Square (SQ) is a payments and financial services technology company. As such, it creates cutting-edge hardware products that facilitate credit card transactions and also provides reporting, analytics, and next-day settlement services.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The main value for SQ comes from its highly scalable payment processing business, which provides flat fees, innovative point-of-sale devices, and user-friendly software solutions. These qualities have enabled it to achieve dominant market share in the micro acquirer space, which in turn has given it a significant cost advantage. SQ also offers a Cash App service that facilitates convenient and secure person-to-person payments as well as bitcoin transactions, both of which are growing spaces.

In its most recent quarter, SQ announced strong growth across its platform, particularly in its bitcoin transaction business. Non-bitcoin revenue grew by a whopping 44% year-over-year. Meanwhile, its core seller services business segment revenue grew by a strong 19% year-over-year. (See Square stock charts on TipRanks)

Valuation Metrics

Despite the company’s remarkable momentum and long-term potential, its valuation appears rather rich. Its forward price to earnings ratio is a sky-high 156.1x and its enterprise value to EBITDA ratio is 119.3x, which is extremely high by any metric.

While earnings-per-share will likely continue to grow at a steady clip, the company already has extremely bullish projections factored into its valuation. As a result, forward shareholder returns may not be nearly as attractive as they have been in the past.

Wall Street’s Take

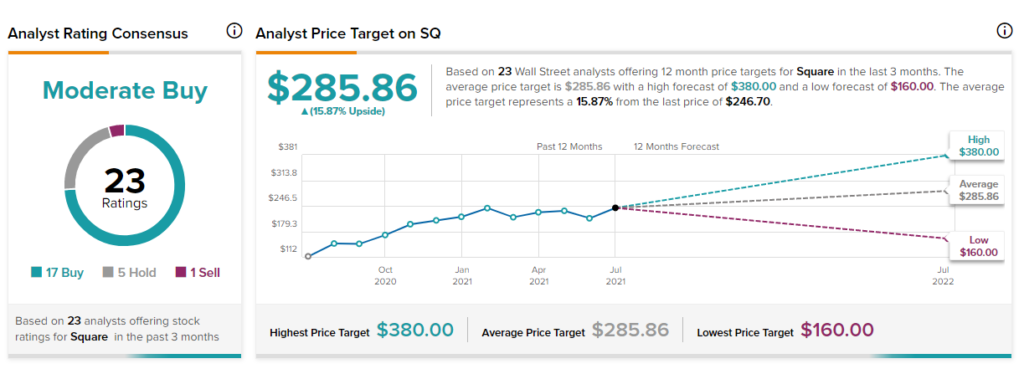

From Wall Street analysts, SQ earns a Moderate Buy analyst consensus based on 17 Buy ratings, 5 Hold ratings, and 1 Sell rating in the past 3 months. Additionally, the average Square price target of $285.86 puts the upside potential at 15.9%.

Summary and Conclusions

SQ is riding significant momentum from its rapidly growing Cash App and Bitcoin transaction business, while its other business segments continue to generate strong growth as well. Additionally, its highly scalable business model in the rapidly growing and ripe-for-disruption financial services and technology spaces combine with SQ’s strong competitive advantages, growth, and overall Wall Street analyst bullishness to make it appear to be an attractive investment.

That said, based on its sky-high valuation multiples, the stock looks expensive right now and may therefore fail to generate attractive risk-adjusted returns moving forward. This is particularly true given the fact that in order to justify its rich valuation, it must expand into midsized payments, where it lacks a clear competitive advantage and competition is much stiffer.

Furthermore, its Cash App also faces serious and growing competition. While the person-to-person space is growing fast enough right now to offset the impacts of competition, eventually it may face growing challenges in this segment.

Last but not least, SQ has yet to generate meaningful profitability. While the revenue and market share growth have been phenomenal thus far and management has proven itself adapt at innovating, until the company can generate consistently strong profits, the stock’s rich valuation makes it a risky bet.

SQ certainly has a lot going for it and may be worth an investment right now, but investors should not expect future returns to repeat the stock’s past performance, given its rich valuation.

Disclosure: On the date of publication, Samuel Smith had no position in any of the companies discussed in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.