week. Nevertheless, SBUX could be the “sleeper” stock of the second half of this year. Investors just need the economic math to pan out in their favor. Therefore, I am bullish on SBUX stock.

SBUX Stock Toys with the Market’s Emotions

For those willing to stick it out with SBUX stock, the ride admittedly has been cruel. Yes, shares bounced up more than 6% since the beginning of this year. That’s a bit lower than the benchmark S&P 500 index (SPX) but also much higher than several other embattled enterprises. Nevertheless, even an earnings beat last week couldn’t spark consistency in Starbucks’ chart performance.

As TipRanks contributor Steve Anderson mentioned, for the barista’s second quarter of Fiscal Year 2023, it generated earnings per share of 74 cents. On the flip side, analysts anticipated Starbucks delivering EPS of 65 cents. Not only that, but revenue increased by 14.5% on a year-over-year basis to $8.7 billion, beating the consensus target of $8.43 billion.

Nevertheless, SBUX stock fell following the earnings disclosure. Investors were likely disappointed that new Starbucks CEO Laxman Narasimhan didn’t upgrade the company’s annual forecast despite beating earnings.

Still, as TipRanks contributor Joey Frenette pointed out prior to the earnings report, SBUX stock may enjoy a better-than-expected year as Narasimhan injects fresh vitality into the brand. To be certain, Starbucks faces significant challenges. Between the pandemic’s negative impact and the possibility of a recession induced by the Federal Reserve’s hawkish monetary policy, the company “needs to find that new path to return to its market-beating ways,” said Frenette.

Still, Frenette stated that he thinks “Schultz found the right man for the job with Mr. Narasimhan. Starbucks’ new leader has shown he’s willing to roll up his sleeves to gain a better understanding of the company’s day-to-day operations by committing to working as a barista at least one time per month.”

Frenette details other active means of potential success for SBUX stock. However, investors should note the passive tailwinds.

When Work from Home Fades, Starbucks Will Win

Let’s jump right into it: the grand work-from-home experiment that the COVID-19 pandemic forced will probably end soon enough. When it does, SBUX stock will win out as the nine-to-fivers indulge their caffeine addiction. Therefore, it’s too early to give up on Starbucks.

Of course, the above statement begs the question, how can one be so confident in the work-from-home demise? Basically, it comes down to basic human psychology. As the publication Pacific Standard pointed out, drivers immediately respond to the sight of police officers on the roadways by slowing down – irrespective of whether they did anything wrong or not.

Without accountability, it’s too easy to cheat the rules. Just look at U.S. freeways: the only time 65 is obeyed at scale is when highway patrol officers lurk in the open. Otherwise, your average driver has a loose interpretation of the posted speed limit.

Similarly, to believe the nonsense stories that workers at scale are more productive at home (without accountability) than in the office is to believe that traffic safety laws are obeyed more frequently when fewer police officers are present.

Again, it’s plain nonsense, and employers aren’t naïve. Therefore, it’s more than likely that companies will start reversing course on their remote work policies. Further, as mass layoffs continue to rise, the easiest way for workers to be counted is to first be seen.

About the only way to accomplish this objective is to show up in the office. As a result, society should see higher traffic volume from commuting. Since Starbucks represents a go-to destination of the nine-to-five destination, SBUX stock should be a clear (albeit cynical) beneficiary.

Is Starbucks Stock a Buy, According to Analysts?

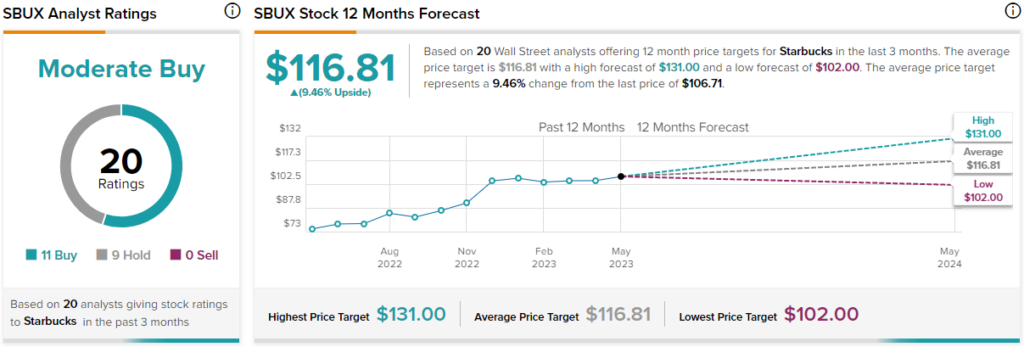

Turning to Wall Street, SBUX stock has a Moderate Buy consensus rating based on 11 Buys, nine Holds, and zero Sell ratings. The average SBUX stock price target is $116.81, implying 9.5% upside potential.

The Takeaway: SBUX Stock Just Needs Time to Bloom

While SBUX stock seems shaky at the moment, bullish investors likely just need to exercise patience. On the active front, Starbucks’ new CEO appears eager to move needles that need moving, sparking vitality in the coffee shop. However, it’s important not to ignore the passive tailwind — with more people likely to return to the office, Starbucks should be a sleeper hit later this year.