In this piece, I evaluated two website-builder stocks, Squarespace (NYSE:SQSP) and GoDaddy (NYSE:GDDY), using TipRanks’ comparison tool to determine which is better. Squarespace is a content management system that allows subscribers to create a website, host their content, register their own domain name, sell products, track their website’s analytics, and more. Similarly, GoDaddy acts as a web host, website builder, website services provider, and domain registrar.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Squarespace shares are up 29% year-to-date and 31% over the last year, while GoDaddy is up just 1% year-to-date and 2% over the past year.

With Squarespace rallying so much this year while GoDaddy is just barely in the green, it may come as a surprise that Squarespace is the one that’s losing money as GoDaddy turns a profit. However, a closer look provides some answers.

Since Squarespace is unprofitable, we’ll look at the companies’ price-to-sales (P/S) ratios to gauge their valuations against each other and that of their industry. For comparison, the U.S. application software industry is trading at a P/S of 7.7 versus its three-year average of 9.9.

Squarespace (NYSE:SQSP)

At a P/S of 4.3, Squarespace is trading at a sizable discount to its industry. Its lack of profitability does suggest a discount is in order, although the size of that discount could be debated. However, a mixed picture consisting of some critical questions suggests a neutral view might be appropriate.

First, there is the issue of profitability. A consensus of 16 analysts suggests Squarespace could become profitable again, recording a net income of $49 million for the full year. However, that would require a big turnaround, as its losses on a trailing-12-month basis stand at around $220 million.

Nevertheless, Squarespace’s earnings reports suggest a full-year profit might be possible this year. The company reported net income of $502,000 for the March quarter and $3.66 million for the June quarter.

The problem is that Squarespace has a mixed track record on earnings, as it can sometimes miss expectations by a wide amount. Importantly, the company was profitable on an annual basis as recently as 2020, but it began to struggle with rapidly rising operating expenses in 2021.

On a positive note, Squarespace’s operating expenses ticked slightly lower recently, falling from $701 million in 2022 to $688.3 million for the last 12 months. This suggests it could be moving in the right direction, but it’s too early with too many uncertainties to assign a bullish view.

What is the Price Target for SQSP Stock?

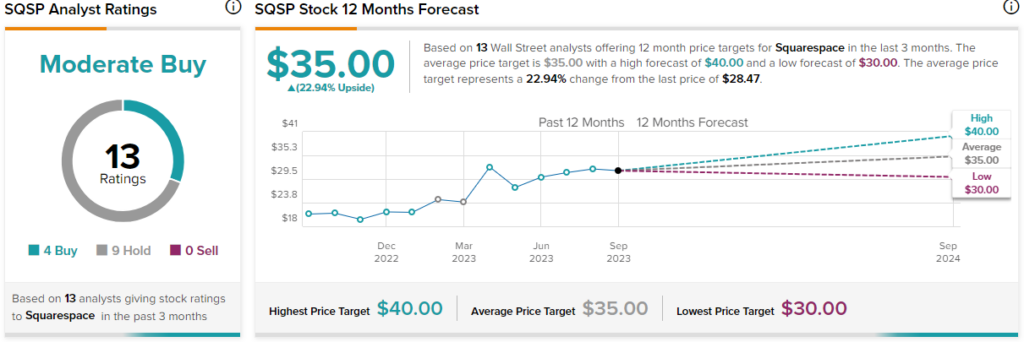

Squarespace has a Moderate Buy consensus rating based on four Buys, nine Holds, and zero Sell ratings assigned over the last three months. At $35, the average Squarespace stock price target implies upside potential of 22.9%.

GoDaddy (NYSE:GDDY)

At a P/S of 2.7, GoDaddy is even more discounted than Squarespace, likely because it’s also dealing with a mix of issues. Activist involvement (discussed below) often drives upside in stock prices, but we haven’t yet seen any significant increase with GDDY. On the other hand, insider sales are bearish. Factoring in the steep discount, the possibility of activist-driven upside, and the insider sales, a neutral view seems appropriate.

In its open letter to management, activist investor Starboard Value called on the company to cut costs, improve sales, or sell the company. Starboard also wants an explanation about why GoDaddy came up short of the guidance given at its 2022 shareholder day.

The firm also outlined multiple other issues, including a view that the company appears to be coming up short of competitors like Squarespace in several areas. For example, Starboard noted that Squarespace and Wix (NASDAQ:WIX) managed to improve their sales despite the macroeconomic weakness, but GoDaddy’s top-line performance missed its own updated guidance.

Moreover, insider sales of $1.6 million over the last three months are bearish for GoDaddy. Those sales include a number of auto-sell transactions, likely part of insiders’ pre-set trading plans that may involve selling at a pre-set price. There were also four non-open-market sales two weeks ago.

What is the Price Target for GDDY Stock?

GoDaddy has a Moderate Buy consensus rating based on seven Buys, three Holds, and zero Sell ratings assigned over the last three months. At $91.78, the average GoDaddy stock price target implies upside potential of 23.2%.

Conclusion: Neutral on SQSP and GDDY

Despite the matching neutral ratings, Squarespace looks like the winner, given the prospect of profitability in the near term. Notably, Squarespace’s net income margins have been improving, rising to -24% for the last 12 months from -29% for 2022 and -32% for 2021.

Further, the company is doing this at a much smaller scale. Meanwhile, GoDaddy is raking in billions of dollars in annual revenues with net income margins ranging from 6% in 2021 to 9% in 2022 and 8% for the last 12 months, giving credence to Starboard’s calls for improvements.

In short, if both companies stand at a crossroads now, any potential future bull case for Squarespace based on profitability could play out faster than GoDaddy’s potential prospects of long-term, activist-driven improvements.